As of the survey time, the global spot gold price touched $3,533 per ounce, $33 higher than the April 2025 peak.

Fluctuations in global gold prices. (Source: Kitco)

The upward momentum was boosted after Fed Chairman Jerome Powell hinted at potential policy adjustments, while the employment report released last weekend continued to show a cooling labor market.

According to the CME’s FedWatch tool, traders currently price in a 90% probability of a 0.25 percentage point rate cut by the Fed at its September 17 meeting. The USD Index has also fallen to its lowest level in more than a month, making gold even more appealing to international investors.

Joni Teves, a strategist at UBS, believes that investors are increasing their gold allocations, especially as the Fed prepares to cut rates, thus supporting the upward trend in prices.

“Our base case is for gold to continue to reach new highs in the coming quarters. The low-interest-rate environment, weak economic data, and persistent high geopolitical risks continue to reinforce gold’s portfolio diversification role,” he said.

Meanwhile, Michele Schneider, Director of Strategy at MarketGauge.com, believes that the current price range is not too late for investors.

“The longer the accumulation phase, the stronger the breakout. I believe the $3,800 – $4,000 per ounce range is entirely realistic before profit-taking sets in,” she said.

She also emphasized that gold’s new momentum comes from the Fed’s shifting priorities, as Powell has shown greater concern about the risks of economic downturn and the labor market, rather than solely focusing on the 2% inflation target. This has further heightened concerns about the purchasing power of the US dollar, driving capital flows towards gold.

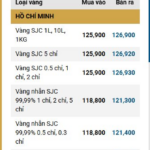

In the domestic market, despite the holiday period, gold ring and SJC gold prices continued to surge and remained at high levels. This morning, DOJI listed gold ring prices at 124.5 – 127.5 million VND per tael (buy-sell), Bao Tin Minh Chau at 124.7 – 127.7 million, PNJ at 122.5 – 125.4 million, and SJC Company maintained gold ring prices at 122.5 – 125 million.

Gold prices for bars were listed at 128.6 – 130.6 million VND per tael by several enterprises.

Gold ring and bar prices have not been adjusted since the previous session’s close.

Today: Domestic Gold Prices Continue to Surge Amid Global Decline

This morning, gold ring and SJC gold prices continued their upward trajectory, reaching new heights while global gold prices took a downturn.

The Golden Opportunity: Unveiling the Latest Proposition on Gold Bullion

“We propose the integration of QR code technology into the packaging and sealing of gold bars. This innovative approach will revolutionize the management and tracking of these valuable assets, offering unparalleled convenience and security. With a simple scan, authorized personnel will have instant access to crucial information, enhancing efficiency and transparency in the industry.”

The Golden Rush: Gold Prices Soar to Record Highs, Flirting with the 127 Million Dong per Tael Mark

The SJC gold bar price has officially soared to a new peak of VND 125.9 – 126.9 million per tael. This unprecedented surge marks yet another pinnacle for the precious metal’s value.