According to data from VietstockFinance, the combined revenue of 23 plastic enterprises listed on the HOSE, HNX, and UPCoM exchanges in the first quarter reached approximately VND 13.6 trillion, up 23% year-on-year. Most large-scale companies achieved double-digit growth. The industry’s net profit increased by 12% to VND 643 billion, mainly thanks to the strong performance of the two leading companies, BMP and NTP.

Construction plastics: Upturn continues from last year

Building on the positive results from the second half of 2024, plastic pipe manufacturers entered the first quarter of 2025 with optimistic signals, mainly due to low PVC raw material prices and a recovering construction market.

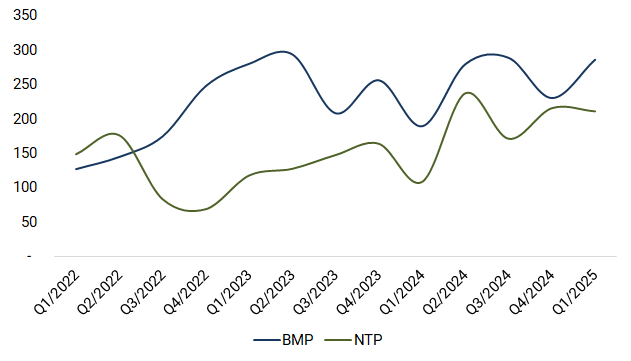

Binh Minh Plastic Joint Stock Company (HOSE: BMP) achieved a revenue of VND 1.38 trillion, a nearly 38% increase, and a net profit of VND 287 billion, a more than 51% surge. The gross profit margin remained at 42.7%, slightly lower than the record high of 43.8% in the second quarter of last year.

Similarly, Youth and Young Plastic Joint Stock Company (HNX: NTP) continued its impressive performance, with a net profit of VND 212 billion, a 94% increase, making it the third-best quarter in the company’s history. Revenue reached VND 1.27 trillion, a 34% increase, and the gross profit margin climbed to 28.2%, the highest in four years.

|

High profits for BMP and NTP (in VND billion)

Source: Author’s compilation

|

Packaging plastics: Mixed performance

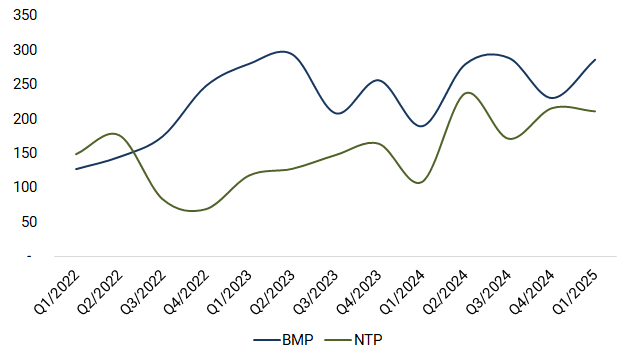

The packaging group saw mixed results in the first quarter as they faced rising input costs and intense competition.

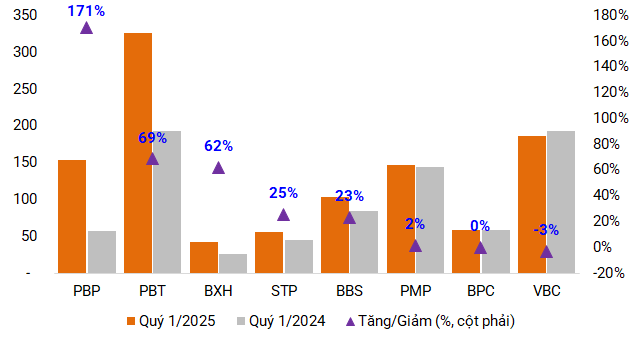

Some companies performed well. Vietnam Oil and Gas Packaging Joint Stock Company (HNX: PBP) achieved a 170% revenue increase to VND 154 billion and an almost 84% surge in net profit to over VND 2 billion. VICEM Hai Phong Packaging Joint Stock Company (HNX: BXH) also had positive results, as the consumption of cement bags recovered strongly, resulting in a nearly threefold increase in profit to nearly VND 200 million.

On the other hand, several companies continued to face challenges. VICEM But Son Packaging Joint Stock Company (HNX: BBS) had to lower its selling prices to stay competitive, causing a nearly 20% decline in profit to VND 1.24 billion. Binh Son Petroleum Packaging and Trading Joint Stock Company (UPCoM: PBT) significantly increased its revenue but experienced a nearly 15% drop in net profit to VND 4.4 billion due to higher management costs.

Similarly, Song Da Industry and Trade Joint Stock Company (HNX: STP) saw a nearly 15% decline in net profit to VND 2.6 billion, despite improved revenue, due to additional provisions for receivables.

|

Revenue growth for most packaging companies (in VND billion)

Source: Author’s compilation

|

|

Profit divergence among packaging companies (in VND billion)

Source: Author’s compilation

|

An Phat Holdings Group: Investment losses drag down performance

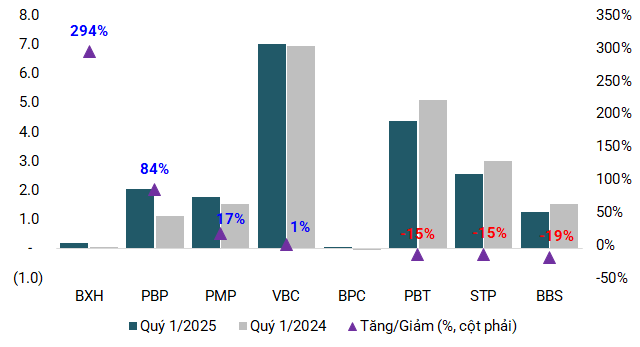

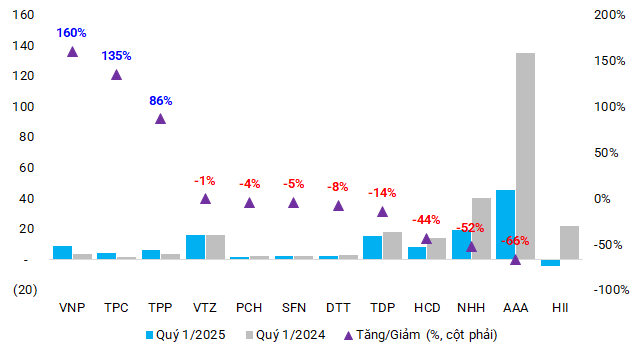

Members of the An Phat Holdings Group, including AAA, HII, and NHH, saw sharp declines in profits, mainly due to financial investment losses.

An Phat Plastic and Green Environment Joint Stock Company (HOSE: AAA) reported a 30% revenue increase to over VND 3.8 trillion but a 66% drop in net profit to VND 45 billion due to an investment loss of nearly VND 119 billion.

An Tien Industries Joint Stock Company (HOSE: HII) posted a loss of VND 4 billion compared to a profit of VND 22 billion in the same period last year, despite a nearly 23% rise in revenue. Similarly, Hanoi Plastic Joint Stock Company (HOSE: NHH) saw its net profit halve to VND 19 billion, despite a nearly 28% increase in revenue.

Other notable bright spots

The household plastics segment also performed well. Tan Phu Plastic Joint Stock Company (HNX: TPP) maintained its growth trajectory with an 8% increase in revenue and an 86% surge in net profit, thanks to a more favorable market in the first quarter of this year and successful cost-cutting efforts. Vietnam Plastic Production and Trading Joint Stock Company (HNX: VTZ) also achieved double-digit revenue growth.

Tan Dai Hung Plastic Joint Stock Company (HOSE: TPC) reported a 135% surge in net profit to over VND 4 billion, attributed to a 20% increase in sales volume.

Vietnam Plastic Joint Stock Company (UPCoM: VNP) surprised with a 41% decline in revenue but a more than 160% jump in net profit to VND 9 billion. This positive result was due to significant contributions from associated companies.

However, some companies like TDP, HCD, PCH, SFN, and DTT experienced profit declines due to volatile raw material prices and rising operating costs.

|

Profit decline for An Phat Holdings Group members (in VND billion)

Source: Author’s compilation

|

– 08:00 25/05/2025

Unlocking Profits: How Diversified Plastics and Construction Industries are Poised for a “Double Win” by 2025

The plastic industry witnessed significant revenue growth in the final quarter of 2024, yet profits were mixed. While the industry experienced an overall boost in revenue, several prominent businesses reported a decline in profits.