The VN-Index showed positive recovery momentum in the mid-week sessions after retreating to the support zone of 1,290-1,300 points in the second session. The recovery was led by positive signals in trade negotiations between Vietnam and the US.

Accordingly, at the end of the second round of talks, Vietnam and the US made some positive progress, identifying issues where consensus was reached and those that needed further discussion to reach an agreement in the near future.

Both sides also outlined the contents for the third round of negotiations, to be held in early June. Meanwhile, The Trump Organization officially launched a $1.5 billion project in Hung Yen. These moves raised expectations that Vietnam could achieve a more favorable reciprocal tax trade agreement within the next 45 days.

In addition, the market was supported by the upward momentum of Vingroup’s stocks after a series of positive news, including the Prime Minister’s request for relevant agencies to research and propose the construction of a high-speed railway by Vinspeed, and the official commencement of the Tu Lien Bridge project, which will improve infrastructure connectivity for the Vin Global Gate Co Loa project with the inner city.

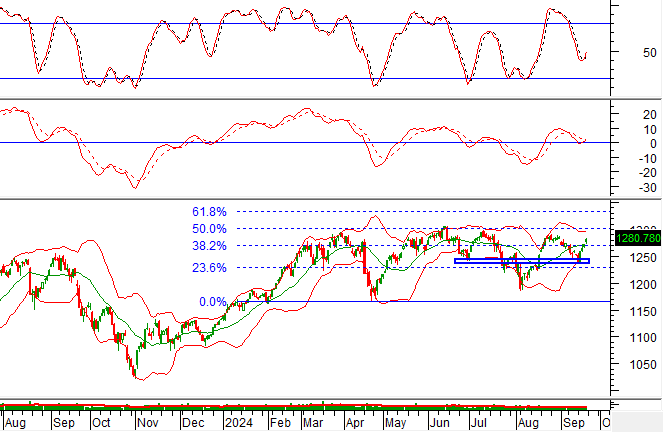

The upward trend cooled off in the last two sessions of the week as profit-taking pressure returned at the 1,320-1,340 resistance zone. The VN-Index closed the week with a total gain of 1.4%, ending at 1,314.5 points.

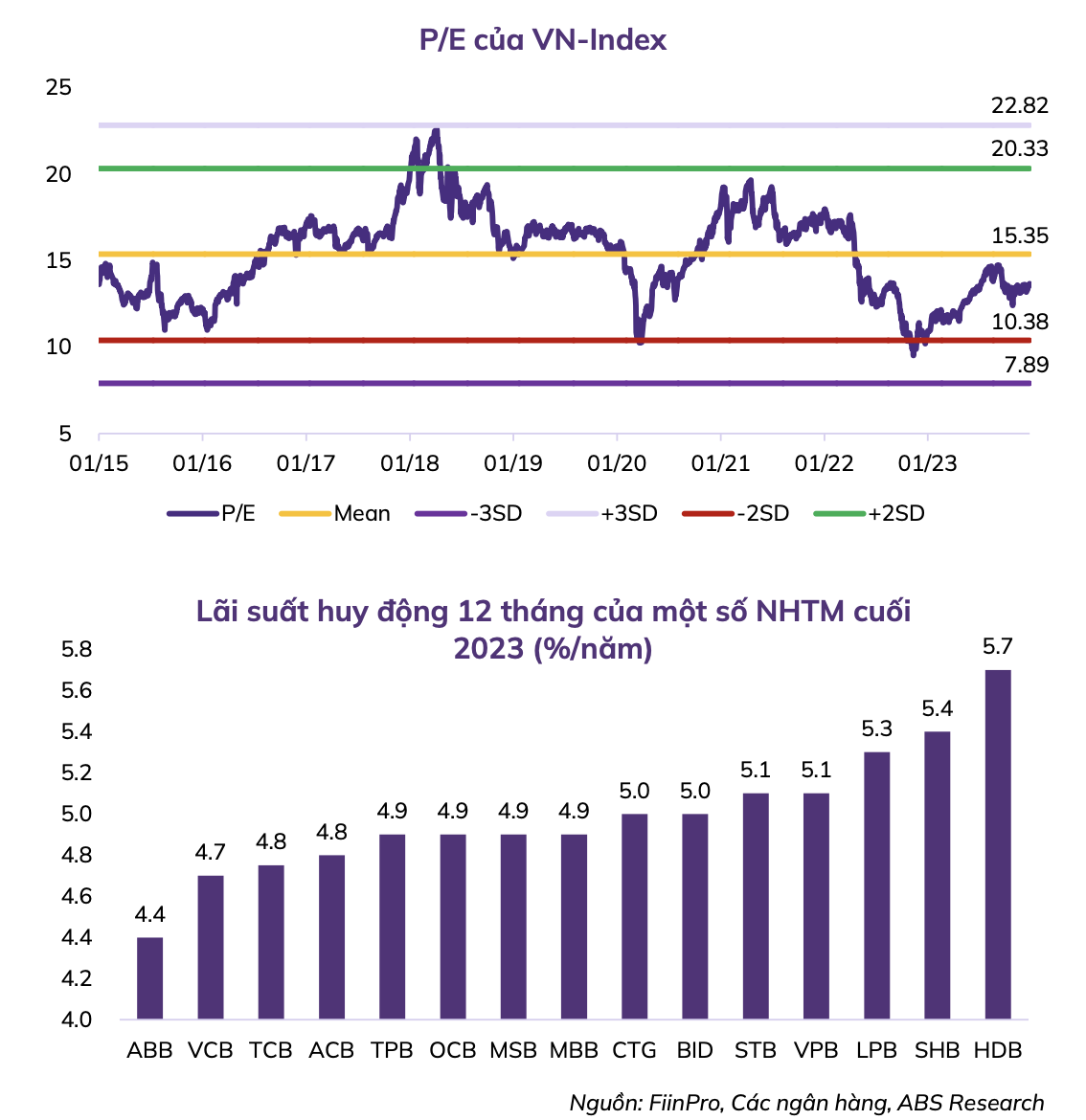

Commenting on the market for this week, Mr. Dinh Quang Hinh, Head of Macroeconomic and Market Strategy Analysis at VnDirect Securities, said that the 1,320-1,340 resistance zone remains a significant challenge as it marks the peak from the beginning of the year. The market is entering a “news vacuum” phase after the first-quarter business results reporting season and the 2025 Annual General Meeting.

With the Vietnam-US trade negotiations taking place in early June, the VN-Index may trade sideways within the 1,290-1,340 range to absorb profit-taking pressure, awaiting new developments.

Short-term investors need to shift to a “cautious” state, maintain a reasonable stock proportion, and refrain from buying stocks that have already surged. In the medium to long term, Vndirect expects breakthrough policies to boost the private sector, following Resolution 68-NQ/TW and Resolution 198/2025/QH15. These policies are expected to drive comprehensive reforms, significantly improving the business environment in Vietnam, which will be a significant driver for the Vietnamese stock market in the medium and long term.

Mr. Nguyen The Minh, Director of Analysis for Individual Customers at Yuanta Securities, opined: The past trading week was negative for US bonds as bond yields surged, causing a significant valuation gap between bonds and stocks. US government bonds experienced a sharp sell-off due to concerns over the Trump administration’s policies leading to an increasing budget deficit. Meanwhile, stock prices adjusted lower as the market reacted less negatively to recent tariff-related events, including President Trump’s warning of imposing higher tariffs on the EU and Apple.

Mr. Minh attributed this significant gap to the psychological cycle of investors, who tend to overreact when an event first occurs and gradually become accustomed to it as it unfolds. However, historically, when such a gap between bonds and stocks occurs, the disparity tends to narrow, suggesting that bond prices may recover or stock prices may adjust.

The median short-interest ratio for S&P 500 stocks, as a percentage of float, surged to 2.3%, the highest since 2016. This indicates a resurgence of short-selling ahead of tariff-related concerns and policy shocks, further signaling potential adjustments or declines for S&P 500 stocks.

Global gold prices closed up nearly 2% on May 23, 2025, confirming a short-term upward trend as investors remain anxious about the Trump administration’s tariff policies. In the short term, gold prices and the S&P 500 index are negatively correlated, so the confirmation of gold’s short-term upward trend also signals potential risks for the S&P 500’s short-term outlook.

“The VN-Index continued its upward trend, recording a 1% weekly gain, while liquidity slightly decreased compared to the previous week. However, the rise was uneven, with large-cap stocks like the Vingroup and GEX groups contributing significantly. Meanwhile, a downward trend is forming on the VN-Index, indicating increasing short-term risks,” emphasized the Director of Analysis for Individual Customers at Yuanta Securities.

Similarly, MBS Securities suggested that market liquidity suddenly dropped by 30% in the last session of the week, indicating that even the group of stocks breaking their ceilings (corresponding to the VN-Index above the 1,340-point threshold) might have experienced their first distribution session. This differentiation phenomenon may become more apparent this week, as there are no new supportive news, making it challenging to select healthy stocks, and investors are likely to be more cautious.

Overall, with the cautious sentiment reflected in the last session, the likelihood of breaking through the previous peak (1,330 – 1,340 points) is low. The market is currently in an information vacuum, so the likely scenario is that it will fluctuate within a trading range, awaiting new developments (such as Vietnam-US tariff negotiations).

Technically, on the weekly chart, the VN-Index seemed to “run out of steam” at the 1,320-point threshold. On the daily chart, the index showed no progress in the last six sessions, despite high liquidity. Thus, this range, approximately 1,320 – 1,330 points, is considered a short-term resistance zone.

In the base case scenario, the market is expected to correct towards the support zone of 1,280 points and fluctuate within the 1,280 – 1,320 range. At this point, breaking through the 1,340-point peak is unlikely, but a sharp decline is also improbable as the market remains above critical support levels from MA20, MA50, MA100, and MA200. Although distribution signs are evident in many stocks, the short-term upward trend may persist, at least above the 1,270-point zone.

Investors should refer to support levels for specific stocks rather than the general index and closely manage their portfolios, reducing leverage and adjusting the stock-to-cash ratio to a safe state. The market is likely to experience strong differentiation, making it increasingly challenging to select the right stocks, and risks are on the rise. Some sectors to consider for portfolio restructuring include banking, logistics, investment funds, electricity production, and distribution…

‘The Privileged Few’: A Tale of Stock Market Privilege

Mr. Nguyen Trong Minh, the son of former Ha Do Group’s Chairman, Nguyen Trong Thong, is planning to purchase 4 million HDG shares, amounting to over a hundred billion VND. Meanwhile, Mr. Le Viet Hieu, the son of Le Viet Hai – the Chairman of Hoa Binh Construction Group – will be investing approximately 3 billion VND to acquire 500,000 HBC shares.

“VN-Index: What’s in Store for the Week Ahead?”

The stock market is heating up, and with it, the pressure on the VN-Index to adjust. In light of this, leading securities companies are advising investors to refrain from buying into the hype and engaging in short-term stock speculation.

The Flow of Funds: Is the Market Still Poised for a Breakthrough at the Old Peak?

The experts’ cautious sentiment was evident as the leading stock group showed signs of fatigue. Indeed, the VN-Index last week was heavily influenced by the pair of stocks VIC and VHM, which rose 12.4% and 10.8%, respectively. These two stocks alone contributed a significant 34.9 points to the index’s total weekly gain of 13.07 points.