The Hanoi Stock Exchange (HNX) has just published financial information about F88 Business Joint Stock Company (F88).

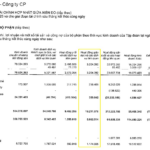

According to the report, for the first six months of 2025, F88 recorded a post-tax profit of nearly VND 252.4 billion, 2.8 times higher than the same period last year. As a result, F88 turned its accumulated loss into a profit of nearly VND 99 billion.

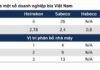

As of June 30, 2025, F88’s equity stood at nearly VND 2,044.8 billion, up 34.6% from the previous year. Owner’s investment capital remained unchanged at nearly VND 1,673.2 billion, while post-tax undistributed profit was recorded at nearly VND 371.6 billion.

Illustrative image

The debt-to-equity ratio decreased from 1.96 times to 1.77 times compared to the previous period, with total debt standing at over VND 3,612.3 billion.

Of this, bond issuance debt amounted to nearly VND 763.6 billion, an increase of 28.5%, while other debts totaled nearly VND 2,351.3 billion, accounting for 65.1% of total debt. Other payables amounted to nearly VND 497.5 billion.

In the first half of 2025, F88 made payments of nearly VND 186 billion in principal and interest for nine bond lots.

Specifically, the company made payments for the F88CH2425001, F88CH2425002, and F88CH2425003 bond lots, with a total payment value of nearly VND 53 billion per bond lot. As a result, these bond lots were fully repaid on time.

At the same time, F88 made interest payments for the F88CH2425004, F88CH2425005, F88CH2425006, F88CH2425007, F88CH2425008, and F88CH2425009 bond lots, with payment values ranging from over VND 2.6 billion to nearly VND 8 billion per bond lot.

Recently, from August 18, 2025, to August 20, 2025, F88 successfully issued 1,000 bonds with the code F8812506, with a par value of VND 100 million per bond, raising a total of VND 100 billion. The bonds have an 18-month term, maturing on February 18, 2027, with a fixed interest rate of 10.5% per annum.

According to HNX statistics, this is the sixth bond lot issued by F88 since the beginning of the year. Most recently, from August 1, 2025, to August 15, 2025, F88 successfully offered 1,000 bonds with the code F8812505, with a total issuance value of VND 100 billion. The interest rate was 10% per annum, with a term of 12 months.

The four bond lots issued earlier included the F8812504 bond lot with a total value of VND 100 billion and a term of 12 months, issued on July 10, 2025; the F8812503 bond lot with a total value of VND 50 billion and a term of 18 months, issued on June 12, 2025; the F8812502 bond lot worth VND 50 billion, issued on May 7, 2025, with a term of 12 months; and the F8812501 bond lot worth VND 150 billion, issued on April 4, 2025, with a term of 12 months.

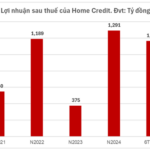

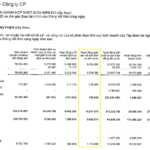

A Consumer Finance Company’s Half-Yearly Interest Profits Soar, Matching 2024’s Full-Year Figures; Bond Debt Surges.

In the first half of 2025, Home Credit Vietnam Finance Company Limited (Home Credit) witnessed a significant surge in both profits and bond debt.