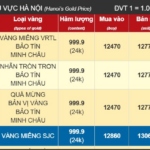

As of September 4th, the price of SJC gold bars among major companies such as SJC, DOJI, and PNJ remained stable at the high end, with buying prices listed at 132.4 million VND per tael and selling prices at 133.9 million VND per tael. This marked the highest official listing price among the prominent companies.

However, in the free market, SJC gold bars continued to surprise. On the evening of September 3rd, several small shops in Ho Chi Minh City quoted buying prices of 137.5 million VND per tael and selling prices of 139 million VND per tael, a significant increase of 2.5 million VND from the previous day.

The price of SJC gold bars in the free market is currently 5 million VND higher than that of the larger companies. Meanwhile, the price of 99.99% pure gold rings and jewelry also remained high, with buying prices at 126.2 million VND per tael and selling prices at 128.7 million VND per tael, the highest recorded thus far.

The domestic gold market witnessed contrasting trends compared to the international market. While international gold prices experienced a sharp decline, the domestic market maintained its upward trajectory. By the end of the day, the precious metal was trading at $3,547 per ounce on the international market, a decrease of approximately $35 from the previous session’s high.

Gold Prices Surge Dramatically

The unexpected surge in SJC gold bar prices in the free market caught even industry experts off guard. In a brief conversation with the Laborer Newspaper on the evening of September 4th, gold expert Tran Duy Phuong expressed his surprise at the dramatic increase, with some gold shops pushing prices close to the 140 million VND per tael mark.

“It is crucial for both consumers and investors to remain calm during this volatile period,” advised Mr. Phuong. “There are inherent risks associated with holding SJC gold bars at the moment. The current price of SJC gold bars is significantly higher than the international market, with a gap ranging from 20 to 25 million VND per tael in the free market. With the upcoming implementation of a new decree on gold management, aimed at breaking the monopoly on gold bars, we can expect an increase in supply from October onwards. Additionally, as international gold prices are nearing their peak, a downward adjustment is likely in the near future.”

Providing insight into the latest international gold price forecast, Mr. Heng Koon How, Head of Market Strategy at UOB Singapore, attributed the recent rally to strong buying from China, expectations of a 0.5% interest rate cut by the US Federal Reserve in September, and the weakening of the US dollar. With gold prices hovering around $3,500 per ounce, UOB’s year-end target has been met.

“Our gold price forecast for the upcoming quarters is $3,600 per ounce for Q1 2026 and $3,700 per ounce for Q2 2026,” added Mr. Heng Koon How.

At present, the international gold price, when converted using the listed exchange rate, is approximately 113.3 million VND per tael, significantly lower than the SJC gold bar price by over 20 million VND per tael, and even further below the free market price.

The emergence of the 139 million VND per tael price point in the free market

SJC gold bar prices soar in recent days

The Golden Opportunity: From Gold to the New Investment Craze

The long queues outside gold shops in Ho Chi Minh City have led to a creative shift in investment strategies. With only a limited amount of gold being purchased, often just a fraction of what people desire, the focus has now turned to silver. This new investment avenue offers a distinct advantage with its affordable pricing and abundant supply.