Mid-Year Losses in 2025, Bond Debt of VND 12,000 Billion

An Thinh Commercial Services Trading Co., Ltd. (An Thinh Company) recently reported its financial statements for the first half of 2025 to the Hanoi Stock Exchange (HNX).

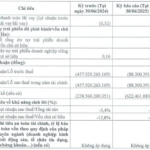

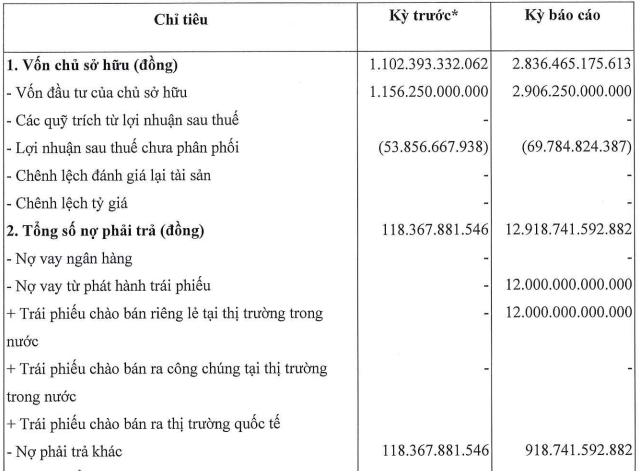

According to the report, An Thinh Company incurred a loss of nearly VND 12 billion, a deeper loss compared to the VND 9 billion loss in the first half of 2024. As of the end of Q2/2025, the company had accumulated losses of nearly VND 70 billion.

The company’s owner’s equity capital increased significantly to VND 2,906.2 billion. Total liabilities surged from VND 118 billion to VND 12,919 billion, mainly due to the issuance of bonds with a value of VND 12,000 billion, and other payables of nearly VND 919 billion. In addition, An Thinh also significantly increased its other payables from over VND 118 billion (end of Q2/2024) to nearly VND 919 billion.

As of June 30, 2025, An Thinh Company’s debt-to-equity ratio was 4.55 times. The current ratio (current assets/current liabilities) was 7.18 times.

Source: HNX

Data from HNX shows that An Thinh Company has two bond issues with a total value of VND 12,000 billion in circulation. Of which, the bond with the code ATHCB2431001 is valued at VND 7,000 billion, issued on December 23, 2024, with a term of 84 months and an interest rate of 3%/year.

According to PV’s sources, An Thinh Company and Hai Dang Real Estate Investment and Development Company Ltd. signed a Contract for the Transfer of a Part of the Real Estate Project No. 2811/2024/HĐNT CNDA BĐS/HĐ-AT, which took effect on November 28, 2024, and any amendments/supplements (if any).

The subject of the transfer is a part of the project “High-rise housing in CT-01, CT-05, CT-06 – Eco-urban Area Dream City” (commercial name is Vinhomes Ocean Park 2) invested by Hai Dang Real Estate Investment and Development JSC, located on CT-05 and CT-06 land plots with an area of 18,713 m2 (in which: CT-05 land plot has an area of 11,533 m2 and CT-06 land plot has an area of 7,180 m2).

On December 17, 2024 (just 6 days before the issuance of ATHCB2431001 bonds), An Thinh Company pledged the assets and interests arising from the above contract at the bank.

The remaining bond issue circulated by An Thinh Company is the ATL12501 bond, valued at VND 5,000 billion, issued on June 25, 2025, with a term of 18 months and an interest rate of 9%/year.

According to our information, on June 19, 2025, An Thinh Company signed a business cooperation contract No. 04/2025/HTĐT/SDI-ANTHINH with Saigon Investment and Development Joint Stock Company.

On June 24, 2025, that is, just one day before the issuance of the ATL12501 bond, An Thinh Company mortgaged this contract together with all assets and all receivables arising from and/or related to the contract at the bank.

Saigon Investment and Development Joint Stock Company (SDI Corp) is the investor of the super project Saigon Binh An Urban Area (The Global City) with a total area of more than 117ha, located on the Long Thanh – Dau Giay highway, intersecting with Do Xuan Hop Street, Thu Duc City (former), Ho Chi Minh City.

According to the project’s website, The Global City includes 1,800 shophouses and 10,000 high-rise apartments, a 92ha golf course with 18 holes, a 400-room hotel…

9X Billionaire Controls An Thinh Company

In addition to the above projects, it is known that on December 16, 2021, the Hanoi People’s Committee issued Decision No. 5273/QD-UBND on allowing Urban and Industrial Zone Infrastructure Development and Investment Company Limited (UID) to transfer a part of the Gia Lam Urban Area project to An Thinh Commercial Services Trading Co., Ltd.

The transferred part to An Thinh Company is called the high-rise housing project on land plots B5 – CT02, B5-CXDV01, and GT2 – Gia Lam Urban Area. The Gia Lam Urban Area is located in Tru Quu town and Duong Xa, Kieu Ky, and Da Ton communes, Gia Lam district (former), Hanoi.

On March 29, 2022, the Hanoi People’s Committee issued Decision No. 1078/QD-UBND on revoking 28,228 m2 of land (including 3 land plots coded: B5-CT02; B5-CXDV01, GT2) of the investment project for construction of “Gia Lam Urban Area” managed by Urban and Industrial Zone Infrastructure Development and Investment Company Limited (UID); and handed over to An Thinh Commercial Services Trading Co., Ltd. to continue investing, constructing, and trading in accordance with the law.

On August 4, 2025, An Thinh Company mortgaged all assets, receivables, and other movable properties arising from the Project for high-rise housing on land plots B5 – CT02, B5-CXDV01, and GT2 – Gia Lam Urban Area at the bank.

Regarding An Thinh Company, the enterprise was established in 2014 with a registered business line in real estate.

According to the enterprise registration updated on December 12, 2024, the company increased its charter capital from VND 1,156.2 billion to VND 2,906.2 billion. The ownership structure includes General Director Phung Thu Hien (born in 1994) holding 95% of capital (equivalent to VND 2,706.9 billion), Chairwoman of the Members’ Council Nguyen Thi Le Phan holding 2% (equivalent to VND 58.1 billion), and Nguyen Huy Lam holding 3% (equivalent to 87.1 billion).

“Phú Thọ Land Plunges into $15 Million Loss in the First Half of 2025”

In a stark contrast to its remarkable performance in 2024, where it achieved a staggering profit of over VND 1,680 billion, Phu Tho Land JSC ended the first half of 2025 with a notable decline, posting a loss of nearly VND 394 billion in after-tax profit. This is a significant deviation from the previous year’s success, where the company recorded a profit of almost VND 60 billion in the same period.

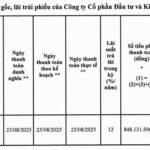

The Khang Điền House Liquidates Over 848 Billion VND in Principal and Interest on Bonds

With a strong track record of financial prudence, Nha Khang Dien has once again demonstrated its commitment to meeting its financial obligations. The company recently made a substantial payment of over VND 848 billion, covering both principal and interest on its bond series KDHH2225001. This timely full repayment underscores the company’s dedication to maintaining a solid financial standing and bodes well for its future endeavors.