As property prices remain high, owning an apartment is becoming a challenge not only for young families but also an increasing concern for singles in urban areas. From the need for a home to asset accumulation, singles are now considered a dynamic and potential customer group in the residential real estate market.

Studio: Convenient and Affordable but Less Popular

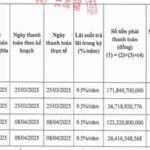

Studio apartments typically have an area of 25m2 and feature an open-plan design without room partitions. The biggest advantage is their lower price range, usually from 1.5 to 2 billion VND, depending on the area, which suits young, single individuals with moderate incomes.

However, a significant disadvantage is the limited living space. If the owner decides to start a family or sell after a few years, the potential buyer pool for a studio apartment is relatively small. Thus, studios are often suitable only for those intending to stay for a short period or considering it as a rental investment.

Studio apartments typically feature an open-plan design without room partitions.

One-Bedroom Apartment: “Just Right” for Long-Term Single Living

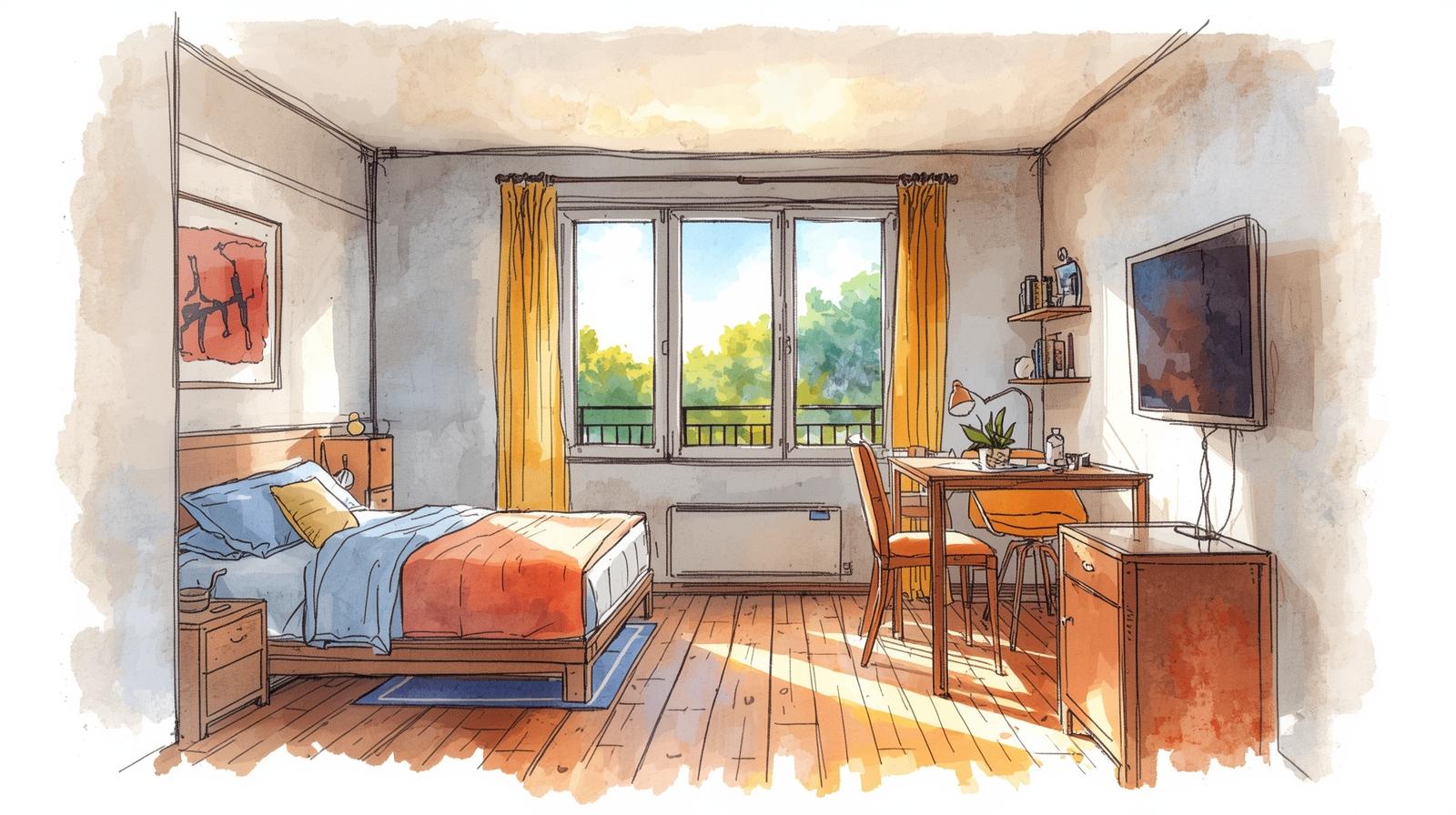

One-bedroom or 1+1 bedroom apartments usually range from 40 to 45m2, with prices between 2 and 3.5 billion VND in Ho Chi Minh City and Hanoi. This is the most popular choice among singles today. The space is moderate, providing a separation between the living room and bedroom, ensuring more privacy than a studio.

Especially, this type of apartment has higher liquidity as it caters to singles, newly married couples, or rental investors. According to many brokers, one-bedroom apartments are currently favored in central areas or near metro lines due to their convenience and rental potential.

Two-Bedroom Apartment: “Exceeds Demand” but Holds Value Well

For financially stable singles, a two-bedroom apartment with an area of 50 to 70 m2 and a price range of 4 to 7 billion VND is considered a “safe” long-term investment.

Although it exceeds current needs, a two-bedroom apartment has the advantage of high liquidity: it can be easily sold to families, rented at higher prices, and suits those planning to start a family in the next few years.

Despite exceeding current needs, a two-bedroom apartment holds strong resale value.

What’s the Trend for Singles?

According to several market research firms, the proportion of single customers buying apartments is increasing, especially in the 27-35 age group. This is driven by improved incomes among young people and a trend towards emphasizing independence and the desire for personal space.

However, when considering “which apartment to buy,” three factors should be balanced: purpose of use – financial capability – liquidity. If the apartment is intended for short-term living, a studio remains a cost-effective choice. For those seeking long-term value and flexibility, 1+1 bedroom and two-bedroom apartments are more sensible options.

Unlocking New Opportunities for Investors: The Transformative Impact of Key Infrastructure Developments in Southern Ho Chi Minh City

According to Ms. Duong Thuy Dung, Executive Director of CBRE Vietnam, investors have recognized the irrationality of real estate prices in the center of Ho Chi Minh City and are strongly shifting their focus to the neighboring areas. These peripheral zones benefit directly from existing and upcoming infrastructure and belt road projects, offering significant growth potential.

“A Hefty Payment of 360 Billion VND: How Much Debt Does Tien Phuoc Group Still Hold?”

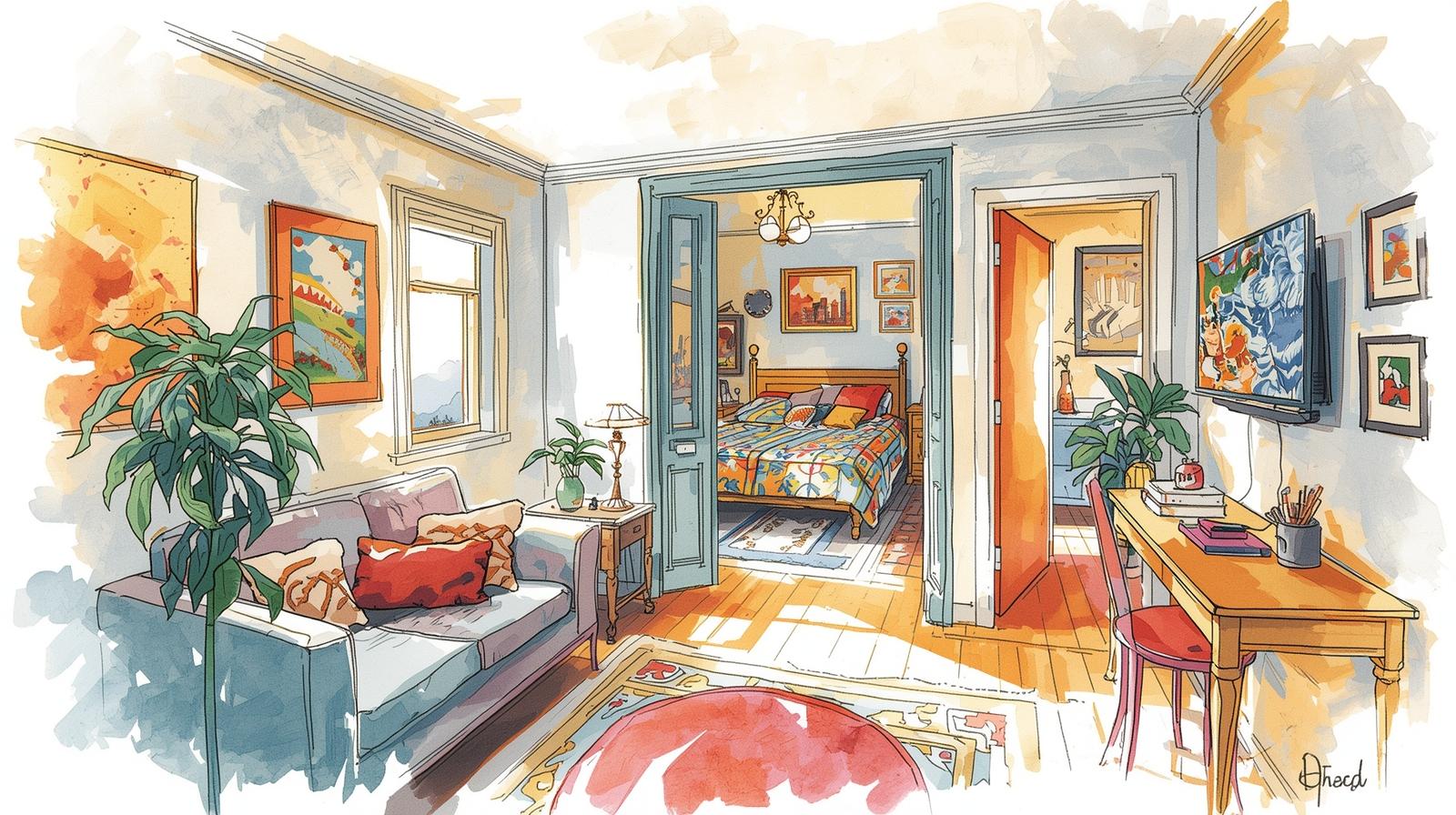

In the first half of 2025, Tien Phuoc Group made significant strides in its financial endeavors by allocating approximately VND 360 billion towards settling principal and interest payments for two bond issuances from 2021. With this substantial repayment, the group has successfully eliminated its bond debt, marking a pivotal moment in their financial journey.

Once a Billion-Dollar Profit-Maker, This Real Estate Giant Now Targets 40,000 Affordable Housing Units Despite Modest Earnings.

The struggling situation of Dia Oc Hoang Quan, a real estate company, is a cause for concern. With a dismal track record of failing to meet business targets for nine consecutive years, their annual profits barely scrape over $1 million. The years 2021 and 2023 were particularly grim, with meager profits of just $174,000 to $218,000. This underperformance paints a picture of a company in dire need of a strategic overhaul to reverse its fortunes.

“Financial and Guarantor Issues for Off-Plan Property Investment.”

Within the context of the dynamic real estate market and evolving legal landscape, Attorney Vu Thi Que, a esteemed member of the Hanoi Bar Association, shed light on crucial updates and considerations regarding guarantees in future real estate transactions as outlined in the 2023 Real Estate Business Law.