The VN-Index closed at 1,696 points on September 4th, marking an increase of nearly 15 points (+0.89%) compared to the previous trading session.

The trading session on September 4th commenced on a positive note, with the VN-Index climbing towards the 1,690-point mark. However, the market soon experienced a tug-of-war in the latter half of the morning session due to contrasting performances among the 30 large-cap stocks. Sectors such as real estate and steel also witnessed a slowdown after their previous robust gains.

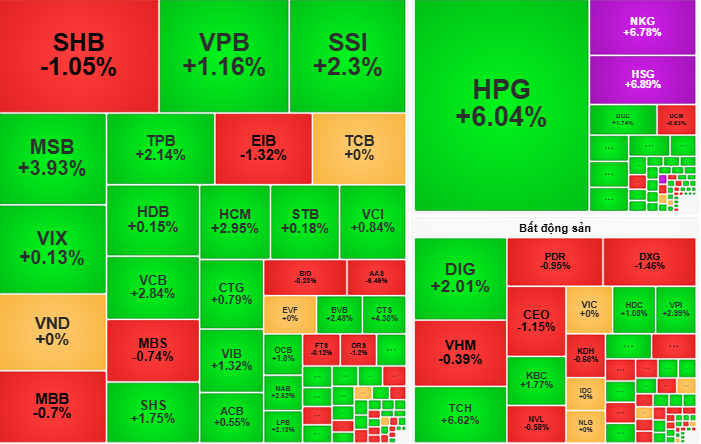

As the afternoon session got underway, the VN-Index swiftly regained its momentum, broadening its gains and approaching the 1,700-point threshold. This upswing was primarily driven by a robust recovery in large-cap stocks, led by HPG (+6.04%), FPT (+1.74%), and banks, including VCB (+2.84%) and VPB (+1.16%).

Proactive buying liquidity surged, focusing on banking, steel, and retail sectors, while foreign investors continued net selling with a net value of VND 751 billion, mainly in VPB, VHM, and MSN stocks.

At the close of the session, the VN-Index stood at 1,696 points, reflecting a gain of nearly 15 points (+0.89%). This positive performance reinforced the market’s accumulation trend around the 1,700-point level.

According to VCBS Securities Company, the increase in proactive buying liquidity is a positive signal, indicating that the market has strong momentum to surpass the 1,700-point threshold. VCBS forecasts that the VN-Index could soon conquer the 1,710-point level and even aim for 1,735 points in upcoming sessions.

“Investors should hold onto stocks that are in a strong uptrend and exhibit good accumulation signals,” advised VCBS. “For investors with high cash proportions, selective investment in stocks showing signs of breaking resistance or consolidating support is recommended, focusing on sectors such as banking, retail, securities, steel, and real estate – construction.”

Rồng Việt Securities Company (VDSC) assessed that the market is striving to maintain its upward trajectory and has recorded new highs. Slightly higher trading liquidity on September 4th compared to the previous session indicated that supply pressure had not significantly impacted, and funds continued to support the market. VDSC anticipated that the VN-Index could further extend its gains in the session on September 5th.

However, investors should remain cautious as supply pressure might intensify when the index nears the 1,750-point resistance level. The supply-demand dynamics in the upcoming sessions will play a crucial role in determining the market’s status.

Market Beat: Profit-Taking Pressure Mounts, VN-Index Down Over 29 Points

The market closed with the VN-Index down 29.32 points (-1.73%), settling at 1,666.97; while the HNX-Index fell 3.32 points (-1.17%) to 280.67. The sell-off dominated today’s trading session, with 477 decliners against 319 advancers. The large-cap basket, VN30, mirrored the broader market with 24 losers, 3 gainers, and 3 stocks closing unchanged.

Market Pulse, September 3rd: Foreigners’ Robust Selling of Blue-chips, VN-Index Hanging at 1,680 Points

The trading session concluded with the VN-Index dipping 0.91 points (-0.05%) to 1,681.3. In contrast, the HNX-Index climbed 2.72 points (+0.97%), finishing at 282.7. The market breadth tilted towards gainers, as 468 stocks advanced against 268 decliners. However, the large-cap VN30 index painted a different picture, with 15 stocks falling, 12 rising, and 3 unchanged, resulting in a sea of red.

Stock Market Week Sept 03-05, 2025: The Unexpected Drop After Hitting 1,700 Points

The VN-Index took a surprising tumble during the week’s final session, bringing an end to four consecutive weeks of gains. This sudden shift highlights the intense profit-taking pressures at play in the higher price ranges, with persistent foreign sell-offs further exacerbating the situation and significantly impacting investor sentiment.