The afternoon session saw a widespread sell-off, with the VN-Index experiencing a significant correction. The HoSE was dominated by red, with 230 tickers in the red, while only 100 managed to stay in positive territory. The banking sector, often referred to as the “king” of the stock market, was the main driver of the downward pressure, as most stocks in the industry simultaneously witnessed a decline.

At the close, only BAB and PGB managed to stay at their reference prices, while the majority of their peers lost between 2-4%. Heavyweights VCB, VPB, MBB, CTG, and LPB, among others, featured prominently among the day’s worst performers.

Banking stocks underwent a broad-based correction.

The securities sector also succumbed to the bearish trend, with many stocks plunging sharply. AGR hit its daily lower limit, while VND, CTS, BVS, BSI, SBS, and APS declined by over 5%. Notably, SSI was among the top 10 stocks that dragged the market down the most.

Amidst the market correction, the real estate and steel sectors couldn’t escape the negative sentiment. Real estate tickers like PDR, CII, CEO, DXG, KDH, HQC, GEX, TCH, HHS, and IJC all traded in negative territory.

The steel industry witnessed a clear divergence, with POM and KVC surging to their daily upper limits, while HMC, NKG, TLH, HSG, TVN, HPG, SMC, and VGS ended the day in the red.

Market breadth surged towards the end of the session as investors rushed to take profits, and buyers also stepped in. The value of transactions on the HoSE exceeded 48 trillion VND. HPG, SHB, and SSI each recorded trading values of over 2,000 billion VND.

At the close, the VN-Index lost 29.32 points (-1.73%) to close at 1,666.97. The HNX-Index fell 3.32 points (-1.17%) to 280.67, while the UPCoM-Index edged down 0.03 points (-0.03%) to 111.82.

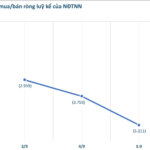

Foreign investors net sold nearly 1.5 trillion VND, focusing on VPB, VHM, MBB, HDB, and TCB, among others. Their net selling activities, especially in August when they net sold 42.7 trillion VND, also weighed on the market sentiment.

VN-Index Hits Record High, Surpassing 1,700 Points for the First Time

The Vietnamese stock market has been on a remarkable upward trajectory, and this trend has caught the attention of industry leaders and analysts alike. With the VN-Index surging, predictions are now being made that the index could reach a staggering 1,800 points this year and potentially go even higher in the near future. This has sparked excitement and interest among investors, who are now keenly watching this market’s every move.

The Ultimate Guide to High-Yield Dividend Stocks: Unveiling the Secrets to 300% Returns

Since its IPO, Co Khi Pho Yen Joint Stock Company has consistently rewarded its shareholders with high and regular cash dividends. On November 12, the company plans to distribute approximately VND 37 billion as dividends to its 3.7 million outstanding shares.

Great news for Vinhomes, An Khánh, and The Matrix One residents: The “Super Metro” 62,000-billion-VND project is about to begin construction, reducing travel time to the capital’s center.

The upcoming launch of Metro Line 5 is set to revolutionize travel, offering significantly reduced travel times and a host of benefits for residents and businesses along its route. This new line will directly connect and enhance the accessibility of numerous key urban areas and large-scale projects, transforming the way people move and interact within the city.