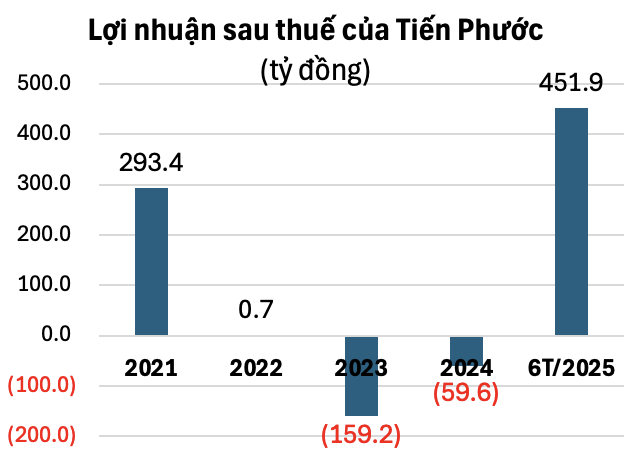

In the financial report for the first half of this year, Tien Phuoc Group JSC posted a remarkable after-tax profit of nearly VND 452 billion, turning around from a loss of nearly VND 182 billion in the same period last year. This record profit enabled Tien Phuoc to clear all accumulated losses and achieve an after-tax profit of over VND 57 billion as of the end of June 2025. Prior to this, the company had incurred consecutive losses during the 2021-2024 period.

Compiled by Vietstock Finance

|

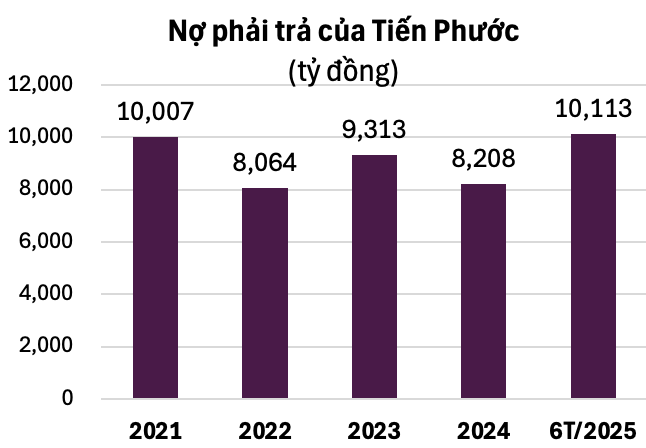

Notably, the company no longer has any bond debt. However, its total liabilities increased to nearly VND 10,114 billion, up from nearly VND 8,516 billion in the previous year.

A breakdown of the debt structure reveals that other payables account for the majority of the liabilities, totaling nearly VND 9,133 billion. The debt-to-asset ratio stands at 0.79 times.

Compiled by Vietstock Finance

|

Back in April this year, Tien Phuoc Group made full repayment of the remaining interest and principal on two bond lots upon maturity. Specifically, the GTPCH2123001 lot had an initial value of VND 300 billion, was issued on March 25, 2021, matured on March 25, 2025, and carried an interest rate of 9.5%/year. The GTPCH2123002 lot was valued at VND 200 billion, issued on April 6, 2021, matured on April 6, 2025, and bore the same interest rate of 9.5%/year.

Despite Tien Phuoc’s significant profit, a related company, TMT Real Estate Investment and Development JSC (TMT), posted an after-tax loss of over VND 177 billion in the first half of this year, compared to a loss of VND 141.2 billion in the same period last year. As of the end of June 2026, TMT Real Estate had accumulated losses of over VND 260 billion. Its bond debt stood at VND 2,015 billion, along with other payables of nearly VND 91.5 billion and a charter capital of VND 360 billion.

According to HNX, TMT Real Estate has one bond lot currently in circulation with the code TMTCH2330001, valued at VND 2,015 billion. It was issued on June 30, 2023, and will mature on June 30, 2030, with a coupon rate of 14%/year.

The bond is secured by all the assets generated from the Tien Phuoc Housing Project in Lot 1, Area 9AB – New Southern Urban Area, Binh Hung, former Binh Chanh District, Ho Chi Minh City. The project, covering an area of over 19.7 hectares, is developed by Tien Phuoc Group.

– 17:37 09/07/2025

“IPA Hydropower Company Reports 14% Dip in Half-Yearly Profits”

“In the first half of 2025, Bac Ha Energy reported a remarkable after-tax profit of over 30 billion VND, reflecting a 14% decrease compared to the same period last year. The company also witnessed a significant reduction in its total liabilities, which fell by 25.6% to 551 billion VND, showcasing a strong financial performance and a positive trajectory for the remainder of the year.”

“Sunbay Ninh Thuận: Questions Arise Over Resort’s Ability to Continue Operations”

Sunbay Ninh Thuan’s woes go beyond consecutive losses; its short-term debt surpasses the total assets of its parent company. This has raised significant concerns about the company’s ability to continue operating, as highlighted by the auditors.