The State Bank’s Branch in Region 2 has just issued a document to credit institutions and economic organizations acting as foreign exchange agents in Ho Chi Minh City regarding the activities of foreign exchange agencies.

Accordingly, the State Bank’s Branch in Region 2 requests that credit institutions authorized and contracted with enterprises with foreign exchange counters continue to strengthen management solutions, inspection, supervision, and other measures to ensure that the operations of these counters comply with legal regulations.

Specifically, the foreign exchange transaction venue must be equipped with essential facilities, including telephones, fax machines, safes, publicly displayed exchange rate boards, and signage displaying the names of the authorized credit institution and the foreign exchange agent…

It is requested that economic organizations acting as foreign exchange agents strictly comply with the regulation to display signage with the names of the authorized credit institution and the foreign exchange agent at the foreign exchange counter.

Foreign exchange agents are required to effectively implement the policy of combating dollarization and strictly prohibit illegal foreign exchange trading… |

Strictly adhere to the regulation that foreign exchange agents are only allowed to purchase foreign currency with cash and sell the purchased foreign currency in cash (excluding the amount of foreign currency retained in the fund) to the authorized credit institution in accordance with the regulations on foreign exchange management and foreign exchange agency.

“Strictly prohibit illegal foreign exchange trading and effectively implement the government’s and the State Bank’s policy of combating dollarization. Compliance with these regulations contributes to maintaining stability in the local foreign exchange market, mitigating risks associated with the use and trading of foreign currency that violates legal provisions, and plays a crucial role in stabilizing foreign exchange rates and the foreign exchange market,” the document from the State Bank’s Branch in Region 2 emphasized.

In case of detecting signs of violation of legal regulations by foreign exchange agents, credit institutions shall take appropriate measures depending on the nature and severity of the violation.

According to the third draft decree on administrative sanctions in the monetary and banking fields, which is being consulted by the State Bank, the highest fine for buying and selling foreign currencies between individuals or at unauthorized organizations is proposed to range from 80 to 100 million VND.

|

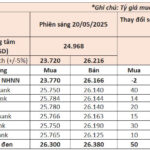

On May 27, the central exchange rate set by the State Bank was 24,935 VND/USD, a decrease of 5 VND from the previous day. Commercial banks are trading the USD at around 25,740 VND/USD for buying and 26,100 VND/USD for selling, an increase of 10 VND compared to yesterday. In the unofficial market, the USD is being traded at around 26,250 VND/USD for buying and 26,350 VND/USD for selling, an increase of 20 VND compared to the previous day. |

Thai Phuong

– 17:56 27/05/2025

The Greenback’s Rally Comes to an End

“In a dramatic turn of events, the USD witnessed a downturn in the week of May 19-23, 2025, as former US President Trump threatened to impose a hefty 50% tariff on imports from the European Union (EU), effective June 1st. This unexpected development sent shockwaves through global markets, causing the USD to retreat.”

“Dollar’s Rise: Banks Hike USD Rates in Unison”

As of May 20th, the USD exchange rate at banks surged compared to the previous day’s listing. The free-market USD rate also witnessed a hike of 30-50 VND, reaching 26,300 – 26,380 VND per USD.