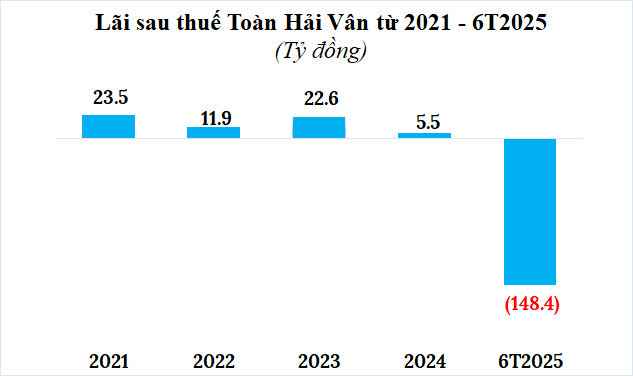

TTC Phu Quoc reports a disappointing financial performance for the first half of 2025, with a record loss of over VND 148 billion, compared to a profit of nearly VND 21 billion in the same period last year. Notably, the company’s total profit after tax for the past four years (from 2021 to 2024) amounted to only VND 64 billion, far less than the massive loss incurred in the first half of this year.

Source: Consolidated by the author

|

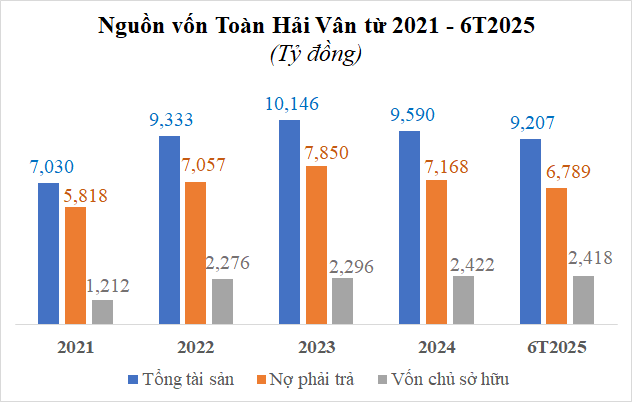

As of the end of June, TTC Phu Quoc’s total assets stood at over VND 9,207 billion, a 4% decrease from the beginning of the year. Owner’s equity remained relatively unchanged at over VND 2,418 billion, including accumulated losses of more than VND 59 billion.

The company’s total liabilities amounted to over VND 6,789 billion, including VND 1,273 billion in bank loans, VND 640 billion in bond debt, and VND 4,876 billion in other payables. In the first half of 2025, the company also made payments of nearly VND 112 billion to bondholders for interest and principal.

Source: Consolidated by the author

|

According to data from the Hanoi Stock Exchange (HNX), TTC Phu Quoc has five outstanding bond batches, THVCH2129001 to THVCH2129004, issued in 2021, with a total remaining value of over VND 520 billion. The THVCH2229001 batch, issued in 2022, has a remaining value of VND 120 billion. These bonds have a combined interest rate of 9.5% per annum and will mature on June 30, 2029.

TTC Phu Quoc, a member of the TTC Group, was established on April 16, 2009, with its headquarters currently located in Duong To, Phu Quoc City, Kien Giang Province (now a special administrative unit of Phu Quoc, An Giang Province). The company has a charter capital of over VND 2,467 billion, and Mr. Nguyen Thanh Ngu is its legal representative and Chairman.

TTC Phu Quoc is the investor of the Selavia Phu Quoc complex project in Duong To, Phu Quoc City, with a total investment of over VND 30,000 billion. The project, which broke ground on April 1, 2021, spans an area of 290 hectares and includes 99 five-story shophouses, high-rise shophouses, a commercial center, condotel, and numerous villas and hotels.

SCR aims to raise VND 850 billion from bond issuance to fund the super project Selavia Phu Quoc

– 15:31 09/07/2025

“Debt Surpasses VND 10.1 Trillion: Tien Phuoc Group Reports Profit of Nearly VND 452 Billion in First Half of Year.”

This is Tien Phuoc Group’s record profit since 2021. A remarkable achievement, this financial success story is a testament to the group’s unwavering dedication, innovative strategies, and exceptional performance. With a sharp eye for market trends and a commitment to excellence, Tien Phuoc Group has navigated the economic landscape with prowess, solidifying its position as an industry leader. This milestone underscores the group’s resilience and fortitude, setting a new benchmark for prosperity and growth.

“IPA Hydropower Company Reports 14% Dip in Half-Yearly Profits”

“In the first half of 2025, Bac Ha Energy reported a remarkable after-tax profit of over 30 billion VND, reflecting a 14% decrease compared to the same period last year. The company also witnessed a significant reduction in its total liabilities, which fell by 25.6% to 551 billion VND, showcasing a strong financial performance and a positive trajectory for the remainder of the year.”