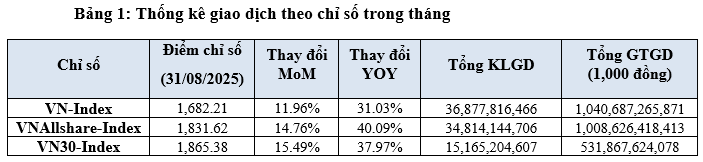

The VN-Index ended the last trading session of August 2025 at 1,682.21 points, while the VNAllshare-Index and VN30-Index reached 1,831.62 and 1,865.38 points, respectively. The indices continued their upward trajectory from the previous month, recording growth of 12%, nearly 15%, and over 15%.

Source: HOSE

|

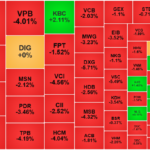

Most sector indices witnessed growth compared to July 2025, with the financial sector (VNFIN) leading the pack with a nearly 22% increase, followed by the real estate sector (VNREAL) at over 16%, and the consumer goods sector (VNCOND) at more than 8%.

In terms of liquidity, the average daily trading volume for stocks exceeded 1.76 billion shares, while the average daily trading value surpassed VND 49,556 billion, representing a 23% increase in volume and a 42% surge in value compared to the previous month.

The average daily trading volume for covered warrants (CW) exceeded 80.4 million CW, and the average daily trading value reached VND 194.2 billion, indicating a 14% rise in volume and an impressive 86% jump in value.

For the ETF channel, the average daily trading volume stood at nearly 3.9 million ETFs, with an average daily trading value of over VND 119.9 billion, reflecting a slight 2% dip in volume but a 9% increase in value.

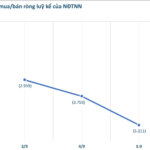

Foreign investors’ total trading value for August surpassed VND 211,472 billion, accounting for 10% of the total market trading value. Notably, foreign investors net sold over VND 40,559 billion during the month.

As of August 31, HOSE listed and traded 671 securities, including 391 stocks, 4 closed-end fund certificates, 17 ETF certificates, and 259 CWs, with a total listed securities volume of nearly 186.9 billion.

The market capitalization of stocks on HOSE reached nearly VND 7.3 quadrillion, reflecting a 12% increase from the previous month and equivalent to over 63% of GDP in 2024. It accounted for nearly 95% of the total market capitalization of listed stocks across all markets.

In August, one new stock was listed and traded on HOSE: Taseco Real Estate Investment Joint Stock Company (TAL).

As of August 31, HOSE boasted 52 enterprises with a market capitalization of over USD 1 billion, including 7 enterprises with a market cap of over USD 10 billion. These top performers included Joint Stock Commercial Bank for Foreign Trade of Vietnam (VCB), Vingroup (VIC), Vinhomes Joint Stock Company (VHM), Joint Stock Commercial Bank for Investment and Development of Vietnam (BID), Vietnam Technological and Commercial Joint Stock Bank (TCB), Vietnam Prosperity Joint Stock Commercial Bank (VPB), and Vietnam Joint Stock Commercial Bank for Industry and Trade (CTG).

With the market’s buoyant performance in August, HOSE witnessed the addition of 2 enterprises with a market capitalization of over USD 1 billion and 3 enterprises surpassing the USD 10 billion mark, including TCB, VPB, and CTG.

– 16:43 09/05/2025

What’s Next for the VN-Index After Hitting an All-Time High?

“With a harmonious blend of robust growth prospects and a still-reasonable price-to-earnings ratio, the VN-Index has the potential to surpass the 1,700-1,800 level,” asserted the expert.