Technical Signals for the VN-Index

The VN-Index witnessed an eventful trading session on the morning of September 5, 2025, breaking past the previous August 2025 peak (equivalent to the 1,680-1,696 range) and surpassing the psychological milestone of 1,700 points.

Reaching an all-time high boosted investor sentiment as the successive formation of higher highs and higher lows reinforced the upward trajectory.

While the emergence of a Doji candlestick pattern may serve as a cautionary sign, it is not a cause for pessimism without subsequent confirmatory candles.

Technical Signals for the HNX-Index

On September 5, 2025, the HNX-Index extended its winning streak to seven consecutive sessions, reflecting prevailing market optimism despite testing the strong resistance zone of 285-289 points (equivalent to the August 2025 peak).

The Stochastic Oscillator has signaled a strong buy, and if the MACD follows suit in the upcoming sessions, the outlook will become even more positive.

The Middle line of the Bollinger Bands (approximately 278-279 points) has provided robust support in recent sessions and is expected to hold firm.

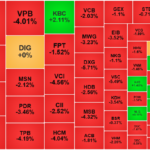

KBC – Kinh Bac City Development Holding Corporation

During the trading session on September 5, 2025, KBC shares witnessed a significant surge in price alongside above-average trading volume, indicating a positive shift in investor sentiment.

Currently, KBC has surpassed the August 2025 peak (41,400-42,600 range) while the MACD indicator consistently forms higher highs and higher lows, suggesting that the medium-term uptrend remains intact.

Moreover, the stock price continues to closely follow the upper band of the Bollinger Bands, indicating a likely maintenance of the positive outlook in the near future.

PVD – Petroleum Drilling and Well Services Corporation

PVD shares witnessed a robust upward surge during the trading session on September 5, 2025, forming a Three White Soldiers candlestick pattern alongside rising trading volume that exceeded the 20-session average, indicating a revival of investor activity.

The Stochastic Oscillator continues to climb after providing a buy signal in the oversold region, further supporting PVD’s recovery momentum.

Additionally, PVD is trending within a medium-term bullish price channel, and with the 50-day SMA and 200-day SMA gradually converging, a potential golden cross formation in the future would reinforce the upward trend.

(*) Note: The analysis presented in this article is based on real-time data up until the end of the morning trading session. Therefore, the signals and conclusions drawn are for reference only and may change once the afternoon trading session concludes.

Vietstock Consulting and Technical Analysis Department

– 12:39 09/05/2025

The Rising Titans: HOSE Welcomes Three New Members to the $10 Billion Capitalization Club

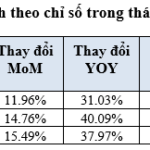

In August 2025, the HOSE witnessed a remarkable surge with key indices climbing upwards. This positive momentum was further emphasized by the growth of most sectoral indices compared to the previous month. Riding on this wave of optimism, HOSE proudly welcomed two more businesses with a market capitalization of over USD 1 billion each and an additional three enterprises with a market cap exceeding USD 10 billion.

Steel Stocks: A Magnet for Investment Funds

With the strong comeback of large-cap stocks, the VN-Index surged towards the 1,700-point mark. Steel stocks attracted significant trading volume in today’s session (September 4th).