On September 5, the State Bank of Vietnam (SBV) disclosed detailed information regarding the results of biometric matching and the status of fraud and manipulation in the banking sector.

As of August 15, the banking sector had collected and biometrically matched over 123.9 million individual customer records (CIF). Image: DNSE |

The SBV has directed the entire banking sector to proactively collect and biometrically match customer information with the National Database on Population (NDBP). It mandated that all personal and organizational payment accounts undergo biometric matching when registering for digital transactions.

As of August 15, the banking sector had biometrically matched over 123.9 million individual customer records (CIF), representing a 100% match for all individual customer payment accounts with digital transaction activities. For organizational customers, over 1.3 million records were biometrically matched, covering 100% of organizational customer payment accounts with digital transaction activities.

This initiative has yielded positive outcomes in data cleansing, with a reduction of over 59% in fraud cases and a decrease of 52% in accounts associated with manipulation compared to pre-biometric matching implementation.

The National Credit Information Center (CIC) collaborated with C06, the Ministry of Public Security, to complete six offline data cleansing batches, encompassing approximately 57 million customer records. Sixty-three credit institutions and foreign bank branches have implemented CCCD chip-enabled cards via counter devices. Fifty-seven credit institutions and thirty-nine payment intermediaries have adopted CCCD chip technology through mobile applications. Additionally, thirty-two credit institutions and fifteen payment intermediaries are in the process of integrating VNeID.

In the first seven months of 2025, compared to the same period in 2024, ATM transactions decreased by 15.83% in volume and 4.97% in value, indicating a shift in consumer preferences away from cash withdrawals and towards cashless payment methods.

NGOC DIEP

– 16:39 05/09/2025

The Stock Market Surge: Expert Tips on Stocks to Boost Your Portfolio

Despite predictions to the contrary, the VN-Index has been on a remarkable upward trajectory, consistently reaching new highs. This has left investors pondering which stock sectors to invest in for the remainder of the year.

“The Banking Sector’s Proposal 06: Driving Economic and Social Development and Empowering Businesses.”

The implementation of Scheme 06 by the banking sector (2022-2025) has yielded impressive results and made significant strides in fostering economic and social development and supporting businesses. This initiative has played a pivotal role in driving innovation and technology adoption, ushering in a new era of progress and transformation.

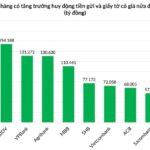

“VPBank’s Deposits Soar in H1 2025: Outpacing Peer Group Growth, Surpassing Two Big4 Banks”

“VPBank stands out amidst a challenging landscape where many banks struggle to keep pace with credit growth, exerting pressure on liquidity. The bank has impressively outperformed several state-owned giants in terms of mobilization, showcasing its prowess in both scale and the quality of its capital sources. VPBank’s remarkable CASA growth and its ability to attract international capital have solidified its position as a leader in the industry.”

“A Challenging Road Ahead: Tackling Bad Debt”

The latest bad debt situation in the banking industry paints a more optimistic picture, with a significant slowdown in growth, reflecting the banks’ efforts to manage their asset quality. While the industry-wide non-performing loan ratio remains higher than pre-pandemic levels, the trend is heading in the right direction. This indicates that although challenges persist, the banks’ strategies to tackle bad debt are showing signs of success.