|

Circular 25/2025/TT-NHNN, recently issued by the State Bank of Vietnam, introduces significant changes and removes legal obstacles for foreign investors.

|

Major changes with immediate effect

Circular 25 brings about several notable changes, especially those outlined in Article 6 and related provisions, which take effect immediately upon signing. This is a crucial aspect as it promptly addresses issues faced by foreign investors ahead of the upcoming market assessment by the UK’s Financial Services Index (FTSE) system.

The new circular allows foreign investors to authorize financial institutions to open, close, and operate payment accounts. This simplifies procedures and facilitates indirect investment processes in Vietnam. Additionally, banks and foreign bank branches can now perform customer due diligence in accordance with anti-money laundering laws without the need for complex procedures.

Significantly, Circular 25 eliminates the requirement for consular legalization in the account opening process for foreign investors. This is a pivotal change as, previously, this requirement prolonged and complicated the process. Furthermore, accepted identity documents have been expanded beyond passports to include other forms of identification issued by foreign competent authorities.

Another noteworthy change is the removal of the obligation for banks and foreign bank branches to monitor the validity of personal documents or maintain and update customer signatures and seals. This reduction in red tape also results in operational cost savings for credit institutions.

The circular also permits the use of the SWIFT (Society for Worldwide Interbank Financial Telecommunication) system for opening and operating payment accounts for foreign investors. Notably, it allows for the opening of foreign currency payment accounts using electronic means. Moreover, withdrawals and transactions through electronic means on payment accounts no longer require biometric verification, enhancing flexibility and convenience for investors.

Streamlining processes to attract foreign capital

The current process for foreign investors to open securities investment accounts involves multiple steps. After obtaining an electronic securities trading code (e-STC) from the Vietnam Securities Depository (VSDC), investors must open a securities trading account with a securities company and an indirect investment account with a custodian bank.

Previously, opening an indirect investment account was time-consuming due to consular legalization requirements, the need for in-person customer due diligence, and the non-recognition of global custodian banks. These factors hindered foreign investors’ ability to quickly access the market.

However, with strong government leadership, several important documents have been issued to improve the situation. Prior to Circular 25, the State Bank of Vietnam issued Circular 03/2025/TT-NHNN (dated April 29, 2025), regulating the opening and use of Vietnamese dong accounts for indirect investment activities. The Ministry of Finance also issued Circular 20/2025/TT-BTC, amending Circular 51/2021/TT-BTC, focusing on information disclosure obligations and reporting regimes for foreign investors.

These changes, coupled with Circular 25, have significantly simplified administrative procedures and reduced account opening timelines. According to the Ministry of Finance, the time required to complete the paperwork has been reduced to approximately two weeks, meeting the expectations of foreign investors and aligning with international practices.

Clear signal for market upgrade expectations

Over time, various legal documents have been introduced to remove obstacles, including Circulars 68/2024/TT-BTC, 18/2025/TT-BTC, 20/2025/TT-BTC, and 03/2025/TT-NHNN, all sharing the common goal of creating a favorable environment for foreign investors and increasing capital inflows into the market.

Notably, Circular 68/2024/TT-BTC allowed foreign institutional investors to trade without full payment of funds, marking a significant step forward in aligning with international practices and boosting investor confidence.

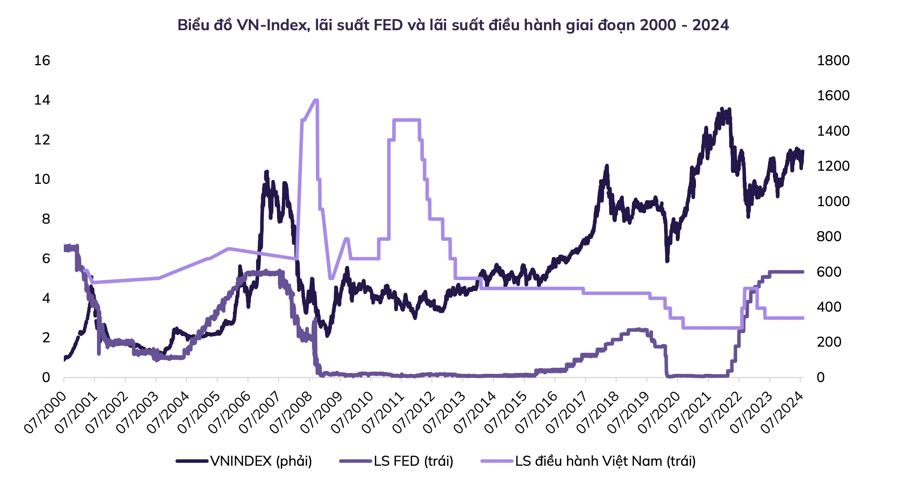

Many organizations and experts believe that these legal changes are pivotal for the FTSE’s upcoming market assessment in September 2025, which will take place on October 7, 2025. There are strong indications that Vietnam’s stock market will be upgraded by the FTSE.

It is estimated that if the market is upgraded, passive funds tracking the index could invest approximately $1 billion in Vietnam. Active funds focusing on emerging markets could also allocate between $4 billion and $6 billion. This would be a significant influx of capital, providing a strong boost to the stock market in the coming period.

Beyond attracting foreign capital, an upgrade would also enhance market depth, improve transparency, and promote standardization in line with international practices. According to VinaCapital’s experts, this would contribute to a sustainable investment environment, strengthening the confidence of both domestic and international investors.

– 10:00 09/08/2025

Challenges Remain to Achieve the Target of Fully Disbursing Public Investment Capital, Says Deputy Finance Minister.

As of the regular Government press conference for August 2025, Vice Minister of Finance Tran Quoc Phuong shared positive updates on the disbursement of public investment capital for the first eight months of the year, totaling nearly VND 410 trillion.

Unlocking Green Finance in Vietnam: From a “Common Language” to an International Financial Center

Experts have outlined a clear roadmap to boost sustainable investment in Vietnam. The government’s introduction of a “common language” is seen as a breakthrough policy move, while the future establishment of an International Financial Center is expected to be the “key” to enhancing transparency and investor confidence. These foundational solutions aim to bridge the gap between the massive capital requirements for Net Zero goals and the current market’s modest size.

The Great Race to Vietnam: A Zero-Tariff Treasure Trove for the World’s Economies

The import of this product from the US is surging, with a significant 78% increase compared to the same period last year.