According to the reviewed semi-annual financial statements for 2025, the auditors highlighted that SMC incurred a loss of over VND 102 billion in the first six months, bringing the total cumulative loss to nearly VND 242 billion. Operating cash flow was also negative at almost VND 130 billion, while short-term debt exceeded short-term assets by VND 972 billion.

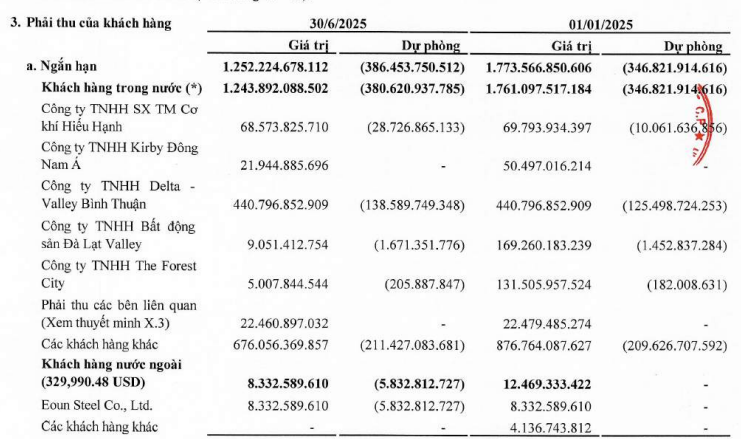

In its explanation, SMC stated that it will “resolutely handle overdue debts, especially from customers belonging to the Novaland Group, in 2025” with the goal of completing this within the year. As of the end of June 2025, the company still had VND 391 billion in bad debts related to the Novaland Group and several other enterprises.

Source: SMC’s Reviewed Semi-Annual Financial Statements

|

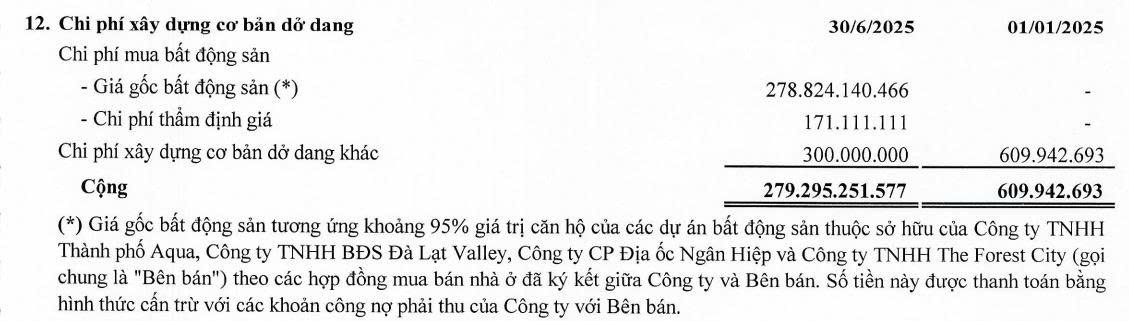

Previously, the two parties had settled a portion of the debt through real estate offset transactions.

On December 20, 2024, SMC and the Novaland Group signed a debt confirmation and repayment commitment. In March-April 2025, the two parties began implementing the aforementioned agreement. Accordingly, SMC recorded an increase in assets awaiting transfer of VND 279 billion and prepaid to sellers related to the purchase/long-term lease of real estate of VND 156 billion to offset receivables from Novaland. The total value of the transaction amounted to VND 435 billion.

Source: SMC’s Reviewed Semi-Annual Financial Statements

|

In addition, SMC implemented a strategy to control costs and improve production efficiency by reducing material and energy consumption and disposing of inefficient assets. The company also optimized its working capital, especially inventory and accounts receivable, amidst fluctuations in the steel market due to changes in tax policies and the global political crisis.

With short-term debt of over VND 3,620 billion as of the end of June 2025, SMC is confident in receiving support from its suppliers through debt repayment extensions. The company affirms its ability to overcome these challenges and continue normal business operations in the coming period.

In the stock market, SMC’s shares recently surged with abnormal trading volume on September 08, 2025, and continued to rise on September 09. Overall, the stock price has increased by nearly 10% in the last two sessions.

| SMC Share Price Movement |

In related news, the company has received the resignation of Mr. Hứa Vũ from the position of Board member due to personal reasons and a change in his job.

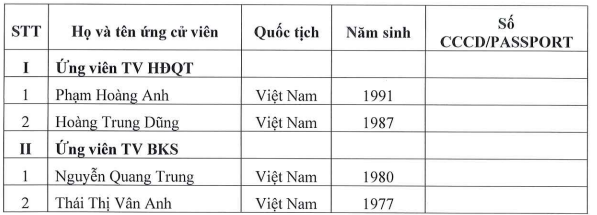

SMC has also published the documents for the upcoming Extraordinary General Meeting of Shareholders, scheduled for the morning of September 25. The Board of Directors will propose to the shareholders the election of two additional Board members and two additional Supervisory Board members for the term 2021-2025.

The Board candidates include Mr. Phạm Hoàng Anh, with a financial background, who has worked at MBS Securities and OCB Bank and is currently the Deputy General Director of ConnectLog Vietnam; and Mr. Hoàng Trung Dũng, Vice Chairman of Hai Duong Road and Bridge JSC, and Head of Investment Advisory at Bao Viet Securities.

Source: SMC’s Extraordinary General Meeting Documents

|

Vu Hao

– 10:06 09/09/2025