Bkav Pro’s Financial Performance in the First Half of 2025

Source: Bkav Pro’s Report to HNX

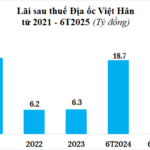

Bkav Pro, a leading antivirus software company, has released its financial report for the first half of 2025, revealing a pre-tax profit of VND 3,048 billion and an after-tax profit of VND 2.58 billion, a 4% decrease compared to the same period last year.

The company’s profits have been on a downward trend since 2019, with a significant drop to just one-tenth of its 2019 profits (VND 117 billion) by 2023. However, there was a slight improvement in 2024, with profits reaching VND 41 billion, the highest in three years.

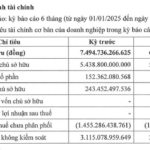

As of June 30, 2025, Bkav Pro’s total assets were valued at nearly VND 614 billion, including owner’s equity of over VND 264 billion and liabilities of nearly VND 350 billion.

The company, led by Mr. Nguyen Tu Quang, currently has outstanding bond debts of VND 162 billion, bank loans of VND 23 billion, and other debts totaling over VND 164 billion.

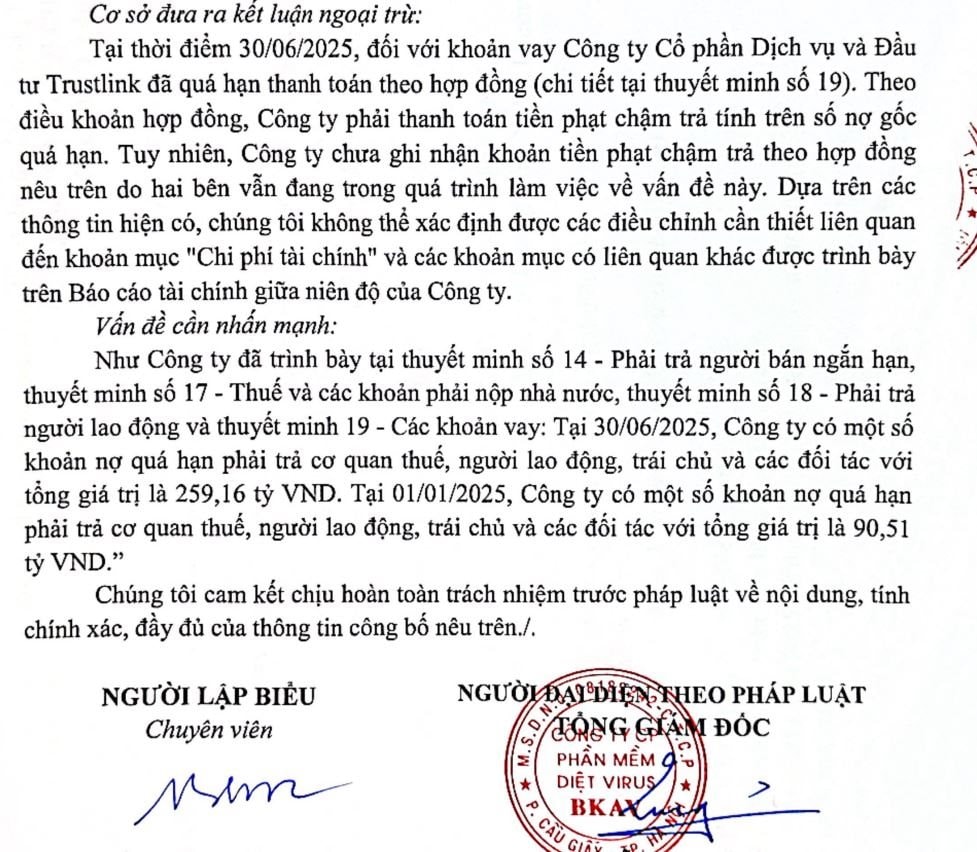

The auditing firm, AASC, provided a qualified opinion regarding a loan from Trustlink Joint Stock Company that was past due as of June 30, 2025. According to the contract, Bkav Pro is liable for late payment penalties on the overdue principal amount. However, as the two parties are still in discussions, the company has not yet recorded these penalties. As a result, the auditors were unable to determine the necessary adjustments to the “Finance Costs” and related items presented in the company’s interim financial statements.

According to VNDirect’s introduction of Bkav Pro’s bonds, the company achieved impressive results in 2018, its founding year, with revenues of over VND 100 billion and profits of tens of billions of dong, and a profit margin of 60%.

However, since 2019, Bkav Pro’s profits have declined significantly, and as of the first half of 2025, its return on equity (ROE) stood at only 0.98%.

The auditors also highlighted that as of June 30, 2025, the company had overdue payments totaling VND 259.16 billion to tax authorities, employees, bondholders, and partners. This figure was VND 90.51 billion as of January 1, 2025.

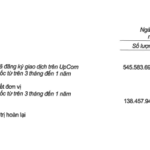

In August 2025, Bkav Pro announced its search for partners to transfer secured assets, including 6.1 million shares owned by Bkav Joint Stock Company and 4.9 million shares owned by Chairman Nguyen Tu Quang.

Established in March 2018, Bkav Pro’s initial chartered capital was VND 50 billion, with three founding shareholders: Bkav Joint Stock Company holding 96%, Vu Ngoc Son holding 2%, and Lai Thu Hang holding 2%. In August 2018, the company increased its charter capital to VND 100 billion, and in October 2018, Bkav Joint Stock Company reduced its ownership to 83.96%, while the two individual shareholders retained their 2% stakes each. In June 2020, Bkav Pro further increased its charter capital to VND 120 billion.

Since July 2022, Mr. Nguyen Tu Quang has been serving as the company’s General Director and legal representative.

“Sunrise City Investor Profits Soar: A Whopping $41 Million in the First Half of 2025”

Nova Land Investment Corporation (NVJC), a subsidiary of Nova Group, reported a net profit of over VND 41 billion in the first half of 2025, a decline of more than 74% compared to the same period last year.

The Second Largest Insurer in Vietnam Invests over $820 Million in Stocks, Recording a Profit of $35 Million in the First Half of the Year

As of June 30th, Prudential Vietnam Insurance’s short-term investment portfolio was predominantly comprised of listed stocks and UPCoM-traded equities, accounting for over half of its total value at VND 19,438 billion.