LNG is a strategic commodity, with the Thi Vai warehouse expansion slated for late 2028.

Regarding the LNG market, PV GAS‘s CEO, Pham Van Phong, shared that it has been a prominent topic in recent months. LNG is identified as one of GAS‘s prioritized products for the upcoming period. Given the nature of the gas market, where domestic gas sources are declining, supplementing LNG is inevitable and a strength of GAS, as evidenced by the Thi Vai LNG warehouse, which has been operational since 2023 and positively contributes to their business.

Annual General Meeting of PV GAS 2025. Photo: Chau An

|

Concerning LNG projects, Mr. Phong asserted that investing in related infrastructure is a prerequisite for market development. “Recently, GAS has decided to focus on investment. The Board of Directors has also approved the investment project to expand and upgrade the Thi Vai warehouse’s capacity to 3 million tons, expected to be completed by the end of 2028-2029 to meet the dry-season electricity demand in 2029,” Mr. Phong shared.

The second project, LNG Son My, is also strategic. Apart from supplying the Son My power complex, the project aims to provide for the power complex in South-Central Vietnam to utilize the warehouse’s full capacity.

“Currently, GAS holds 61% of the Son My warehouse, with the AES Corporation (USA) owning the remaining 39%. The project preparations are essentially complete. Our American partner is also keen to commence the project. As part of our strategy to ensure trade balance with the USA, GAS has presented to the Ministry of Industry and Trade the impact of this port warehouse”.

PV GAS‘s CEO also revealed plans for a central region LNG mega-warehouse, currently under negotiation with the province and gas consumers like EVN. They expect a specific schedule within the next 1-2 months. “With four LNG warehouses in the North, Central, South, and South-Central regions, GAS believes it can provide sufficient gas for most power plants in the region under the Power Development Plan 8 (PDP8). GAS has also convinced the government to invest in central LNG hubs to supply gas to all power plants in PDP8″.

According to Mr. Phong, GAS will witness definite developments in LNG. While challenges remain, with 95% state-owned shares, GAS must adhere to numerous regulations to ensure the projects’ success.

“As for potential, the adjusted PDP8 considers LNG a primary energy source for power plants. However, LNG demand is neither fixed nor stable, subject to issues like competition from alternative fuels (coal). Nonetheless, GAS is committed to the long haul and cannot focus solely on the short term” – he added.

Anticipating gas reduction, unafraid to negotiate

Addressing a shareholder’s concern about the domestic gas reduction trend, Mr. Phong clarified that GAS operates within the exploration, prospecting, and development chain of PVN. Whether desired or not, GAS must follow PVN’s strategy, including the development of fields, exploration, and prospecting.

“The gas reduction is not unexpected, as GAS anticipated it since 2022. If the development of domestic fields cannot be accelerated, GAS‘s growth rate will decrease from 2023-2027. However, with new fields coming into operation, GAS believes this will create positive conditions for growth”.

For short-term solutions, GAS has identified a reduction in gas supply and has expanded its business, including international business, to compensate for revenue and profit shortfalls. In the long term, LNG and developing domestic gas sources remain GAS‘s goals and strengths.

Additionally, GAS actively promotes projects related to green energy, including green nitrogen and others. While not disclosing details, Mr. Phong mentioned that these could be a premise for GAS in the next five years. “There are solutions for stable business operations in the short, medium, and long term” – he affirmed.

Another shareholder raised the issue of the impact of US tariffs and trade balance on GAS. Mr. Phong revealed that GAS was honored to be permitted by the Ministry of Industry and Trade and related agencies to join the delegation negotiating the trade balance with the USA.

“With the USA, GAS has certain advantages in negotiations, not subjected to undue pressure to make excessive concessions, ensuring GAS‘s advantages, so shareholders can rest assured. In reality, with LNG, the US market is not the only one with advantages. Simultaneously, GAS continues to engage with other partners to support the government’s negotiations while ensuring production and business efficiency” – he added.

A cautious plan continues

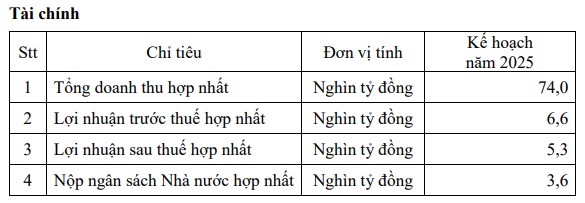

PV GAS‘s AGM approved a consolidated revenue plan of VND 74,000 billion for 2025, a 29% decrease; consolidated after-tax profit of VND 5,300 billion, equivalent to 50% compared to 2024. Notably, GAS typically sets plans lower than the actual implementation of the previous year.

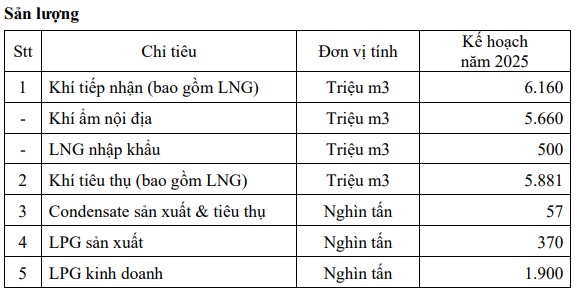

Regarding output targets, the company plans to receive nearly 6.2 billion m3 of gas (including imported LNG); consume over 5.88 billion m3 of gas (including LNG). LPG production is 370,000 tons, while LPG trading plans are 1,900 tons.

|

PV GAS 2025 Plan

Source: GAS

|

|

GAS‘s Output Plan

Source: GAS

|

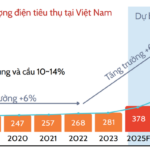

The basis for this plan, according to GAS, is that 2025 is expected to witness continued global economic fluctuations, increasing competitive pressure, declining domestic gas sources, and a tendency for upstream incidents to increase. Meanwhile, the imported LNG market and consumption are predicted to be unstable, and the emergence of a new LNG supplier (Hai Linh Company Limited) and fierce competition in the LPG market pose challenges.

Regarding the LPG market, competitors are willing to offer lower prices than PV GAS to attract customers, flexible financial policies such as contract performance guarantees, and payment guarantees. Other potential foreign competitors are aggressively entering the Vietnamese LPG market, directly competing with PV GAS. Furthermore, illegal LPG filling and charging using the PV GAS brand continue to affect retail operations.

At the AGM, PV GAS‘s CEO acknowledged the company’s competition but considered it inevitable and not abnormal. “Overall, a healthy market development requires multiple participants, buyers, and sellers. GAS is unafraid of competitors because of its strengths and sufficient basis for fair competition”.

Nevertheless, the company aims to strive for an 8% consolidated revenue increase compared to the previous year, instead of a decrease as planned. According to PV GAS‘s CEO, one disadvantage in 2025 is the rapid decline in oil prices, sometimes falling to $60 (USD) (compared to $80 (USD) in the same period). However, there are also unique advantages, such as debt recovery, market expansion, and international business development.

“As a result, GAS‘s business performance is very positive. Apart from the AGM plan, we have a more ambitious plan, challenging GAS. We are responsible for making it happen”.

As of Q1/2025, GAS achieved revenue of VND 25,700 billion, a 10% increase over the same period; net profit of nearly VND 2,760 billion, a 10% increase, mainly due to increased LPG output and LNG prices. The company achieved 35% of its revenue target and over 52% of its after-tax profit plan after Q1.

In the first five months of 2025, GAS announced that gas reception and consumption reached 45-50% of the annual plan; LPG trading exceeded 1.3 million tons (international business over 0.6 million tons), equivalent to 69% of the 2025 plan. Consolidated revenue in the first five months reached over VND 46,500 billion, equivalent to 63% of the 2025 plan; pre-tax profit exceeded VND 7,400 billion, surpassing 12% of the 2025 plan.

Regarding investment construction, the parent company’s disbursement value reached VND 842 billion, equivalent to 25% of the 2025 plan. Focus on implementing investment: Project to expand and increase the capacity of the Thi Vai LNG warehouse to 3 million tons/year, Son My LNG Port Warehouse Project, Ethane Separation Project at Dinh Co; prepare for investment: Cold LPG and LNG Warehouse Project in the North/North Central; Project to supply gas to Long An 1 and 2 Power Plants; Project to upgrade the capacity of the Phu My – Ho Chi Minh City gas pipeline…

According to PV GAS, the 2025 goal is to focus on modern governance methods, renew old motivations, and supplement new ones, ready to shift the business model. The company will promote the development of the gas, LNG, and gas products consumption market, especially the domestic LNG market and international business.

Regarding the investment construction plan, the expected investment value in 2025 is VND 2,900 billion; investment disbursement of VND 3,300 billion (entirely from equity). Mr. Phong shared that GAS plans to invest VND 78,000 billion in the next five years to implement the projects.

“An LNG Hub-related project could cost up to $1 billion (USD). We set higher ambitions for GAS to strive and develop in the future” – he continued.

Mr. Phong is particularly confident about capital disbursement. “The Lot B project is being actively implemented, with annual disbursements of about VND 1,500-2,000 billion in the next three years. GAS is making efforts to arrange capital for the project. Capital arrangement is not a significant issue. Holding GAS shares will give you peace of mind because we are one of the blue chips in the market and have never had problems”.

Dividend of 18.5%, issuance of 70 million shares to increase capital

The GAS AGM approved a dividend ratio of 21% in cash (equivalent to over VND 4,900 billion) for 2024. For 2025, the expected dividend ratio is 18.5%.

Notably, the plan to increase charter capital by issuing a maximum of nearly 70.3 million shares to existing shareholders is equivalent to a value of nearly VND 703 billion according to par value. The entitlement ratio is 3% (shareholders receive one right for each share, and 100 rights will receive three new shares). The shares are not restricted from transfer and will be issued after the AGM approves and receives notification from SSC (expected from Q2-4/2025).

– 07:00 31/05/2025

“PV Gas Targets Profit Matching the First Half of the Previous Year, Issues 70 Million Bonus Shares”

“Amidst a volatile economic landscape, PV GAS, a leading Vietnamese gas company, foresees a challenging year ahead. With domestic gas sources dwindling and competition intensifying, the company has strategically set a cautious target for its 2025 earnings, aiming for half of the previous year’s profit after tax, as revealed in their Annual General Meeting documents.”

“Strengthening Strategic Collaboration Between Vietnam and Leading US Corporations”

The discussions with leading corporations such as Excelerate Energy, Lockheed Martin, SpaceX, and Google have paved the way for new strategic collaborations between Vietnam and the United States. These engagements have outlined key areas of cooperation in the fields of energy, aerospace, technology, and telecommunications.

“Securing Energy Independence and Joining the Global Value Chain: The Case for LNG Development”

“Vietnam is facing an ever-growing energy demand to fuel its economic growth and industrialization goals. The utilization of liquefied natural gas (LNG) emerges as a pivotal solution, offering not just energy security but also a pathway towards cleaner energy sources. LNG presents Vietnam with an opportunity to partake in the global LNG value chain, thereby ensuring a sustainable and secure energy future.”

The Quiet Korean ‘Chaebol’ Makes a Move in Quang Nam

“In a significant move, one of the top 30 economic conglomerates in South Korea has chosen to adopt LNG as the energy source for its industrial complex in Quang Nam. This decision underscores the company’s commitment to sustainable practices and positions it at the forefront of Korea’s energy transition.”