“The Power of Biometrics: Revolutionizing Vietnam’s Banking Sector”

According to statistics from the State Bank of Vietnam, as of August 15, the banking sector has successfully captured and biometrically verified nearly 124 million individual customer records (CIF), representing a remarkable 100% of all personal transaction accounts conducted through digital channels.

For organizational customers, over 1.3 million records have undergone biometric verification, again achieving 100% coverage of all digital transaction accounts.

100% of individual and organizational transaction accounts are now biometrically verified.

This initiative has yielded significant positive outcomes in data cleansing, contributing to a nearly 60% reduction in fraud cases and a 52% decrease in accounts associated with fraudulent activities compared to pre-biometric verification periods.

The National Credit Information Center (CIC) has collaborated with Department C06 of the Ministry of Public Security to complete six offline data cleansing campaigns, encompassing approximately 57 million customer records.

63 credit institutions and foreign bank branches have implemented citizen ID cards with chips through counter devices; 57 credit institutions and 39 payment intermediaries have applied this technology through mobile apps; while 32 credit institutions and 15 payment intermediaries are in the process of adopting VNeID.

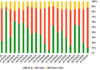

Additionally, the State Bank reports that in the first seven months of this year, compared to the same period in 2024, cashless transaction volumes increased by over 44%, and values rose by 25%. Transactions via the Internet surged by 49.6% in volume and 35.6% in value. Mobile phone transactions grew by over 38% in volume and more than 21% in value, while QR Code transactions witnessed a remarkable spike of nearly 67% in volume and almost 160% in value. Transactions through the Inter-bank Electronic Payment System increased by 4.4% in volume and over 45% in value, and those through the Financial Switching and Electronic Clearing System rose by nearly 15% in volume and 3.7% in value.

In comparison to 2024, ATM transactions continued to decline in the first seven months of this year, falling by nearly 16% in volume and 4.9% in value, indicating a shift away from cash withdrawals and a growing preference for cashless payment methods and habits among the populace.

Unlocking the Gates to Asia: Vietnam Hosts the ‘Golden Bridge’ Event for European Businesses

As of this writing, the FIATA World Congress 2025 (FWC 2025) in Hanoi has garnered significant interest from the European business community.

Unveiling the Hidden Meaning Behind Vietlott’s Iconic Symbol

“What is it that captivates and enthralls? It’s that elusive spark that sets your heart racing and your mind ablaze. It’s that moment when you discover something extraordinary, something that transcends the ordinary and ignites your soul. It’s that feeling of awe and wonder that leaves you breathless and inspired. It’s that ‘it’ factor that makes your website stand out from the crowd and leaves an indelible mark on all who encounter it. It’s time to unlock the potential of your online presence and reveal the ‘it’ that defines your digital destiny.”