The Board of Directors of SSI Securities Corporation (code: SSI) announced that September 26 will be the record date for the 2024 cash dividend payment, with a ratio of 10% (VND 1,000 per share). The expected dividend payment date is October 15, 2024.

With nearly 2.1 billion shares outstanding, SSI is expected to pay out more than VND 2,075 billion to shareholders in this round.

On the market, SSI closed at a new peak of VND 42,450 per share on September 11, marking a nearly 63% increase since the beginning of the year. As a result, its market capitalization also hit a record high of over VND 88,100 billion, solidifying SSI’s position as the largest securities company in terms of market capitalization among listed securities companies.

SSI has recently completed a private placement of over 104 million shares to professional securities investors, with a subscription rate of 100%. The offering price was VND 31,300 per share, and SSI raised over VND 3,256.5 billion from this issuance. Half of the proceeds will be used to supplement capital for investing in deposit certificates, while the remaining half will be allocated for margin lending activities.

At the end of September, SSI will hold an extraordinary general meeting of shareholders, including an important agenda item to discuss the plan to offer up to 415.58 million shares to existing shareholders through a rights issue.

The entitlement ratio is 5:1, meaning that for every five shares held, shareholders will have the right to purchase one new share. The offered shares will not be subject to transfer restrictions. Shareholders holding restricted shares will still be entitled to receive the rights. The offering is expected to take place between 2025 and 2026.

The expected offering price is VND 15,000 per share. If the offering is successful, SSI estimates to raise a maximum of VND 6,234 billion to supplement capital for investment and margin lending activities. Consequently, SSI’s chartered capital is expected to increase from VND 20,778 billion to VND 24,935 billion.

In terms of business performance, for the first six months of the year, SSI’s operating revenue reached VND 5,152 billion, a 20% increase compared to the same period last year, while after-tax profit reached VND 1,812 billion, a 12% increase.

The Rising Titans: HOSE Welcomes Three New Members to the $10 Billion Capitalization Club

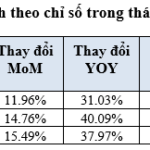

In August 2025, the HOSE witnessed a remarkable surge with key indices climbing upwards. This positive momentum was further emphasized by the growth of most sectoral indices compared to the previous month. Riding on this wave of optimism, HOSE proudly welcomed two more businesses with a market capitalization of over USD 1 billion each and an additional three enterprises with a market cap exceeding USD 10 billion.