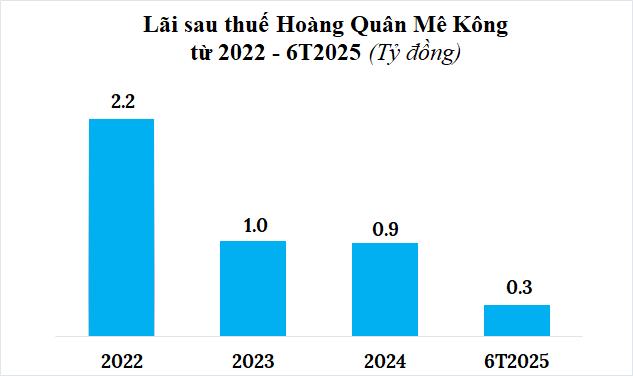

Joint Stock Commercial Consulting Real Estate Services Company Hoang Quan Mekong (HQM) announced its financial results for the first half of 2025, with a net profit of over 315 million VND, up 36% over the same period.

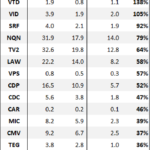

Source: Author’s compilation

|

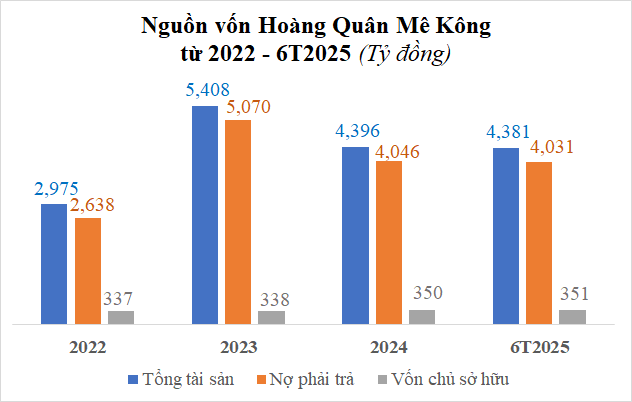

As of June 30, HQM’s equity was nearly 351 billion VND, including almost 24 billion VND in undistributed profits. Payable debt exceeded 4,030 billion VND, mainly consisting of other payable debt of nearly 3,520 billion VND, bond debt of 500 billion VND, and nearly 11 billion VND in bank loans.

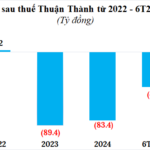

Source: Author’s compilation

|

According to the plan, the company had to pay nearly 31 billion VND in interest for the HQMCH2328001 bond lot on June 27, 2025, but due to delayed arrangement of funds, the payment was made on July 03.

This is the company’s only outstanding bond issue, with a value of 500 billion VND, a term of 5 years, and a maturity date of December 27, 2028. The issuance interest rate was 12% per annum.

Hoang Quan Mekong shares key members with Joint Stock Commercial Consulting Real Estate Services Company Hoang Quan (HOSE: HQC). The enterprise currently has a charter capital of 320 billion VND, with Mr. Hoang Minh Duc as Chairman of the Board of Directors and legal representative.

As of the end of Q2/2025, HQC recorded numerous receivables from HQM, including nearly 405 billion VND in short-term and 10 billion VND in long-term loans with an interest rate of 12% per annum. Additionally, HQC had over 573 billion VND in other short-term receivables, which were collaboration profits according to a contract signed in September 2023 with HQM.

Another notable amount is the 259 billion VND that HQC contributed in capital to HQM for the implementation of the Binh Minh Industrial Park social housing project in Vinh Long. As per the agreement, profits will be distributed at the end of the fiscal year or reinvested in the project. Initially expected to be completed by May 31, 2025, the two parties signed an appendix to extend the deadline by three years.

HQM is the developer of numerous projects in Vinh Long, including the Binh Minh Industrial Park spanning over 134.8 hectares with a total investment of nearly 605 billion VND, and the Phuc Long social housing project with an area of over 3.9 hectares and an investment of nearly 623 billion VND, among others.

Thanh Tu

– 16:35 12/09/2025

What’s the Bottom Line Impact of Half-Year Audit on Listed Companies?

According to statistics from VietstockFinance, 1,006 listed companies on the HOSE, HNX, and UPCoM exchanges experienced a collective loss of over VND 473 billion in net profit after audits, leaving them with just under VND 285 trillion. This decrease equates to nearly 0.2% of their pre-audit profits.

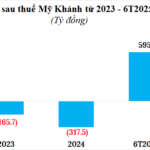

“My Khanh Development Investment Records a Staggering 600 Billion Profit in H1, Freed from Bond Debt”

After suffering losses of over VND 480 billion for two consecutive years, My Khanh Investment and Development turned their fortunes around, reporting a remarkable profit of nearly VND 600 billion in the first half of 2025. The company also repurchased bonds worth over VND 2,800 billion before maturity.

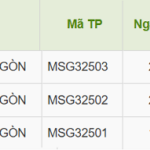

Unveiling the 3 Major Real Estate Tycoons in Ho Chi Minh City with Outstanding Tax Debts

In the latest list of major tax debtors revealed by Ho Chi Minh City’s Tax Department, three real estate businesses top the chart with a combined debt of over 100 billion VND. These companies, all operating in the realm of real estate investment and development, now face public scrutiny as their substantial tax liabilities come to light.