The government has issued Resolution 05/2025/NQ-CP, officially implementing a five-year pilot framework for the issuance and trading of crypto assets. Licensed platforms must have a minimum capital of VND 10,000 billion, with dominant participation from investment organizations and foreign ownership not exceeding 49%. All transactions must be settled in VND, and only domestic enterprises are permitted to issue new crypto assets.

Prior to this, at the 9th session in mid-June, the National Assembly officially passed the Law on Digital Technology Industry, ushering in opportunities for the strong development of digital assets in Vietnam. According to Dragon Capital, Vietnam ranks 5th in the world in terms of crypto asset adoption, with an estimated holding scale of approximately $100 billion, and Resolution 05/2025 is an important step to promote the rapid and sustainable growth of the market.

Dragon Capital believes that this legal framework will help mitigate speculative risks by restricting unregulated platforms, while also fulfilling the orientation of developing the domestic capital market deeper by positioning Vietnam to become one of the managed crypto asset centers in Asia in the near future.

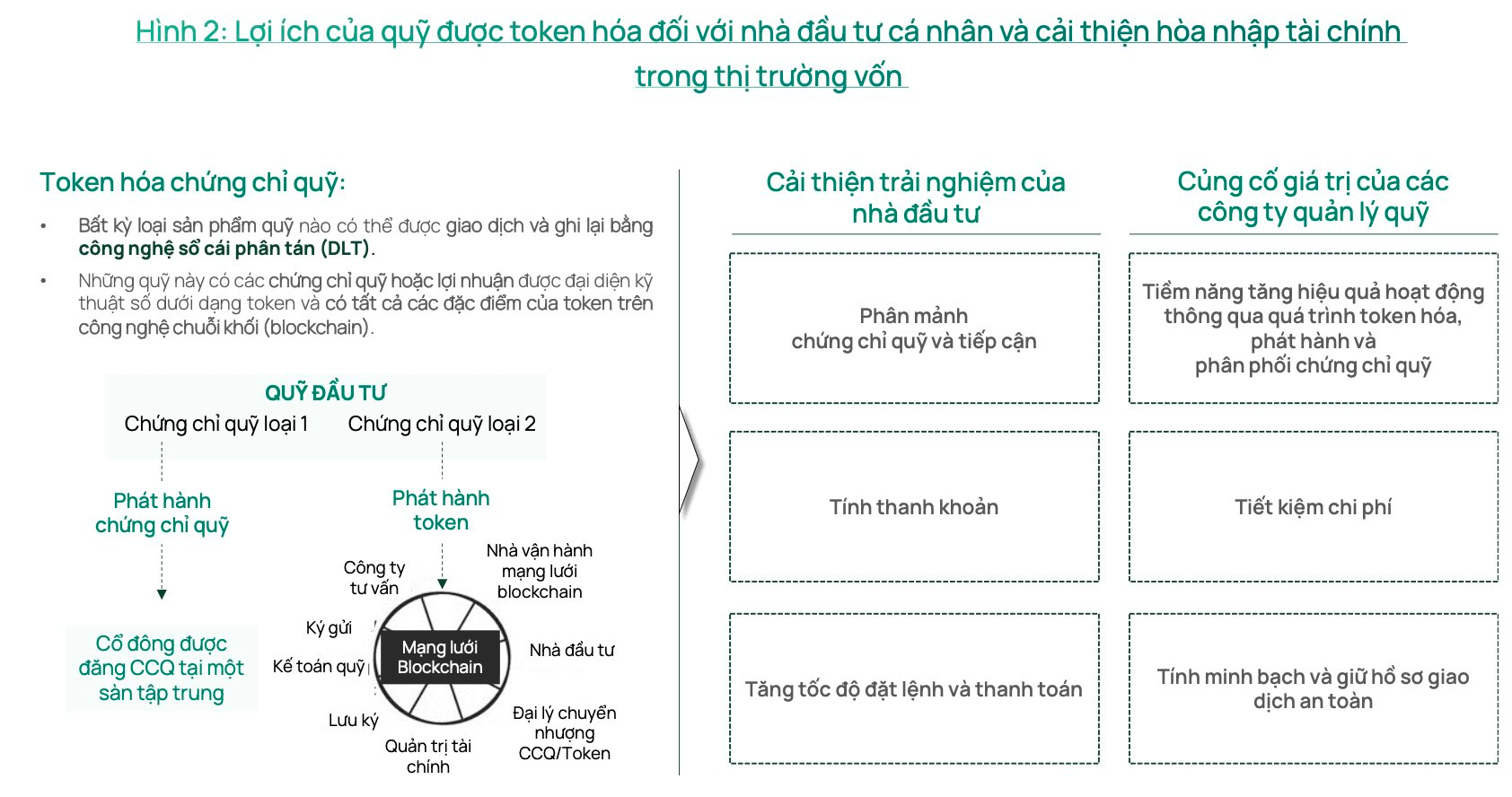

In this context, Dragon Capital has proposed a pilot project on ETF (Exchange Traded Fund) tokenization, as this financial product is already familiar to a large number of individual investors. This approach aims to bridge the gap between traditional investment and digital asset technology, creating opportunities to enhance the participation of individual investors in the capital market while promoting financial inclusion.

Dragon Capital assesses that tokenized ETFs offer a novel and efficient avenue for individual investors in Vietnam to enter the investment arena, combining the benefits of traditional ETFs with the innovative features of blockchain technology. By harnessing the potential of blockchain within a legal framework, tokenized funds can enhance transparency, security, and efficiency in financial markets.

“The Gateway to Vietnam’s Crypto-Asset Revolution”

The draft resolution on the pilot program for the crypto asset market is being finalized. This move towards a pilot crypto exchange in Vietnam’s international financial center is a bold step forward for the country’s fintech industry.

Unlocking the Power of Crypto: Da Nang Embraces Basal Pay, the First Compliant Tokenized Payroll Project

On August 26th, the People’s Committee of Da Nang City officially granted a license to Basal Pay, a project that utilizes blockchain technology for domestic transfers aimed at international tourists, to participate in the FinTech sandbox. This controlled experimental framework allows for the testing of new digital financial models.