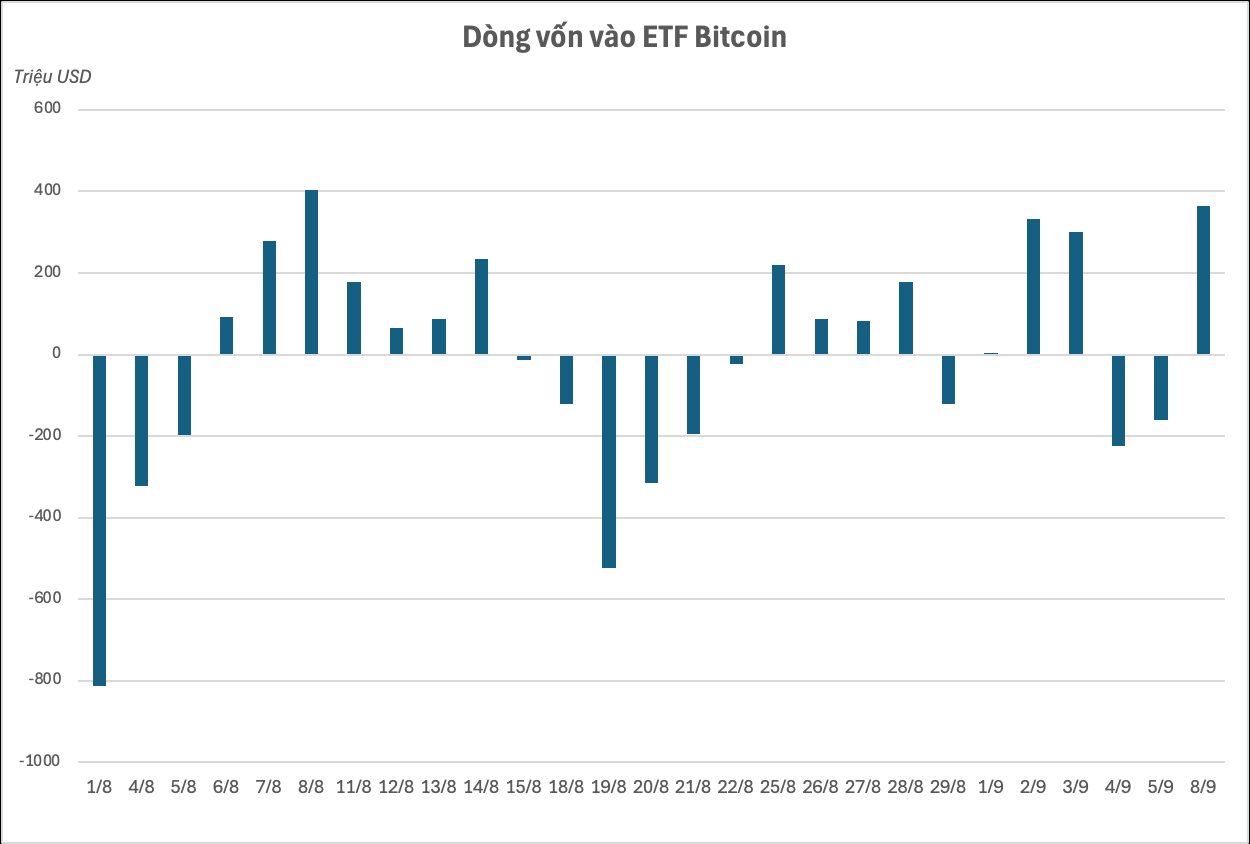

Net inflows into Bitcoin ETFs unexpectedly surged after two consecutive days of outflows. On September 8, Bitcoin ETFs attracted a net inflow of over $364 million, the highest daily inflow in a month. This positive trend continued on September 9, with an additional net inflow of nearly $26 million.

Cumulatively, since the beginning of September, Bitcoin ETFs have seen net inflows of $643.62 million, a significant improvement from the outflows of nearly $734 million experienced in August.

Since their approval in the US in early 2024, Bitcoin ETFs have made a significant impact. BlackRock’s iShares Bitcoin Trust (IBIT), with $83.4 billion in assets under management, is the largest Bitcoin ETF. Other prominent institutions, such as Fidelity (FBTC) and Grayscale (GBTC), have also launched Bitcoin ETFs, attracting tens of billions of dollars in investments. As a result, the global assets under management by Bitcoin ETFs have surpassed $146 billion.

In contrast, Ethereum ETFs have experienced net outflows of nearly $819 million since the beginning of September. The total assets under management by Ethereum ETFs currently stand at $23 billion.

In terms of value, Ethereum is trading above $4,300, unchanged on a daily basis but down about 3% from the previous week. Meanwhile, Bitcoin has gained around 2% over the week, trading at $113,768.

The performance gap highlights Bitcoin’s relatively better defensive characteristics during market volatility. This could also be a factor in the renewed interest in Bitcoin ETFs as investors adopt a more cautious approach towards Ethereum ETFs.

The Asanzo Chairman: Evading Investigation?

In the indictment filed by the prosecution, Mr. Pham Van Tam, Chairman of Asanzo Company, was not only charged with tax evasion of over VND 15.7 billion but also with smuggling goods worth VND 414 million. Regarding the smuggling charge, the case file revealed statements alleging that Mr. Tam instructed his subordinates to evade cooperation with the police.

The Ultimate Guide to Investing: Unlocking the Secrets to Managing Over $6 Billion in Assets.

As of 2025, MB Securities (MBS) boasts a total asset value under management of over $6 billion, a staggering increase of almost 1.5 times compared to the 2024 average. This remarkable growth begs the question: what is the driving force behind this significant surge in NAV?

Where Are Fund Managers Investing Their Money?

As of September 30, 2024, statistics from 24 prominent Fund Management Companies showcase an impressive performance: their collective assets under management (AUM) surpass 550 trillion VND, an astounding 69 times their total assets. This equates to 8% of the total market capitalization of Vietnam’s stock market, illustrating the significant role and impact of these firms in the country’s economic landscape.