August Market Recap

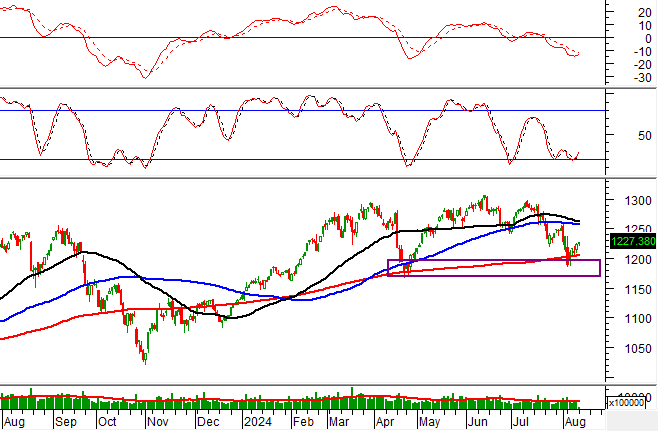

As we transitioned into August, the Vietnamese stock market continued its upward trajectory, buoyed by strong domestic capital inflows and an increasingly optimistic investor sentiment. Despite some notable fluctuations during the month, the overall trend remained positive.

Towards the end of July, the VN-Index had reached a new historical peak, successively conquering significant milestones of 1,552 points, 1,557 points, and approaching 1,600 points in early August 2025. Riding this momentum, the index further solidified its recovery trend that began in late June and sustained a steady upward movement.

By mid-August, the VN-Index broke through the 1,640-point mark, cementing the upward trajectory. This was accompanied by consistently improving market liquidity, with average trading values surging. Statistics show that liquidity during August hovered around VND 47,000 billion per session, indicating investors’ heightened interest in the stock market. Notably, this capital inflow was concentrated on leading stocks, particularly large-cap stocks in sectors such as banking, securities, real estate, and construction, which directly influence the VN-Index.

However, after a persistent upward march since late July, the VN-Index approached the psychological resistance level of 1,700 points in mid-August. At this juncture, profit-taking pressure emerged, leading to some corrective sessions towards the month’s end. Notably, on August 26, the VN-Index rebounded strongly after two days of adjustment pressure, surging by +53.6 points to close at 1,667.63 points. Liquidity remained robust, reflecting the sustained inflow of capital and reinforced market confidence, despite short-term fluctuations.

At the end of August, the VN-Index stood at 1,682.21 points, nearly 180 points higher than the previous month’s close. With the index approaching the psychological resistance of 1,700 points, the market entered a “trial by fire” phase, facing increased profit-taking pressure. In this context, sustaining robust capital inflows is crucial for the VN-Index to successfully breach this critical resistance level.

VN-Index performance from the beginning of the year until August 31, 2025

September Market Outlook

Entering September, the Vietnamese stock market is expected to maintain its upward trajectory, likely fluctuating within the 1,700–1,800-point range. The growth process may be interspersed with technical corrections and fluctuations, which are typical within a robust upward trend. Notably, the 1,640-point level continues to serve as a strong support zone, providing a reliable foundation during market corrections. Liquidity is likely to remain positive, reinforcing the pivotal role of domestic capital inflows in driving the overall market trend.

From a sectoral perspective, several groups of stocks are poised to be in the spotlight during September. The securities sector is anticipated to benefit directly from abundant liquidity and the pervasive optimistic sentiment in the market. Steel (HPG, HSG, NKG, etc.) and chemicals (DDV, DGC, etc.) sectors are expected to recover, driven by favorable domestic consumption trends and positive commodity price movements. Port operations (GMD, VSC, etc.) continue to exhibit positive prospects due to sustained growth in import-export activities, while construction (CTD, HHV, C4G, etc.) may be propelled by public investment capital. Notably, the oil and gas sector (PVD, GAS, BSR, etc.) emerges as a crucial focal point, benefiting from sustained high oil prices and the increasingly evident energy infrastructure investment outlook.

Given these factors, investors’ strategy for September should be flexible and selective. For long-term investors, the focus should be on fundamentally strong stocks with attractive valuations and clear growth prospects. Concurrently, short-term trading can be employed for portfolio restructuring, especially when holding a substantial stock position, thereby optimizing performance in a market brimming with opportunities.

In summary, September not only presents a challenge at a critical resistance level but also offers an opportunity for investors to restructure their portfolios, capitalize on leading sectors, and harness the dynamic capital flow. By doing so, the “trial by fire” can become an “investment bright spot.”

(*) This article is intended to provide information to investors for reference only. Accordingly, forecasts and information in this report are subjective and may change without prior notice. The article does not constitute a solicitation or offer to buy or sell any securities, and investors should make their own decisions based on the information in this article.

Article provided by VPS Securities Joint Stock Company

September Market: Where Should Investors Focus Their Attention?

The VN-Index is predicted to sustain its upward trajectory, targeting the 1700-1800 range, presenting an attractive investment prospect for September. This positive outlook opens up new opportunities for investors, with a focus on sectors such as securities, port services, and steel.

A Surprising $35 Million Foreign Sell-Off of Blue-Chip Stocks in the Week of September 8-12.

The foreign bloc continues to exert significant selling pressure, recording yet another week of net selling exceeding VND 5,000 billion.

![[IR Awards] September 2024 Disclosure Calendar: Mark Your Dates!](https://xe.today/wp-content/uploads/2024/09/LCBTT_Screenshot_1.png)