In the first half of 2025, credit growth surged by 19.32% year-on-year and 9.9% since the beginning of the year, marking the highest credit growth rate since 2023. This robust expansion actively supports economic growth in line with government directives. The driving force behind this growth stems from the corporate customer segment, particularly in industries such as manufacturing and transportation.

Market mobilization as of June 26, 2025, grew by 6.11% year-on-year, with state-owned commercial banks leading the increase. Individual customer deposits saw positive growth throughout the months, while organizational deposits experienced a significant uptick toward the end of the quarter.

Global economic growth in the first half of 2025 has been sluggish, accompanied by numerous latent risks and complex fluctuations. Major organizations have revised their global economic growth forecasts downward. The U.S. Federal Reserve (Fed) maintained the USD interest rate at 4.25-4.5% and is expected to cut rates twice before year-end.

Interbank interest rates remained low, with a slight uptick on June 30, 2025, due to sudden liquidity demands mid-year. The State Bank of Vietnam (SBV) flexibly utilized OMO operations and treasury bills to support market liquidity needs. Market mobilization rates stayed low, with new deposit interest rates averaging 4.18% and new lending rates at 6.85% (a 0.08% decrease from year-end).

The VND/USD exchange rate trended upward, despite the DXY index declining, indicating domestic exchange rate pressures due to cautious sentiment.

System-wide credit growth is projected to exceed 16%. Credit will continue to be directed toward production, business, and priority sectors (such as housing programs for young people, infrastructure investment in science and technology, innovation, and digital transformation) in alignment with government policies.

The exchange rate in 2025 may face pressure from trade tensions between the U.S. and major partners, as well as potential inflation risks that could delay Fed rate cuts, bolstering the USD’s strength.

Deposit interest rates face upward pressure due to high capital mobilization needs for production, business, and public investment, alongside domestic exchange rate pressures. Lending rates will remain low to support the economy, potentially continuing the downward trend in bank net interest margins (NIM).

Exports may benefit from supply chain shifts and goods under Trump 2.0 policies. However, the U.S. may impose stricter rules of origin, targeting goods moving from China to Vietnam for export.

Focusing on 4 strategic pillars, total assets to grow by 8-10%

In 2025, VietinBank will continue to strengthen its 4 strategic pillars.

First, enhance core income growth, ensuring efficiency and sustainability. Develop sustainable scale, diversify revenue streams, and intensify debt recovery and risk management.

Second, increase customer engagement to become the primary transaction bank. Personalize services, shift transactions to digital platforms, and develop a comprehensive ecosystem.

Third, optimize human resource management through comprehensive digital transformation, improve staff quality, and continuously enhance service quality and financial capacity.

Fourth, strengthen risk management capabilities by closely monitoring credit quality, accelerating debt recovery, and addressing technological risks.

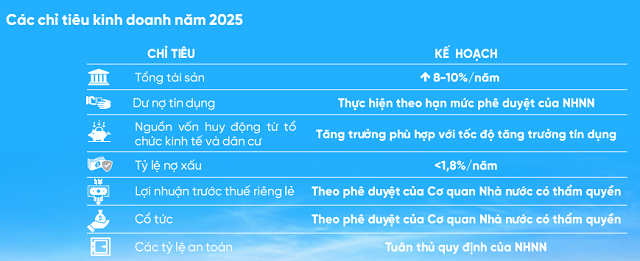

VietinBank sets a 2025 target of 8-10% total asset growth. Credit balance growth will align with SBV approvals. Mobilized capital will match credit growth rates. The non-performing loan ratio will be kept below 1.8%. Pre-tax profit will follow approvals from competent state authorities.

On the Ho Chi Minh City Stock Exchange (HOSE), CTG shares are trading around VND 49,300 per share (as of August 20, 2025), up over 30% since the beginning of the year. Average liquidity exceeds 8 million shares per day.

| CTG share price movement since the beginning of the year |

– 09:44 20/08/2025

The Crypto Market Today, September 7: Bitcoin Loses Key Support

The crypto market is ever-evolving, and analysts predict that Bitcoin could very well revisit the $75,000 mark. This prediction is not far-fetched, given the volatile nature of the cryptocurrency market and Bitcoin’s proven resilience. As we navigate these dynamic times, investors and enthusiasts alike await with bated breath, eager to witness Bitcoin’s next move.

“Steering a Course for Growth: Fiscal and Monetary Strategies for 2025 and Beyond”

Prime Minister Pham Minh Chinh has signed Dispatch No. 159/CD-TTg on September 7, 2025, providing guidance and direction for fiscal and monetary policy.