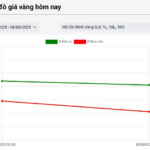

Global and domestic gold prices have experienced significant fluctuations.

|

Global gold price trends over the past year

Source: VietstockFinance

|

According to the State Bank of Vietnam (SBV) Branch II, since the beginning of 2025, global gold prices have consistently risen, reaching new peaks and breaking previous records. As of September 10, 2025, the global gold price stood at $3,646 per ounce, marking a 39.9% increase compared to December 31, 2024.

The primary drivers of this surge include heightened global political instability, prolonged military conflicts, and escalating strategic competition, such as the ongoing Russia-Ukraine war and other global tensions. These factors have led to economic and political sanctions, retaliatory measures, and increased gold purchases by central banks and investment funds to bolster foreign exchange reserves. Additionally, the U.S. imposition of high tariffs on multiple countries has negatively impacted investor sentiment regarding global economic growth, prompting a shift of investment capital into gold.

Domestically, the price of SJC gold bars has mirrored global trends. As of September 10, 2025, the selling price of SJC gold bars reached 135.3 million VND per tael, a 64.6% increase from the end of 2024. The price gap between SJC gold bars and the converted global gold price has widened to 19 million VND per tael, up significantly from 4 million VND per tael at the end of 2024.

The SBV Branch II attributes the faster rise in domestic gold prices and the expanded price gap to several factors. These include expectations of continued global gold price increases due to anticipated negative impacts of U.S. tariff policies on the global economy, unpredictable monetary policy trajectories from the Federal Reserve, ongoing geopolitical tensions, and potential commodity price shocks driving up gold demand. Additionally, the domestic supply of gold bars has not increased since the beginning of 2025.

Furthermore, it cannot be ruled out that some businesses and individuals may be exploiting market volatility to engage in speculation, price manipulation, and profiteering.

Updates on New Regulations and Important Recommendations

Gold trading activities must comply with Decree No. 24/2012/NĐ-CP (Decree 24). The government has issued Decree No. 232/2025/NĐ-CP (Decree 232) to amend and supplement Decree 24, effective from October 10, 2025. Key updates include:

- Transition from a monopoly mechanism for gold bar production to a licensing mechanism for gold bar production activities.

- Gold transactions of 20 million VND or more per day must be settled through bank accounts.

- Regulations on the responsibilities of organizations permitted to produce and trade gold bars, the import of raw gold, and the responsibilities of ministries, provincial People’s Committees, and central cities.

Given the volatile gold market and its associated risks, the SBV Branch II advises the following:

First, individuals are only permitted to buy and sell SJC gold bars through licensed credit institutions or enterprises authorized by the SBV. Enterprises dealing in gold jewelry and art are not licensed to trade gold bars, and engaging in such transactions with individuals or organizations violates Decree 24 (as amended by Decree 232). Non-compliant gold bar transactions will be penalized under Decree 88/2019/NĐ-CP.

Second, gold trading enterprises (jewelry, art, and gold bars) must strictly adhere to legal regulations regarding operating licenses, certificates of eligibility for jewelry production, gold bar trading licenses, product origin and quality, invoices, and public price displays. Compliance ensures transparency, risk mitigation, and prevents counterfeit goods, smuggling, and tax evasion.

Third, given gold’s volatile nature as a financial asset, individuals should exercise caution when purchasing or investing in gold to avoid risks associated with price fluctuations. Adhering to legal regulations contributes to market stability, curbs speculation and price manipulation, and safeguards the national economy’s interests.

– 17:53 13/09/2025

“Monetary, Gold and Stock Market Management: Strategies for Stability and Growth”

The Deputy Prime Minister, Ho Duc Phoc, has signed and issued an urgent dispatch on the 11th of September 2025, addressing the management and governance of the monetary, gold, and securities markets. This dispatch, numbered 161/CD-TTg, underscores the government’s proactive approach to maintaining stability and devising effective solutions for these vital markets.

Today, September 8: Gold Ring and SJC Gold Prices Drop Sharply

The relentless rally in gold prices has finally taken a breather, with gold rings and SJC gold witnessing a unanimous decline today.

The Golden Opportunity: Mapping the Route to a Vibrant Gold Exchange

Introducing the visionary initiative to revolutionize the gold trade in our nation: the proposal to establish a National Gold Exchange or enable gold trading on the Commodity Exchange, including the formation of a dedicated Gold Trading Floor. This ambitious endeavor aims to create a transformative platform that elevates the gold market to new heights, offering unparalleled opportunities for investors and traders alike. With a focus on innovation, transparency, and security, this exchange promises to be a game-changer, fostering a vibrant and robust gold trading ecosystem.

Unlocking Golden Opportunities: The Central Bank’s Imminent Move to Grant Gold Import and Bar Manufacturing Licenses to Businesses and Banks

The State Bank of Vietnam is expediting the release of guidelines for the implementation of Decree 232/2025/ND-CP. According to Vice Governor Pham Quang Dung, these guidelines will provide detailed instructions on the registration process for enterprises and commercial banks to obtain licenses for gold imports and gold bar production. The aim is to ensure a swift entry into the gold market for these entities.

The Golden Rush: Authorized Gold Bar Trading Locations Revealed in Ho Chi Minh City

The SJC gold bar price surged this morning, September 9, by 700,000 VND per tael across listed companies. Meanwhile, the price of 99.99% gold rings and jewelry also witnessed a significant increase of 600,000 VND per tael.