Illustrative image

SBV Sold $1.5 Billion in Forward Contracts in August

In a newly released monetary market report, MB Securities (MBS) noted that the US Dollar Index (DXY) continued its downward trend in August, pressured by expectations of a Federal Reserve (Fed) rate cut and political tensions in the US.

By the end of August, the index stood at 97.7 points, marking a 1.4% decline from the beginning of the month and a 10.6% drop year-to-date.

Despite the DXY’s fall, the USD/VND exchange rate maintained its upward trajectory in August. According to MBS, this was primarily driven by increased domestic demand for foreign currency, especially as businesses ramped up imports of raw materials for year-end production. Additionally, the trend of hoarding USD amid the State Bank of Vietnam (SBV)’s loose monetary policy further pressured the exchange rate.

In response, the SBV intervened by selling approximately $1.5 billion in two days (August 25-26) through 180-day forward contracts (with cancellation options) to credit institutions with negative foreign exchange positions, at a rate of 26,550 VND/USD.

“This is considered a flexible measure, helping to stabilize market sentiment while preserving foreign exchange reserves in case banks cancel transactions when exchange rate pressures ease,” MBS assessed.

The exchange rate showed signs of cooling after the announcement but quickly rebounded. By the end of August, the interbank rate reached 26,345 VND/USD (up 3.5% year-to-date), while the free market rate climbed to 26,685 VND/USD (up 3.6%). Conversely, the central rate dipped slightly by 0.04% to 25,240 VND/USD (up 3.7%).

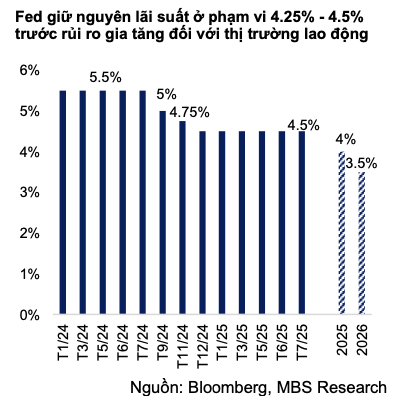

Although the Fed is expected to cut rates this year, MBS believes four internal factors will continue to pressure the exchange rate upward.

First, the VND-USD interest rate differential remains high even if the Fed reduces rates to 4%. Second, import demand will rise as the 0% tax on US goods takes effect, while exports slow, narrowing the trade surplus.

Third, FDI inflows are slowing as investors await clearer tariff policies. Finally, the gap between domestic and global gold prices remains significant.

“We forecast the average exchange rate for 2025 to range between 26,600 and 26,750 VND/USD, a 4.5-5% increase from the start of the year,” MBS stated.

Deposit Rates May Decline Further

Regarding interest rates, MBS noted that after the SBV resumed net withdrawals from late July, overnight rates surged, peaking at 6.4% per annum on August 7. However, this trend quickly reversed.

In August, the SBV injected over 361 trillion VND via the OMO channel at a 4% interest rate with 7-91 day terms, while maturities totaled 386.1 trillion VND. Overall, the SBV net withdrew more than 25.2 trillion VND.

Despite this, overnight rates continued to fall, hitting a two-month low of 1.6% on August 28, indicating ample system liquidity. By month-end, overnight rates rebounded to 3.8% due to pre-National Day spending demand, while 1-week to 1-month rates fluctuated between 4.2% and 5.2% per annum.

Contrary to short-term interbank rate volatility, deposit rates remained stable. As of late August, the 12-month deposit rate for private banks stood at 4.89% (down 0.16% year-to-date), while state-owned banks maintained 4.7%.

This stability occurred amid robust credit growth. As of August 29, system-wide credit balances rose 11.8% from late 2024 and 20.6% year-on-year.

MBS attributed the stable deposit rates to ample liquidity following the SBV’s significant net injections in June-July. This has helped banks maintain low rates to stimulate economic growth, as directed by the Government.

MBS expects deposit rates to face year-end pressure from high credit growth, especially after the SBV announced increased credit growth quotas for institutions to meet economic capital needs.

However, in July, the SBV also urged institutions to implement measures to stabilize and reduce deposit rates, contributing to monetary market stability and creating room for lower lending rates. Coupled with expectations of a 0.5% Fed rate cut in the second half, a narrower VND-USD interest rate differential will enable the SBV to maintain a low-rate environment.

“The 12-month deposit rate for private banks may ease slightly by 0.02 percentage points to 4.7% by year-end 2025,” MBS predicted.

SSI Research: A Major Correction May Unfold by Late September

The latest insights from SSI suggest that a significant market adjustment in the near term could present a prime opportunity for long-term investors to accumulate stocks.

The Art of Monetary Manipulation: A $730 Million Open Market Move

In the last week of August (25-29/08), the State Bank of Vietnam (SBV) net withdrew capital from the open market due to limited new issuances in the term purchase channel.