At SJC Company, the price of gold rings is listed at 125 – 128 million VND per tael, a significant drop of 1.6 million VND compared to the previous session.

DOJI Gold also recorded a sharp decline, with buying and selling prices now at 126.2 – 129.2 million VND per tael, down 1.5 million VND on the buying side and 1.3 million VND on the selling side.

Bao Tin Minh Chau adjusted the price of gold rings to 127 – 130 million VND per tael, a decrease of 700,000 VND per tael. Meanwhile, PNJ reduced the price of gold rings to 126.2 – 129.2 million VND per tael, a drop of 1.1 million VND on both buying and selling sides.

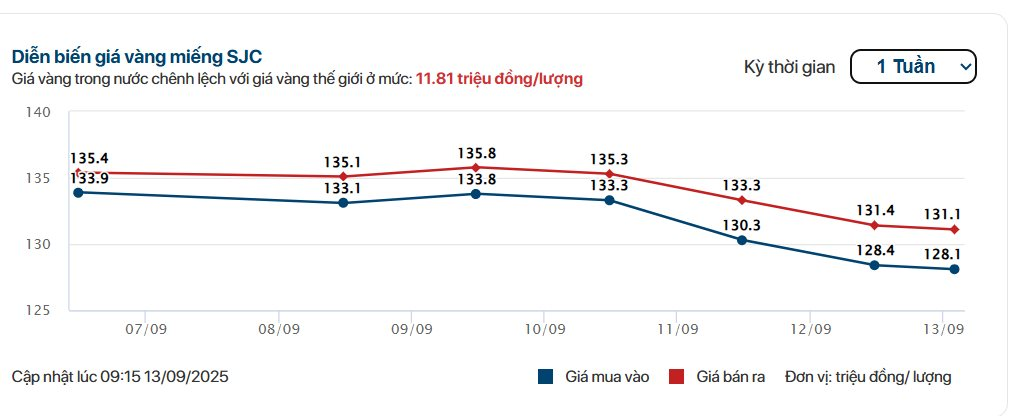

Gold bar prices at these companies have also plummeted, currently trading around 128.1 – 131.1 million VND per tael. Compared to the same time yesterday, the decrease is up to 1.4 million VND on the buying side and 1.7 million VND on the selling side.

Gold bar price fluctuations over the past week. Source: Cafef.

In contrast to domestic trends, global gold prices remain high at $3,641 per ounce. According to economic experts, gold prices continue to climb to new record highs as a series of disappointing U.S. economic data provides further room for the Federal Reserve to resume its policy easing cycle.

According to expert Colombo, the significant weakening of the U.S. labor market and the increasing risk of recession could force the Fed to cut interest rates by up to 100 basis points. However, he warns of the risk of the Fed “overreacting” by losing its policy independence.

Robert Minter, ETF Strategy Director, believes the current moderate rate-cutting path is sufficient to support gold’s technical breakout to $3,700 per ounce. However, the risks are skewed to the upside, as the Fed could take more aggressive action than expected.

“With the recently released labor data, the Fed has a pretext to unexpectedly deliver a 50-basis-point cut, which was previously seen as a panic move,” Minter analyzed. “If this scenario unfolds, gold could surge well beyond the $3,700 target.”

The CME FedWatch Tool currently shows only a 5% chance of a 50-basis-point cut next week. According to Lukman Otunuga (FXTM), this scenario could quickly push gold prices above $3,700 per ounce. However, he emphasizes that the market will focus on the “dot plot,” the Fed’s latest interest rate forecast. If the projections do not meet expectations of a 75–100 basis point easing, gold may enter a technical correction.

Michael Brown (Pepperstone) suggests that the market may be “overbetting” on the Fed. “There’s a high chance the Fed will disappoint, signaling only a total of 50 basis points in cuts this year. With the market pricing in around 70 basis points, the risk of a ‘hawkish’ reaction is quite clear,” he said, but still asserts that any correction should be seen as an opportunity to buy gold.

Ole Hansen, Head of Commodity Strategy at Saxo Bank, remains optimistic: “Even with short-term sell-offs, the technical trend still supports gold moving towards $3,800 per ounce. Every correction is a buying opportunity.”

Beyond the Fed, next week will see several other key decisions: The Bank of Canada is expected to cut rates by 25 basis points on Wednesday; the Bank of England is forecast to hold rates steady on Thursday; and the Bank of Japan is likely to remain on hold.

Morning of September 12: Gold ring and SJC gold prices continue to plummet

Why Do Gold Ring Prices Decline More Slowly Than Gold Bullion?

Over the past few days, while the price of gold bars has seen a sharp decline, the price of gold rings has dropped at a much slower pace, with moments of complete stagnation.

“Monetary, Gold and Stock Market Management: Strategies for Stability and Growth”

The Deputy Prime Minister, Ho Duc Phoc, has signed and issued an urgent dispatch on the 11th of September 2025, addressing the management and governance of the monetary, gold, and securities markets. This dispatch, numbered 161/CD-TTg, underscores the government’s proactive approach to maintaining stability and devising effective solutions for these vital markets.