Deputy Prime Minister Ho Duc Phoc chaired a meeting with the State Bank of Vietnam and relevant ministries on monetary policy management and gold market regulation.

|

These were the directives of Deputy Prime Minister Ho Duc Phoc during the September 16 meeting with the State Bank of Vietnam and various ministries, reviewing the first nine months of monetary policy and gold market management, and outlining future directions.

Sustainable and Transparent Stock Market Development

At the meeting, the Ministry of Finance reported on state budget collection, expenditure allocation, and tax exemption policies. They also highlighted challenges in fiscal policy management moving forward.

Regarding the stock market, the Ministry of Finance noted its stable growth and positive outlook, with expectations of a potential upgrade in the near future. The ministry pledged to collaborate with relevant agencies to implement measures ensuring a sustainable and transparent market.

The Ministry of Finance also provided updates on government bond issuance, corporate bond issuance, public investment disbursement, and tax policies related to the real estate market.

They will work with the State Bank, the Government Inspectorate, and other agencies to inspect gold trading activities as per regulations.

The Ministry of Finance agreed with the State Bank’s solutions and proposed closer coordination between monetary and fiscal policies.

Directing Credit Flows to Priority Sectors

Representatives from the Ministry of Public Security, Government Inspectorate, Ministry of Agriculture and Environment, Ministry of Industry and Trade, and the Government Office largely agreed with the State Bank’s report and the Ministry of Finance’s comments.

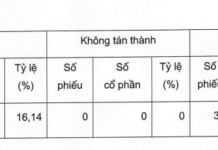

They also discussed the State Bank’s assessment of challenges in monetary policy and gold market management, inspections of gold trading businesses, and urged the swift issuance of the Circular guiding Decree 232/2025/ND-CP.

They addressed real estate credit growth, credit structure, economic growth drivers, bad debt resolution, and emphasized directing credit flows to priority sectors while strictly adhering to government directives on monetary policy, fiscal policy, and gold market management.

The State Bank and Ministry of Finance further elaborated on real estate credit, the Circular guiding Decree 232/2025/ND-CP, inspection efforts, inter-ministerial coordination in gold trading management, corporate bond issuance structure, and tools to regulate the real estate market, preventing speculation and ensuring transparency.

Deputy Prime Minister Ho Duc Phoc delivering his directives

|

Tightening Control Over Private Bond Issuance

The Deputy Prime Minister instructed the Ministry of Finance to focus on managing, inspecting, and controlling margin lending, tightening oversight of private corporate bond issuance, urging timely bond repayments, enhancing gold transaction invoice management, and studying taxation for gold trading to combat speculation.

He also urged the Ministry of Finance and relevant ministries to actively implement solutions to support production, business, investment attraction, and boost investor confidence. This includes diversifying export and import markets and fostering a sustainable stock market.

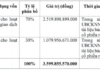

The Deputy Prime Minister requested the Ministry of Finance to explore capital support for the Vietnam Bank for Social Policies and the Vietnam Development Bank, and increase charter capital for enterprises.

He called on ministries, agencies, and localities to accelerate the development of social housing, worker housing, and affordable commercial housing, while addressing real estate market speculation and manipulation.

– 08:25 17/09/2025

Maintain Interest Rate and Exchange Rate Stability

“The Prime Minister has directed to maintain stable interest rates and boost exports to ensure high growth targets are met in 2025. With a focus on economic stability and prosperity, this directive aims to foster a robust financial environment for the nation’s future.”

A Strategic Approach to Fiscal and Monetary Policy: Steering Vietnam’s Economy Towards 8.3-8.5% Growth in 2025

“Prime Minister Pham Minh Chinh has signed Dispatch No. 159/CD-TTg on September 7, 2025, providing guidance and direction on fiscal and monetary policy frameworks. This dispatch outlines the government’s strategic approach to managing the nation’s finances and currency, with the aim of fostering economic growth and stability.”