Vietnam’s Consumer Market Rebounds, Domestic Demand Surges

Vietnam’s economic landscape in Q3 paints an optimistic picture, driven by robust domestic demand. After a period of stagnation, consumer spending has rebounded significantly, becoming a key growth driver. According to the General Statistics Office (GSO), total retail sales and consumer service revenue in August 2025 reached VND 588.2 trillion, a 10.6% increase year-on-year. For the first eight months, this figure stood at VND 4,579 trillion, up 9.4%, surpassing the 8.9% growth in the same period in 2024.

Essential consumer goods like food, beverages, and groceries continue to dominate spending, while the tourism sector’s recovery further boosts consumption. Favorable visa policies, promotional campaigns, and festive events attracted 1.68 million international visitors in August, a 16.5% rise year-on-year. Cumulatively, Vietnam welcomed 13.9 million international tourists in the first eight months, up 21.7% from last year. This influx has spurred spending on dining and retail, boding well for the retail sector in the year-end season.

Consumer spending has emerged as a bright spot in Vietnam’s economy, especially as other drivers like exports and foreign investment face challenges. Notably, this trend isn’t limited to major cities; it’s spreading to provinces, fueled by the expansion of modern retail infrastructure. Modern retail channels are no longer confined to urban supermarkets but are reaching rural areas and satellite cities. Consumers increasingly prioritize safety, convenience, and quality control, making modern retail an inevitable choice. This shift presents significant opportunities for local businesses, which understand consumer needs and can rapidly scale operations.

Local Enterprises Accelerate Growth

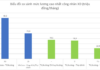

Masan Group (HOSE: MSN), a leading consumer and retail conglomerate, exemplifies this trend. Its modern retail arm, WinCommerce (WCM), opened 415 new stores in the first eight months of 2025, with 75% located in rural areas where consumer demand is rapidly growing. In August alone, WCM recorded VND 3,573 billion in revenue, a 24.2% year-on-year increase, pushing the eight-month total to VND 25,000 billion, well above annual targets. Remarkably, all new stores quickly turned profitable, a rarity in the retail sector where new outlets typically take time to achieve financial viability.

WCM’s rapid rural expansion, targeting areas home to over 60% of Vietnam’s population, not only increases its market reach but also reflects a shift from traditional to modern, quality-controlled shopping. This transition explains why WCM’s new stores achieve profitability faster than industry norms. In July 2025, Masan MEATLife’s (UpCoM: MML) daily revenue per WCM store averaged nearly VND 2.3 million. If extended to all 4,200+ stores, daily revenue could reach nearly VND 9.5 billion, highlighting the growth potential of modern retail channels. Branded chilled meat now accounts for 69% of WCM’s meat sales, up from 62% in Q2, underscoring the growing role of branded products in driving revenue and modern consumer trends.

Despite positive business results, consumer and retail companies face challenges. The domestic market is increasingly competitive, with both international corporations and rapidly expanding local chains. Opening hundreds of stores annually strains operational costs, from leasing and logistics to staffing. Fluctuating raw material prices also impact profit margins, especially in the food sector. To sustain growth, businesses must balance expansion with cost optimization and effective risk management.

Nevertheless, with the consumer market on an upswing and recent positive outcomes, there’s reason to believe Masan can achieve its 2025 goals, showcasing Vietnamese enterprises’ adaptability in a fiercely competitive environment.

– 06:30 18/09/2025

The Airport’s Connectivity Concerns: Expert Views on Long Thanh’s Infrastructure Challenges

The highly anticipated Long Thanh International Airport is racing against time for its grand opening in 2026. While the airport’s construction is on overdrive, concerns linger about the supporting infrastructure. Experts worry that the surrounding transportation network might not be adequately prepared to handle the influx of traffic that the new airport will bring. This raises questions about the overall accessibility and convenience for travelers, potentially casting a shadow over the airport’s debut.

How to Find Gold While Sifting Through Sand: A Guide to Seizing Opportunities

Sharing his insights at the ‘Khớp lệnh’ program on November 25, 2024, Mr. Dao Hong Duong, Director of Industry and Equity Analysis at VPBank Securities Joint Stock Company (VPBankS), asserted that several sectors exhibit positive signals based on their profit growth prospects for 2025. These sectors are expected to be relatively unaffected by external factors and offer suitable valuation ranges.