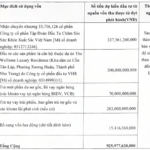

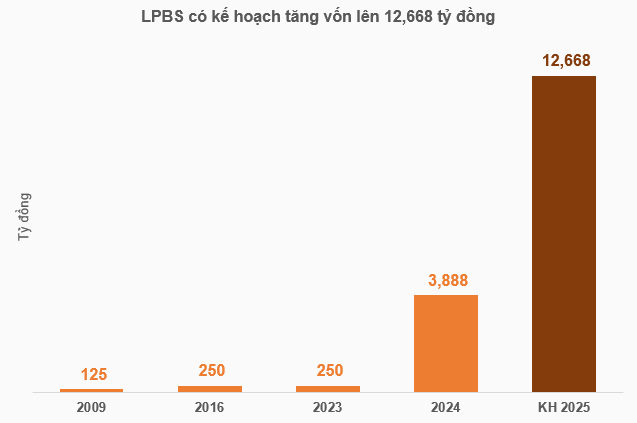

Specifically, the maximum expected offering is 878 million shares, corresponding to a ratio of 1,000:2,258.23 (shareholders owning 1,000 shares will receive 1,000 purchase rights, and 1,000 rights can purchase 2,258 new shares). If successful, the company’s capital will increase to 12,668 billion VND.

At an offering price of 10,000 VND per share, LPBS could raise 8,780 billion VND. Of this, 60% will be allocated to investing in securities on the bond market and deposit certificates; 30% will supplement capital for margin lending activities; and 10% will support underwriting services and other operations. The capital utilization is planned from 2025 to the end of 2026.

According to the plan, shareholders can transfer purchase rights from September 15 to October 10. Registration and payment for purchases will take place from September 15 to October 15. Previously, the company finalized the shareholder list on September 8.

In 2024, LPBS successfully offered 363.8 million shares to existing shareholders, increasing capital to 3,888 billion VND, concluding on April 16, 2024. The entire raised amount of over 3.6 trillion VND has been disbursed, including 2,938 billion VND to supplement capital for lending, margin trading, advance payments for securities sales, and other services; 500 billion VND for proprietary trading; and 200 billion VND to expand branch networks across provinces and cities.

This event was the primary driver behind LPBS’s surge in revenue and profit since then.

Source: Author’s compilation

|

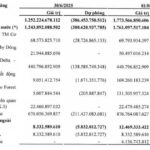

In the first half of 2025, LPBS generated nearly 546 billion VND in operating revenue, nearly 18 times higher than the same period last year. Several business segments saw robust growth, notably profits from financial assets measured at fair value through profit or loss (FVTPL), held-to-maturity (HTM) investments, and lending and receivables.

After deducting expenses, primarily over 87 billion VND in operating costs (mostly for brokerage activities) and nearly 118 billion VND in interest expenses, LPBS achieved a net profit of nearly 247 billion VND, almost 19 times higher than the same period.

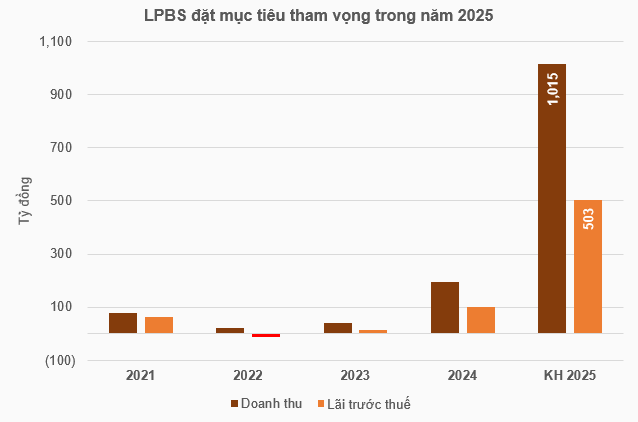

For 2025, LPBS set a revenue target of 1,015 billion VND and pre-tax profit of 503 billion VND, both over five times the 2024 results. Key implementation solutions include maintaining and expanding brokerage, margin trading, proprietary trading, and investment banking, as well as increasing charter capital to broaden operations, enhance financial capacity, and improve competitiveness.

With over 309 billion VND in pre-tax profit in the first half of the year, LPBS has achieved 61% of its annual profit plan.

Source: Author’s compilation

|

– 15:43 17/09/2025

Exclusive Private Placement: VDS to Offer 48 Million Shares at VND 18,000 Per Share

Dragon Capital Securities is set to join the capital increase race, aiming to boost its charter capital to VND 3.2 trillion.

Steel Company’s Stock Surges 140% in 5 Months Following Debt Recovery from Novaland

Novaland Group’s debt at SMC, encompassing Delta – Valley Binh Thuan Co., Ltd., Dalat Valley Real Estate Co., Ltd., and The Forest City Co., Ltd., has decreased by nearly VND 287 billion. Specifically, Dalat Valley’s debt reduced by over VND 157 billion, while The Forest City’s debt saw a decline of more than VND 126.5 billion.

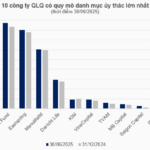

Unraveling the Puzzle: A $26 Billion Investment Trust Landscape in the Fund Management Industry

By the end of Q2 2025, Vietnam’s asset management industry boasted a combined discretionary portfolio value exceeding 614 trillion VND, marking a nearly 5% increase from the year’s start. This growth fueled a surge in management fee revenue. Notably, three firms stood out with colossal portfolios, each managing hundreds of trillions of VND, heavily invested in bonds. Their success is attributed to the robust support from their insurance ecosystem.

The Ultimate Capital Boost: Unveiling NRC Corporation’s Extraordinary General Meeting

The NRC Group, a dynamic organization with a fresh vision, is leaving no stone unturned to ensure its success. With a new name, a new CEO, and an extraordinary general meeting on the horizon, the Group is set to discuss a private placement plan to boost its charter capital. This forward-thinking approach demonstrates the Group’s commitment to growth and innovation, as it charts a new course for the future.