Economic Growth and the Challenge of Transformation

Over the past four decades, Vietnam has made a significant mark on Asia’s economic map, transforming from a low-income agrarian economy into a dynamic manufacturing hub. This shift has lifted millions out of poverty and fostered a robust middle class. However, amidst global market volatility and escalating climate risks, Vietnam must transition to a new growth model—one that is more sustainable, innovation-driven, and globally competitive.

Sustainable development is no longer a mere compliance requirement; it has become a critical component of business strategy and a source of competitive advantage.

Policies Driving the Green Transition

The Vietnamese government is laying the groundwork for a green transition through targeted policies. Resolution 198 introduces a range of incentives to promote ESG adoption and develop key industries, including:

- Green credit support with preferential interest rates for eligible projects

- Corporate income tax exemptions for innovative startups

- Reduced land rental fees for SMEs and high-tech companies in industrial zones

Additionally, plans to establish International Financial Centers (IFCs) in Ho Chi Minh City and Da Nang underscore Vietnam’s ambition to become a regional green finance hub. These centers will serve as platforms for green finance, carbon credit trading, and fintech innovation, supported by tax incentives and a regulatory sandbox.

Vietnam also maintains the highest infrastructure investment rate in Southeast Asia, allocating 5–6% of GDP annually. To sustain competitiveness, businesses must innovate, digitize, and embed sustainability into their core strategies.

From Compliance to Strategic Sustainability

According to UOB’s 2025 Business Outlook Study, 90% of Vietnamese businesses recognize the importance of sustainability, and 75% have begun implementation. SMEs are leading this trend, driven by investor expectations and operational efficiency demands.

However, many still view ESG as a cost burden. Certification, reporting, and compliance are often seen as pressures. This mindset must shift. Sustainability is now a strategic lever for growth, enhancing brand reputation and access to investment capital.

Integrating Sustainability for Strategic Advantage

Forward-thinking businesses are integrating sustainability into product development, supply chain management, and customer engagement, rather than treating it as a reporting requirement. This approach is increasingly essential for attracting foreign investment, securing long-term contracts, and building brand credibility.

Access to green finance is becoming more streamlined. Tools like sustainability-linked loans and green bonds enable businesses to fund their transition while benefiting from performance-based incentives. These financial instruments are particularly relevant for rapidly evolving sectors such as manufacturing, agriculture, and logistics.

Digital transformation plays a critical supporting role. Technologies like AI, cloud computing, and automation help businesses improve operational efficiency and manage ESG data. Localizing supply chains and adopting the “Make in Vietnam” standard further reduce external risks and align with national development goals.

The Role of Financial Institutions

Financial institutions are central to the sustainability ecosystem. For instance, UOB has supported the sustainability efforts of numerous businesses across key sectors through tailored financial solutions. UOB’s sustainability-linked loans offer preferential rates tied to emission reduction targets, while its green finance framework—certified by ERM—ensures verifiable and sustainable outcomes.

Notably, UOB’s framework is designed for the Asian context, aligning with the Singapore-Asia Taxonomy and incorporating practical transition criteria. This localization makes it more relevant for regional businesses compared to frameworks borrowed from other markets. Such adaptation is key to ensuring effective and scalable sustainability efforts in Vietnam’s unique economic landscape.

A Decisive Moment for the Future

The next chapter of Vietnam’s development will be measured not just by speed, but by sustainability. With supportive policies, robust infrastructure, and growing investor interest, Vietnam is poised to lead regional innovation-driven sustainable growth.

The Weakening US Dollar: Opportunities and Challenges for Emerging Economies?

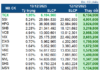

Standard Chartered forecasts a weaker USD over the next 6–12 months, predicting the DXY index to drop to around 96 as the Federal Reserve initiates rate cuts. This scenario presents opportunities for exchange rate stability, easing import inflation pressures, and attracting capital inflows into Asia. However, it also poses challenges for export competitiveness and capital flow risks should market expectations reverse.