Source: VietstockFinance

|

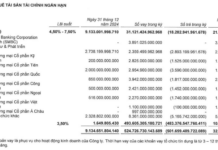

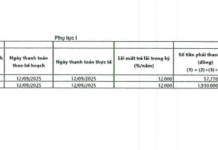

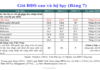

With over 337.9 million outstanding shares, PNJ is expected to allocate approximately VND 473 billion for this dividend payment. Previously, in February 2025, the company paid an interim cash dividend of 6%, totaling over VND 200 billion. Upon completing the remaining payout, PNJ will fulfill its 2024 cash dividend plan of 20% (equivalent to VND 2,000 per share), reaching a total value of nearly VND 676 billion.

PNJ has maintained a consistent cash dividend policy of 20% annually since 2020. The company plans to continue this rate in 2025.

Source: VietstockFinance

|

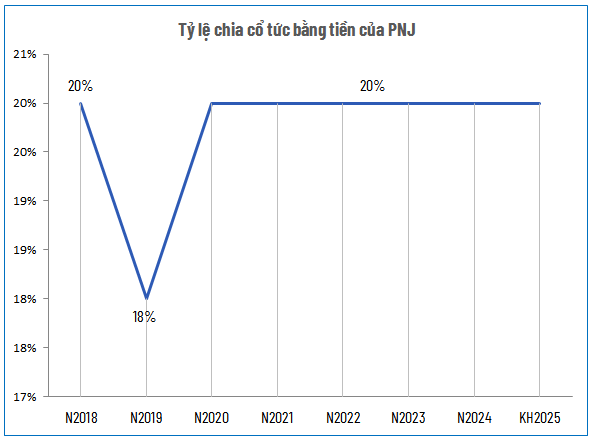

As of the end of Q2/2025, PNJ‘s sole major shareholder is T.Rowe Price Associates, holding a 5.42% stake. By the end of August, this foreign fund increased its ownership to 6.01% and is set to receive over VND 28 billion from the upcoming dividend distribution.

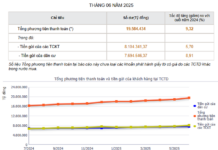

| PNJ’s 6-Month Business Results Over the Years |

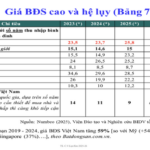

In the first half of 2025, PNJ reported net revenue of VND 17,218 billion, a 22% decline year-over-year, due to weak consumer demand amid rising gold prices. Net profit reached VND 1,119 billion, down only 4%, thanks to an improved gross margin of 21.4% and controlled operating expenses. Compared to the 2025 plan (VND 31,600 billion in revenue and VND 1,960 billion in post-tax profit), PNJ has achieved 55% of its revenue target and 57% of its profit goal after six months.

By Khang Di

– 13:00 18/09/2025

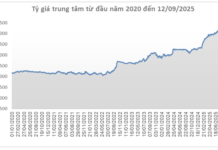

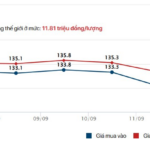

Today, September 13th: Ring Gold and Gold Bar Prices Continue Their Sharp Decline

Domestic gold prices continued their steep decline at the opening of today’s trading session. Ring and bullion gold prices at several enterprises plummeted by nearly 2 million VND per tael compared to the same time yesterday.