I. MARKET ANALYSIS OF THE UNDERLYING STOCK MARKET ON SEPTEMBER 16, 2025

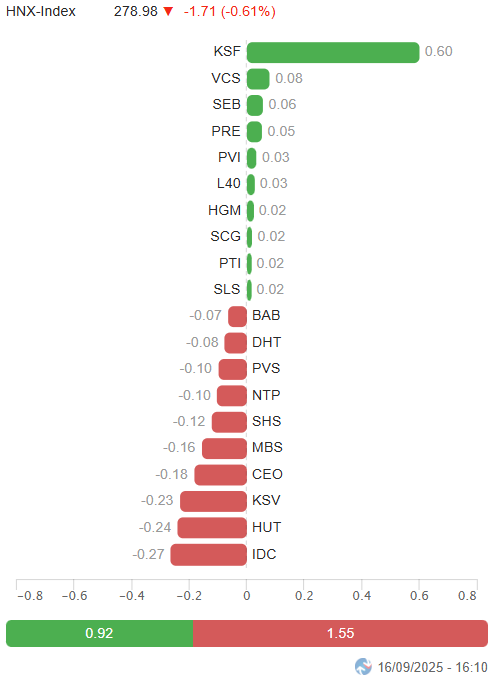

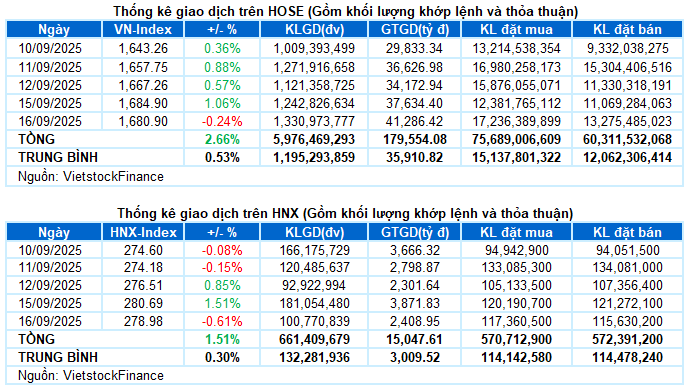

– Major indices collectively adjusted during the September 16 trading session. Specifically, the VN-Index decreased by 0.24%, closing at 1,680.9 points, while the HNX-Index also fell by 0.61%, settling at 278.98 points.

– Trading volume on the HOSE increased by 9.8%, surpassing 1.2 billion units. In contrast, the HNX recorded 100 million matched units, a slight 1% decrease compared to the previous session.

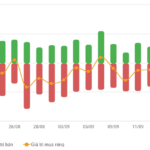

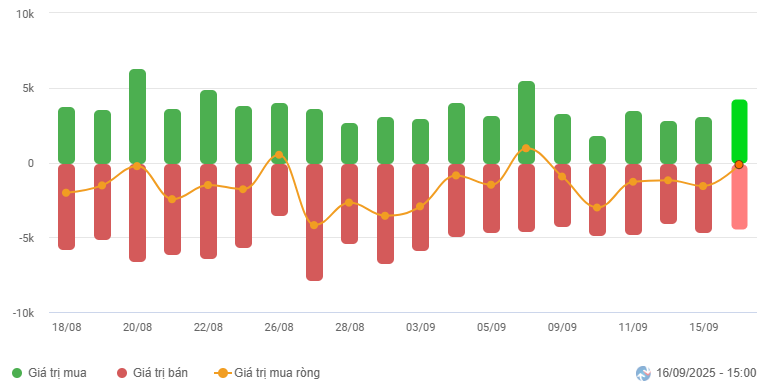

– Foreign investors resumed net buying on the HOSE, with a value exceeding 11 billion VND, but intensified net selling on the HNX to 127 billion VND.

Foreign Investors’ Trading Value on HOSE, HNX, and UPCOM by Date. Unit: Billion VND

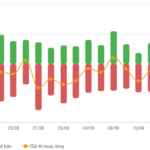

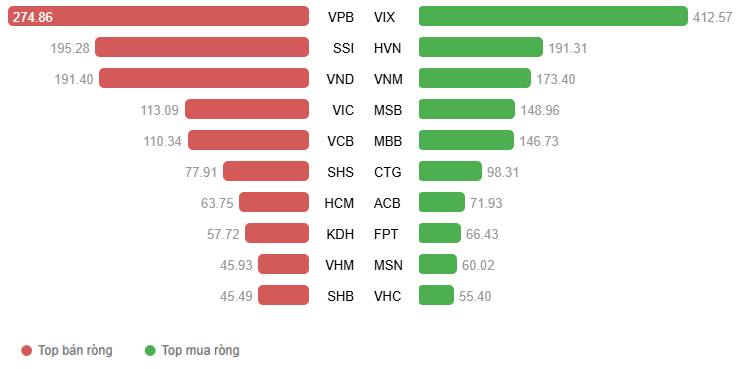

Net Trading Value by Stock Code. Unit: Billion VND

– Vietnam’s stock market experienced a tug-of-war session on September 16. The VN-Index opened with enthusiasm, gapping up and approaching the 1,700-point mark, driven by the financial sector. However, this positive momentum was short-lived as profit-taking pressure quickly intensified, causing the index to decline steadily until the end of the morning session. Post-lunch, support from blue-chip stocks once again propelled the VN-Index back to the morning’s peak, but a lack of consensus among other stocks and increasing selling pressure toward the end of the session turned the index red. The VN-Index closed at 1,680.9 points, a 4-point drop from the previous session.

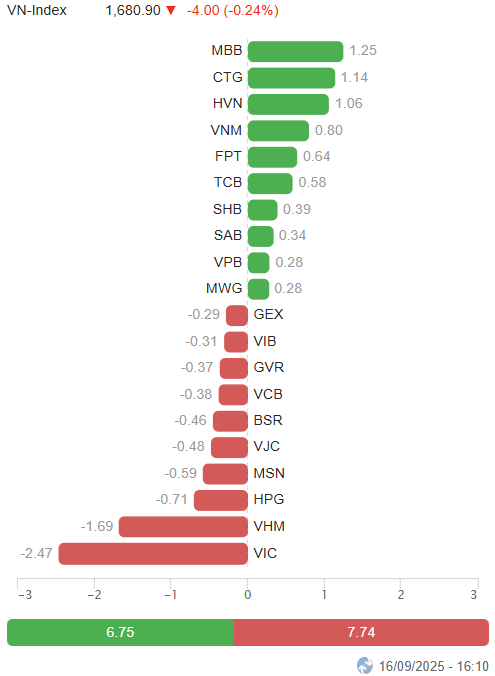

– In terms of impact, the duo VIC and VHM exerted the most pressure on the VN-Index, subtracting 2.5 points and 1.7 points, respectively. Conversely, MBB, CTG, and HVN acted as pillars of support, contributing over 3 points of gain and helping to curb the index’s decline in the final session.

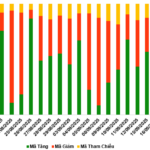

Top Stocks Influencing the Index. Unit: Points

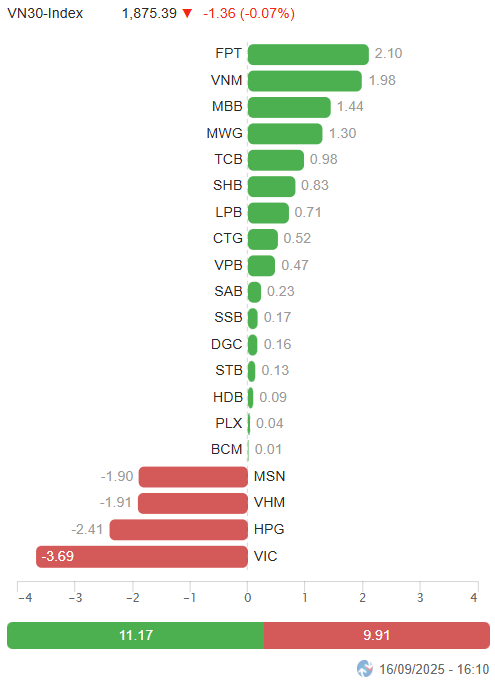

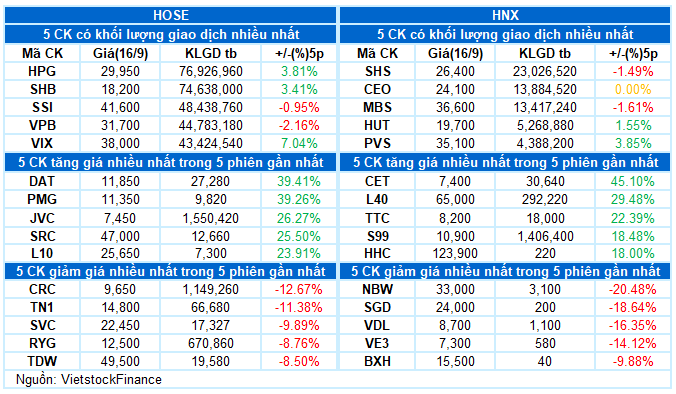

– The VN30-Index closed just below the reference level at 1,875.39 points. The basket’s breadth was relatively balanced, with 16 gainers, 13 losers, and 1 unchanged stock. Notably, VNM, MBB, SAB, and SHB attracted positive demand, all rising over 2%. In contrast, VJC and VIC faced the most pressure, adjusting by 2.5% and 2%, respectively.

Among sectors, information technology shone as the market leader in gains, driven by key stocks such as FPT (+1.57%), CMG (+1.84%), and ELC (+3.7%). Conversely, real estate and raw materials faced the strongest selling pressure, both declining over 1%. Red dominated with major stocks like VIC (-2.03%), VHM (-1.72%), KDH (-1.58%), DXG (-2.48%), CEO (-2.03%), VPI (-2.5%), DIG (-2.5%), KBC (-3.06%), HPG (-1.32%), GVR (-1.34%), KSV (-1.12%), MSR (-1.77%), DCM (-2.27%), and HSG (-2.42%).

Other sectors were generally mixed, with green and red alternating. For instance, in the financial sector, capital flowed into bank stocks, with many positive gainers such as CTG (+1.74%), MBB (+2.42%), TCB (+0.9%), MSB (+1.82%), SHB (+2.25%), OCB (+1.15%), and KLB hitting the ceiling. Meanwhile, most securities stocks were bathed in red, notably SSI (-1.42%), VND (-2.03%), MBS (-1.08%), VIB (-1.86%), VCI (-2.33%), and VDS (-3.4%).

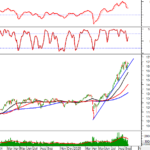

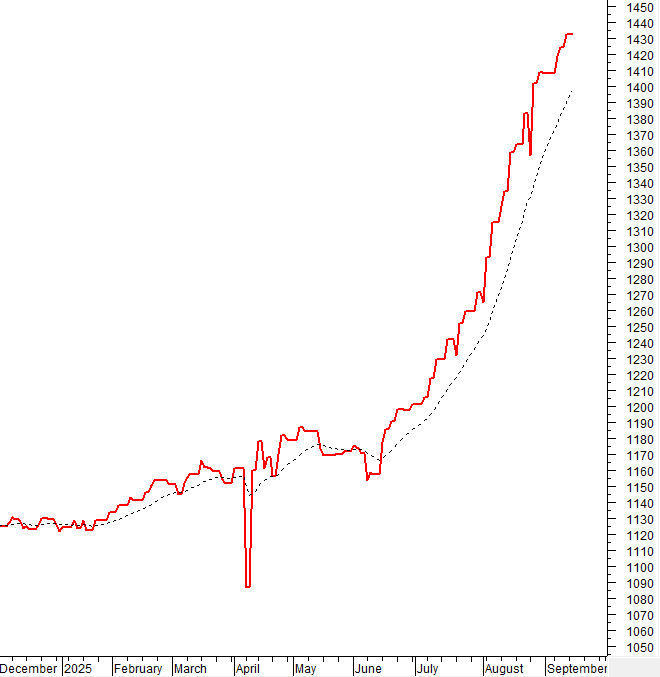

The VN-Index retreated after encountering profit-taking pressure at the August 2025 and early September 2025 peaks (equivalent to the 1,690-1,711 point range). Fluctuations around this resistance level are likely to continue in the short term. Should selling pressure persist, the short-term trendline (equivalent to the 1,635-1,650 point range) will serve as critical support for the index.

II. PRICE TREND AND VOLATILITY ANALYSIS

VN-Index – Testing the Old Peak Range of 1,690-1,711 Points

The VN-Index retreated after encountering profit-taking pressure at the August 2025 and early September 2025 peaks (equivalent to the 1,690-1,711 point range). Fluctuations around this resistance level are likely to continue in the short term.

Should selling pressure persist, the short-term trendline (equivalent to the 1,635-1,650 point range) will serve as critical support for the index.

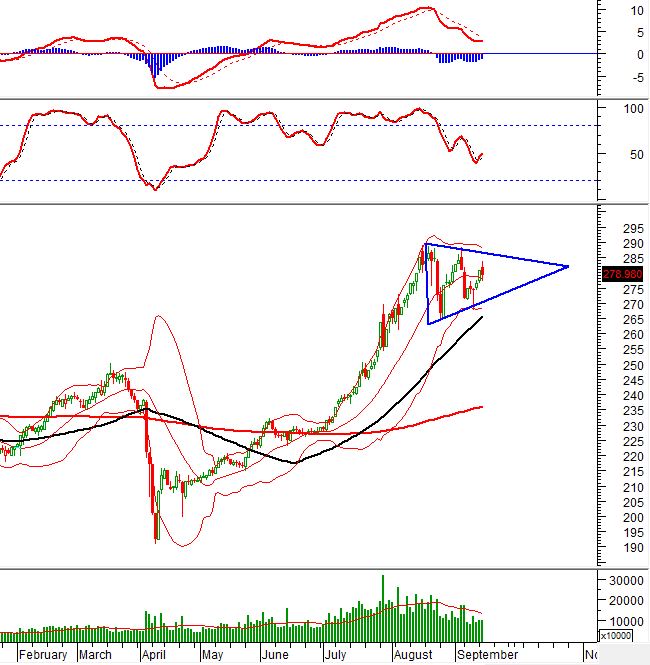

HNX-Index – Maintaining Above the Middle Line of Bollinger Bands

The HNX-Index declined after a strong tug-of-war session but remained above the Middle line of the Bollinger Bands.

Additionally, the index is forming a Triangle pattern. With a buy signal from the Stochastic Oscillator, the likelihood of breaking through the upper edge of this pattern is heightened.

Capital Flow Analysis

Smart Money Movement: The Negative Volume Index of the VN-Index is above the 20-day EMA. If this state continues in the next session, the risk of a sudden downturn (thrust down) will be mitigated.

Foreign Capital Movement: Foreign investors were net sellers in the September 16, 2025 trading session. If foreign investors maintain this action in upcoming sessions, the outlook will become more pessimistic.

III. MARKET STATISTICS FOR SEPTEMBER 16, 2025

Economic Analysis & Market Strategy Department, Vietstock Consulting Division

– 17:15 September 16, 2025

Vietstock Daily 19/09/2025: Market Volatility Persists – Can Stability Be Regained?

The VN-Index swiftly narrowed its decline and closed just above the Middle Bollinger Band. This indicates that the short-term trendline (ranging between 1,645 and 1,660 points) continues to effectively support the index. However, with trading volume showing no signs of improvement, expectations for a short-term breakout or surge remain low.

Vietstock Daily 18/09/2025: Cautious Sentiment Prevails?

The VN-Index persists in its corrective phase, with trading volumes remaining below the 20-day average for seven consecutive sessions, reflecting investors’ cautious sentiment. However, short-term risks appear manageable as the Stochastic Oscillator has generated a buy signal, and the short-term trendline (equivalent to the 1,635-1,650 point range) continues to provide robust support.

Market Pulse 17/09: Continued Volatility as VN-Index Drops Nearly 10 Points

At the close of trading, the VN-Index fell by 9.93 points (-0.59%), settling at 1,670.97 points, while the HNX-Index dropped by 1.35 points (-0.48%), closing at 277.63 points. Market breadth favored the sellers, with 483 decliners outpacing 283 advancers. Similarly, the VN30 basket saw red dominate, with 19 losers, 10 gainers, and 1 unchanged stock.