At the 2025 Housing Real Estate Forum themed “Satellite Wave,” organized by the Labor Newspaper on the afternoon of September 18th in Ho Chi Minh City, Mr. Vo Hong Thang, Deputy General Director of DKRA Consulting (under DKRA Group), stated that the real estate market is recovering and witnessing significant changes in both residential and investment buyer groups, creating new market directions.

“Since April 2022, when the government tightened control over real estate credit, particularly bond issues, the real estate market faced a capital shortage and plunged into crisis,” said Mr. Thang. He believes this challenging phase has ended, and from late 2023 to now, recovery signals have become evident in both supply and consumption, especially in the first eight months of 2025.

Mr. Vo Hong Thang, Deputy General Director of DKRA Consulting, speaking at the forum.

|

Supply and consumption surge across all three segments

In the apartment segment, DKRA reports that the Southern region saw 114 projects under development, with approximately 28,000 units launched in the first eight months, a nearly 58% increase compared to the same period in 2024. Consumption reached around 20,000 units, triple that of the previous year. However, compared to the pre-2020 peak, this scale is only about 50–60%.

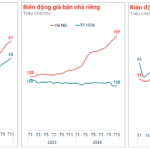

Structurally, in former Ho Chi Minh City, 73% of the supply is concentrated in the A and A+ segments, while B and C-class apartments are primarily located in former Binh Duong. The average primary price is currently 70.9 million VND/m² in Ho Chi Minh City and around 45 million VND/m² in Binh Duong. Mr. Thang notes that over the past three years, the average primary price has increased by more than 10% annually, a trend that could continue for 2–3 years without policy intervention. Consequently, next year’s prices for primary apartments in former Binh Duong could reach 50 million VND/m².

The townhouse and villa segment has also seen a strong recovery. In the first eight months, over 10,000 products from 87 projects were launched, a 70% increase year-on-year, with consumption more than tripling. Long An emerged as the focal point, accounting for 40% of the supply and nearly 67% of consumption. Primary prices in this segment rose by about 15% compared to 2024.

For land plots, new legal frameworks have led to a long-term reduction in supply, shifting it to more remote areas. In the primary market, approximately 100 projects (over 3ha, with 1/500 planning) offered a total of 7,100 products, a 3% increase year-on-year. Consumption reached over 1,000 products, primarily in former Long An and Binh Duong, which accounted for more than 60% of the supply and over 90% of transactions. Primary land plot prices surged by 10–18% year-on-year, reflecting a general price increase despite tighter market regulation.

70% of buyers are investors

A survey of over 2,000 transactions conducted by DKRA reveals two main buyer groups: residential buyers (30%) and investors (70%).

Residential buyers are cautious, spending considerable time surveying projects and heavily influenced by friends and relatives with real estate experience, Mr. Thang analyzed. These buyers base their decisions on five key criteria: proximity to work, family, schools, a safe and convenient living environment, and price with payment terms.

Most residential buyers in the survey are first-time homebuyers, accounting for about 80%. This group typically has a budget under 3 billion VND, while established families (aged 35 and above) are willing to spend 5–10 billion VND, favoring 2–3-bedroom apartments or townhouses with good connectivity and optimized functionality. The buying age is increasingly younger, with those under 34 forming a large proportion.

Meanwhile, most investors already own two or more properties and use idle funds (bank deposits) to purchase additional properties, carefully considering multiple projects before deciding. They focus on ROI, transportation planning, developer reputation, pricing, payment terms, and sales support. “After the 2020–2023 crisis, investment preferences have shifted from speculative waves to safer products with clear legal status, sustainable cash flow, rental potential, and easier access to loans,” Mr. Thang explained. This shift explains the renewed appeal of apartments (easier to rent) and the more cautious approach to land plots.

The relationship between the two buyer groups is evident: residential buyers often consult investors before deciding, while the younger demographic and “affordable” needs of the residential group are influencing investors’ strategies. They are now shifting toward smaller, medium-sized products in projects with strong infrastructure connectivity, high rental potential, and liquidity. Thus, the behavior of residential buyers is reshaping investment preferences and market product structures.

What trends will shape the next 3–5 years?

According to Mr. Thang, the market is influenced by six short-term trends: younger home buyers; a strong shift to satellite cities; preference for TOD-model projects with integrated amenities; legal status and developer reputation as prerequisites; growing demand for green, sustainable living spaces; and the popularity of smart amenities and technology in management.

Over the long term (3–5 years), three key trends stand out: a focus on real residential needs and affordable products; a shift from speculation to safe, liquid, and cash-flow-positive products; and development aligned with green, smart, and sustainable standards to add project value.

Mr. Thang cited that within a 50km radius of former Ho Chi Minh City, DKRA identified about 18 projects over 100ha in progress or soon to launch, totaling approximately 16,500ha. Currently, eight projects are underway, covering about 3,500ha and offering around 50,000 units. In the next 3–5 years, about 10 more projects are expected to be announced and planned, potentially adding over 200,000 products if all plans materialize. All these projects share a common feature: development along highways, airports, metro lines, and key transportation routes, confirming that the “satellite” trend and infrastructure connectivity will frame the next five-year cycle, Mr. Thang noted.

– 21:29 18/09/2025

The Great Property Inventory Surge: Navigating the Market’s Imbalance

In the second quarter of this year, real estate businesses witnessed a significant surge in their inventory levels. The primary culprit behind this phenomenon was the mismatch between the offerings of various projects and the actual demands of both end-users and investors. This discrepancy occurred amidst a market desperately yearning for affordable options.

The Southern Real Estate Market: Where is the Money Going?

The Vietnamese real estate market in 2024 is expected to witness a distinct polarization between segments, painting a tripartite picture: a North-South divide, high-rise versus low-rise constructions, and a center-periphery contrast.

The Expert’s Paradox: When Supply Increases, Prices Should Decrease, But Not in This Case.

Mr. Nguyen Van Dinh, Vice President of the Vietnam Real Estate Association, shared his insights on the country’s real estate market. He noted that it is unlikely for property prices to decrease and that there are indications of rising prices. Interestingly, he pointed out a contradiction where an improvement in supply should, in theory, lead to lower selling prices. However, in the current market, supply is increasing, but prices remain high.