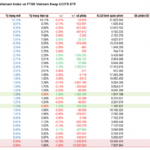

On September 12, 2025, the MarketVector Vietnam Local Index (referenced by VanEck Vectors Vietnam ETF) and the STOXX Vietnam Total Market Liquid Index (referenced by Xtrackers Vietnam Swap UCITS ETF) announced their new index constituents. September 19, 2025, is expected to be the completion date for the full rebalancing of the ETF portfolios based on these indices.

Regarding the anticipated portfolio rebalancing of the Fubon ETF (benchmarked to the FTSE Vietnam 30 Index) for the September 2025 review period, FTSE will not publish changes to the FTSE Vietnam 30 Index constituents. The Fubon ETF’s portfolio rebalancing is scheduled to commence on September 19, 2025.

In its latest report, BIDV Securities (BSC) updated changes to index constituents and forecasted portfolio adjustments for the September rebalancing period.

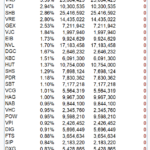

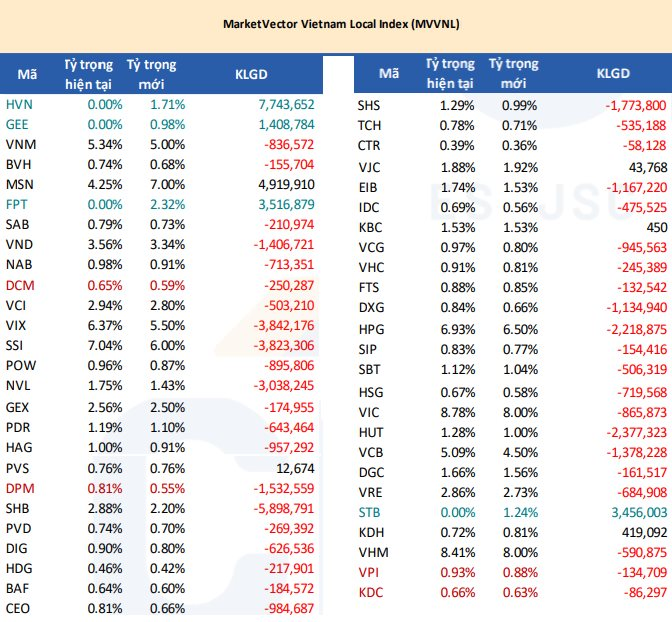

For the MarketVector Vietnam Local Index (referenced by VanEck Vectors Vietnam ETF), four new stocks—FPT, HVN, STB, and GEE—will be added, with no deletions. The VanEck Vectors Vietnam ETF currently manages approximately USD 600 million, equivalent to VND 15.8 trillion.

BSC forecasts that the VanEck Vectors Vietnam ETF may purchase 3.5 million shares of FPT, 7.7 million shares of HVN, 3.5 million shares of STB, and 1.4 million shares of GEE for inclusion. Additionally, the fund may acquire more MSN (4.9 million shares) and KDH (419 thousand shares). Conversely, it may sell SHB (6 million shares), VIX (3.8 million shares), SSI (3.8 million shares), and HUT (2.3 million shares), among others.

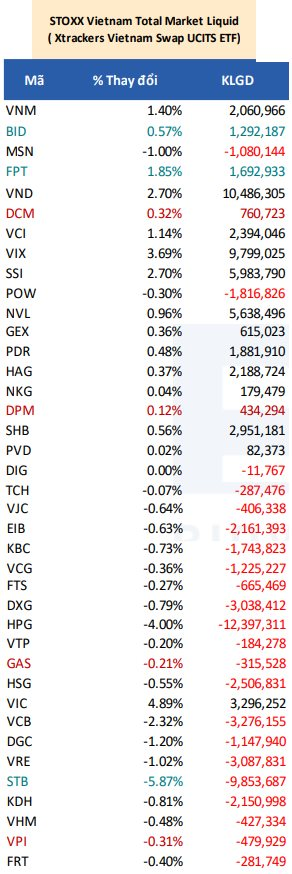

For the STOXX Vietnam Total Market Liquid Index (referenced by Xtrackers Vietnam Swap UCITS ETF), FPT will replace GAS as a new constituent. The Xtrackers Vietnam Swap UCITS ETF currently manages around USD 357 million, equivalent to VND 9.4 trillion.

BSC predicts the Xtrackers Vietnam Swap UCITS ETF will buy 1.7 million shares of FPT for inclusion and sell 315 thousand shares of GAS for exclusion. The fund may also increase holdings in VIX (9.8 million shares), SSI (6 million shares), VIC (3.3 million shares), VND (10.5 million shares), and SHB (3 million shares). Conversely, it may reduce positions in POW (1.8 million shares), DXG (3 million shares), and MSN (1 million shares), among others.

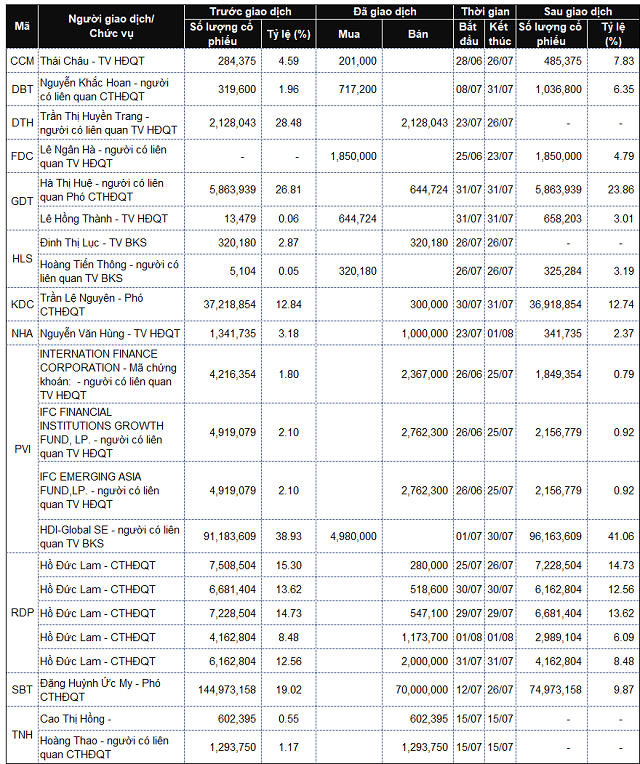

For the FTSE Vietnam 30 Index (referenced by Fubon ETF), BSC Research forecasts the addition of BID and BSR during the September 2025 review. If this occurs, KDC and VPI would be the first to be removed.

BSC notes that BID is likely to meet the minimum free-float/investment weight threshold of 5%. BSR, listed on HoSE since January 17, 2025, is also expected to meet the criteria. The Fubon ETF currently manages approximately VND 13.5 trillion.

BSC highlights that HVN and TPB are the next candidates for inclusion, potentially replacing DPM and DCM. However, HVN’s inclusion is uncertain due to trading restrictions on HoSE, though FTSE’s latest update does not exclude it. TPB may also qualify, as it is close to meeting foreign ownership ratio requirements.

BSC forecasts the Fubon ETF will purchase 7 million shares of BID and 6 million shares of BSR for inclusion, while selling 2.6 million shares of VPI and 2.4 million shares of KDC for exclusion.

The fund may also increase holdings in VNM (6.4 million shares), VND (5.7 million shares), and MSN (4.7 million shares), while reducing positions in VIC (5.1 million shares), STB (5 million shares), and KDH (4.8 million shares), among others.

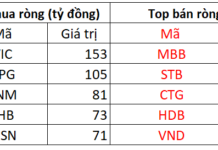

In total, BSC Research projects that the three ETFs, with a combined AUM of approximately VND 39 trillion, may collectively purchase VND (14.7 million shares), MSN (8.5 million shares), and BID (8.3 million shares). Conversely, they may sell HPG (15 million shares), STB (11.5 million shares), and KDH (6.5 million shares), among others.

The Future is Bright: Revamping the FTSE Vietnam Index

On September 5, 2025, FTSE Russell, a leading global index provider, announced the constituent stocks for the third-quarter review of two prominent Vietnamese stock indices: the FTSE Vietnam Index and the FTSE Vietnam All-Share Index.

The Two Large-Scale ETFs Gear Up to Purchase Tens of Millions of Shares in the Securities Group

Two large-scale ETFs, comprising of diverse stocks such as VIX and VCI, are set to make a significant impact on the market. With a combined worth of tens of millions of shares, these ETFs are poised to offer a unique opportunity for investors seeking exposure to a wide range of industries and sectors.

“Unveiling the Most Off-Loaded Stocks as the Two Mammoth ETFs Revamp their Portfolios”

The sell-off trend dominated the market with notable volume spikes. VIC witnessed the highest sell-off with 8.19 million shares traded, followed by SAB with 1.17 million, HUT with 5.7 million, VND with 13 million, SSI with 10.1 million, and HAG with 3 million shares.