Phu Nhuan Jewelry Joint Stock Company (Stock Code: PNJ, HoSE) has announced that September 29, 2025, will be the final registration date for the second cash dividend payment of 2024.

The company plans to distribute a 14% cash dividend to shareholders, meaning each shareholder holding one share will receive VND 1,400. The payment is scheduled for October 23, 2025.

With over 337.9 million shares currently in circulation, PNJ is expected to allocate approximately VND 473.1 billion for this dividend payout.

Illustrative image

During the 2025 Annual General Meeting of Shareholders, PNJ finalized a 20% cash dividend plan for 2024, equivalent to VND 2,000 per share.

In March 2025, PNJ disbursed over VND 202.7 billion as an interim dividend at a rate of 6% per share, or VND 600 per share.

Additionally, PNJ is offering over 3.2 million ESOP shares to its employees at VND 20,000 per share, aiming to raise nearly VND 65 billion. The payment period for these shares runs from September 9 to September 23, 2025.

This issuance is part of the 2025 Employee Stock Ownership Plan (ESOP), designed to reward employees and key personnel for their contributions to the company and its subsidiaries in 2024.

If successful, PNJ’s chartered capital is expected to increase from over VND 3,380.7 billion to nearly VND 3,413.2 billion.

According to the published list, 110 PNJ employees are eligible to purchase ESOP shares. Mr. Le Tri Thong, CEO, leads with 308,000 shares, followed by Ms. Tran Phuong Ngoc Thao, Board Member, with 136,800 shares.

In terms of financial performance, PNJ’s 2025 semi-annual consolidated financial report shows a net revenue of over VND 17,217.5 billion, a 22.1% decrease compared to the first half of 2024. After-tax profit reached over VND 1,114.7 billion, down 4.4%.

For 2025, PNJ targets an after-tax profit of nearly VND 1,959.7 billion, a 7.3% decrease from 2024.

By the end of Q2 2025, PNJ had achieved 56.9% of its annual after-tax profit goal.

As of June 30, 2025, PNJ’s total assets slightly decreased by nearly VND 54 billion from the beginning of the year, totaling approximately VND 17,153.8 billion. Inventory accounts for 79.9% of total assets, valued at over VND 13,708.7 billion.

On the liabilities side, total debt stands at nearly VND 5,184.4 billion, a 12.9% reduction from the start of the year. Short-term loans amount to nearly VND 3,096.3 billion, representing 59.7% of total debt.

LPBS Set to Boost Capital to Nearly VND 13 Trillion

On September 15th, the Board of Directors of LPBank Securities JSC (LPBS) passed a resolution to offer up to 878 million shares to existing shareholders. This move is expected to increase the company’s chartered capital to VND 12,668 billion, a 3.3-fold increase from its current level. The majority of the proceeds from the offering will be allocated to investments in bonds, deposit certificates, and margin lending.

PNJ Wins JWA Award for Sustainable Development

On the evening of September 17th, in Hong Kong, China, PNJ stood as the sole Vietnamese representative to be honored at the JWA 2025 Awards, securing the prestigious “Sustainability Leadership” category for its exceptional sustainable development strategies.

Steel Company’s Stock Surges 140% in 5 Months Following Debt Recovery from Novaland

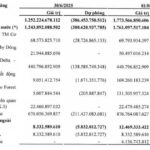

Novaland Group’s debt at SMC, encompassing Delta – Valley Binh Thuan Co., Ltd., Dalat Valley Real Estate Co., Ltd., and The Forest City Co., Ltd., has decreased by nearly VND 287 billion. Specifically, Dalat Valley’s debt reduced by over VND 157 billion, while The Forest City’s debt saw a decline of more than VND 126.5 billion.