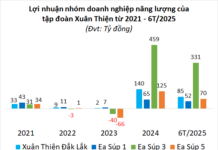

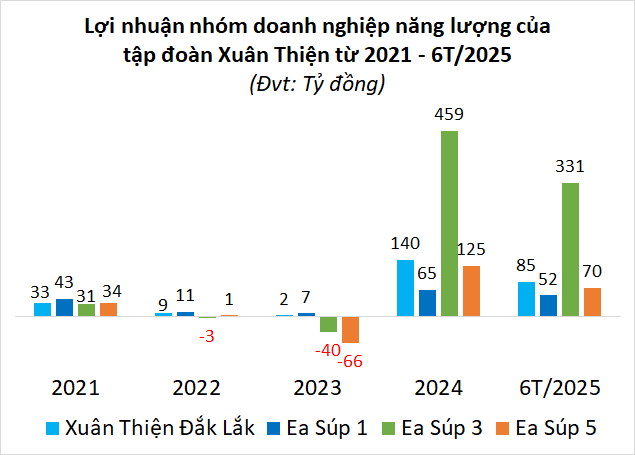

Xuan Thien Dak Lak LLC announced its financial results for the first half of 2025, reporting an after-tax profit of over VND 85 billion, a 4% decrease compared to the same period last year. As of June, the company’s equity stood at more than VND 1,305 billion, 6% lower than the first half of the previous year, with retained earnings exceeding VND 182 billion.

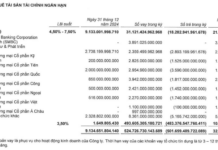

Total liabilities rose by 5% to over VND 3,522 billion, primarily consisting of bank loans (VND 2,130 billion) and other payables (nearly VND 1,388 billion). Outstanding bond debt remained at VND 4.4 billion, with the company paying VND 240 million in bond interest during the first half of the year.

CTCP Ea Súp 5 reported a less favorable performance, with profits declining by 36% to nearly VND 70 billion. Equity decreased by 8% to VND 1,251 billion, while liabilities increased by 6% to over VND 3,044 billion, mainly from bank loans (VND 2,311 billion), other payables (VND 717 billion), and bond debt (VND 16 billion). The company paid VND 500 million in bond interest.

On a positive note, CTCP Ea Súp 1 recorded a 30% profit increase to nearly VND 52 billion. Equity grew by 6% to VND 932 billion, with retained earnings of VND 196 billion. Liabilities decreased by 3% to VND 2,078 billion, including bank loans (VND 1,205 billion), other payables (VND 871 billion), and bond debt (VND 2 billion). The company paid VND 100 million in bond interest.

CTCP Ea Súp 3 delivered the most impressive results, with after-tax profits surging fourfold to over VND 331 billion. Equity increased by 18% to VND 6,631 billion, with retained earnings of VND 895 billion. However, liabilities ballooned to VND 8,573 billion, 4.5 times higher than the first half of 2024, primarily due to other payables (VND 7,410 billion), bank loans (VND 1,161 billion), and bond debt (VND 3 billion). The company paid VND 162 million in bond interest.

Source: Author’s compilation

|

Ea Súp 1, Ea Súp 3, Ea Súp 5, and Xuan Thien Dak Lak are part of the Xuan Thien Group’s ecosystem, managing various group projects alongside other companies such as Ea Súp 2, Xuan Thien Ninh Thuan, Xuan Thien Thuan Bac, and Son La Energy.

Notable Xuan Thien projects include the Suoi Sap 1 Hydropower Plant, Khao Mang Hydropower Plant, Song Lo 3, 5, and 6 Hydropower Plants in Ha Giang, and the Xuan Thien Thuan Bac Solar Power Plant (Phases 1 and 2), as well as the Ea Súp 1–5 projects.

Notably, in February 2024, the four aforementioned companies repurchased over VND 4,500 billion in bonds ahead of maturity. According to the Hanoi Stock Exchange (HNX), Xuan Thien Dak Lak currently has one remaining bond tranche valued at VND 4.4 billion; Ea Súp 1 has one tranche of VND 4 billion; Ea Súp 3 has two tranches totaling VND 2 billion; and Ea Súp 5 has three tranches worth nearly VND 10 billion.

Xuan Thien Group’s Subsidiaries Repurchase Over VND 3.1 Trillion in Bonds Ahead of Maturity

– 10:55 17/09/2025

Billion-Dollar Deal in Dong Nai: Thai Industrial Park Giant Sells Project to Novaland-Affiliated Entity

The sale of a 51% stake in two subsidiary companies developing urban service projects in Long Thanh not only secured over $46 million for Amata VN but also marked a strategic partnership with experts in residential real estate, including entities affiliated with Novaland.

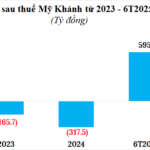

“My Khanh Development Investment Records a Staggering 600 Billion Profit in H1, Freed from Bond Debt”

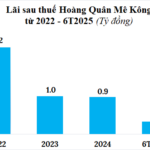

After suffering losses of over VND 480 billion for two consecutive years, My Khanh Investment and Development turned their fortunes around, reporting a remarkable profit of nearly VND 600 billion in the first half of 2025. The company also repurchased bonds worth over VND 2,800 billion before maturity.

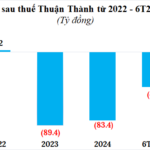

A Web of Debt: Auditors Question Recoverability of Social Housing Loans in Thuận Thành

The mid-year 2025 report of Thuan Thanh Social Housing paints a dire picture of prolonged losses, further compounded by a series of adverse audit opinions related to accounting practices and challenging-to-recover personal loans.