I. VIETNAMESE STOCK MARKET OVERVIEW FOR THE WEEK OF SEPTEMBER 15-19, 2025

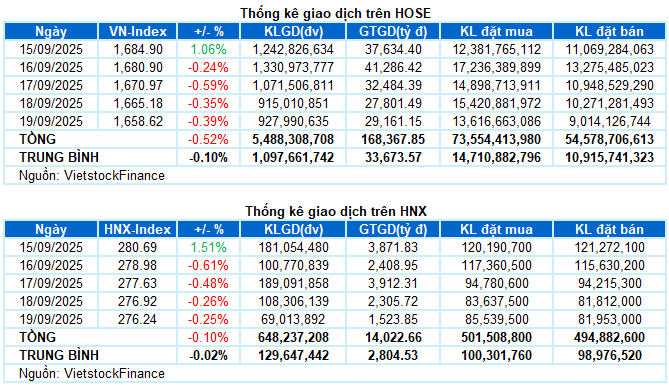

Trading Activity: Major indices continued their downward trend during the September 19th session. The VN-Index closed the week at 1,658.62 points, a 0.39% decline from the previous session; the HNX-Index also fell by 0.25%, settling at 276.24 points. For the entire week, the VN-Index shed a total of 8.64 points (-0.52%), while the HNX-Index hovered near the reference level, dipping slightly by 0.27 points (-0.1%).

Vietnam’s stock market concluded a rather subdued week as cautious sentiment prevailed. Despite an enthusiastic start with efforts to approach the previous peak around 1,700 points, profit-taking pressures quickly resurfaced, dragging the VN-Index into four consecutive sessions of decline. Without major pillars alternating to sustain momentum, the downturn could have been more severe, as market breadth largely favored selling and foreign investor pressure showed no signs of abating. By week’s end, the VN-Index closed at 1,658.62 points, down 0.52% from the prior week.

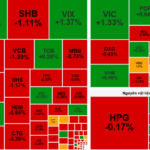

In terms of impact, VCB, VHM, and BID were the top drags in the final session, collectively erasing 5 points from the VN-Index. Conversely, VIC single-handedly bolstered the index by nearly 8 points, though it wasn’t enough to lift overall sentiment.

Red dominated across most sectors. The energy sector saw the most negative performance, declining 1.68%, as leading stocks like BSR (-3.17%), PLX (-0.7%), PVS (-0.58%), PVD (-1.09%), PVC (-1.67%), and PVB (-2.68%) all retreated sharply.

The financial sector also exerted significant pressure on the broader market, falling 1.08%. Numerous banking and securities stocks adjusted downward by over 1%, including VCB, BID, TCB, VPB, HDB, STB, SSI, VIB, SSB, VCI, VIX, and VND.

On the flip side, real estate was the sole sector holding onto gains, thanks to positive contributions from VIC (+5.66%), KDH (+2.69%), NVL (+5.63%), KSF (+4.07%), DIG (+1.45%), CEO (+3.38%), and QCG, which hit its upper limit. However, several stocks in this sector still saw notable declines, such as VHM (-1.74%), VRE (-2.48%), KBC (-1.63%), SJS (-3.68%), SIP (-2.04%), IDC (-2.36%), and VPI (-4.68%).

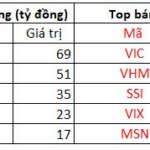

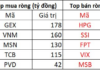

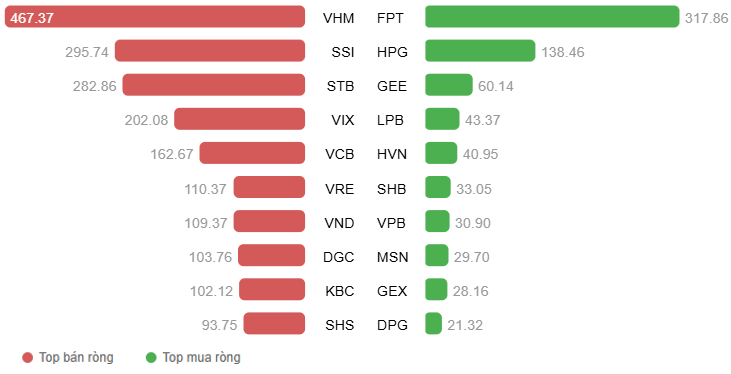

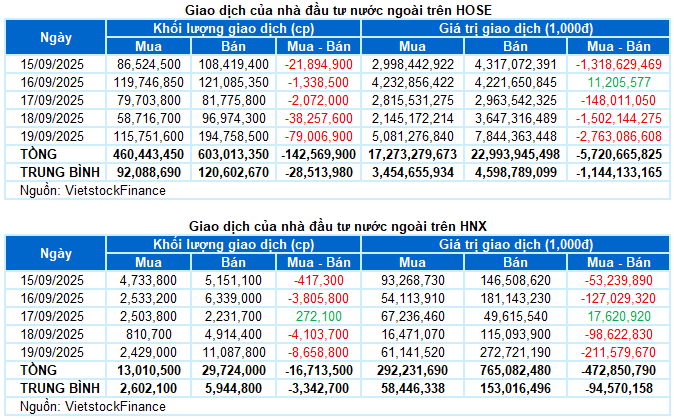

Foreign investors continued their heavy selling, with net outflows nearing 6.2 trillion VND across both exchanges last week. Specifically, foreign investors net-sold over 5.7 trillion VND on the HOSE and nearly 473 billion VND on the HNX.

Foreign Investors’ Trading Value on HOSE, HNX, and UPCOM by Day. Unit: Billion VND

Net Trading Value by Stock Code. Unit: Billion VND

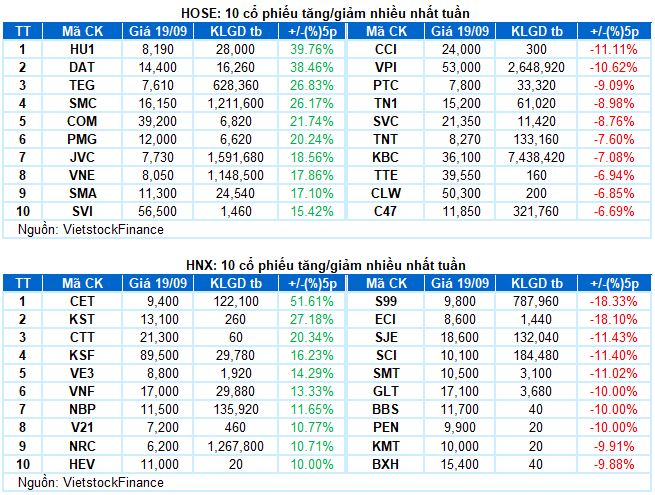

Top Gaining Stock of the Week: SMC

SMC Surged 26.17%: SMC delivered an impressive week with five consecutive sessions of gains. The emergence of Big White Candles alongside trading volumes consistently above the 20-day average reflected investor optimism.

Currently, the MACD indicator continues to widen its gap from the Signal line after generating a buy signal, reinforcing the stock’s positive short-term outlook.

Top Declining Stock of the Week: VPI

VPI Plummeted 10.62%: VPI tumbled in four straight sessions, breaching both the SMA 50 and SMA 100 day lines. Elevated trading volumes during sharp declines indicate heightened investor pessimism.

Short-term adjustment risks persist as the Stochastic Oscillator and MACD continue their downward trajectory following sell signals.

II. WEEKLY STOCK MARKET STATISTICS

Economic Analysis & Market Strategy Division, Vietstock Advisory Department

– 17:10 19/09/2025

September 19th Stock Market Update: Mid and Small-Cap Stocks Continue to Attract Investment Flow

The steady rise in mid- and small-cap stocks is fueling expectations that capital inflows into this segment will continue to grow.