Throughout most of the morning session, the market exhibited a narrow range of fluctuations. However, after 2 PM, widespread selling pressure swiftly pushed numerous stocks, both large and small, into the red. Investor caution was evident, as many opted to remain on the sidelines rather than actively bottom-fishing as seen in previous sessions.

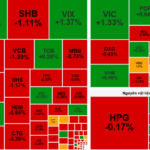

The banking sector, a market pillar, experienced a sharp decline. Major capitalization stocks such as BID, CTG, TCB, VPB, MBB, and VCB fell by 1-3%, significantly impacting the VN-Index’s downward trend. The weakness in the banking group indicates that short-term capital has yet to return to leading stocks.

Widespread selling pressure quickly pushed numerous stocks into the red during today’s afternoon session.

Securities stocks also faced intense selling pressure. Major players like SSI, VND, SHS, and VCI plummeted by 2-4%, reflecting investor pessimism about short-term prospects. Declining liquidity further eroded the group’s recovery momentum.

The real estate sector continued to face significant pressure, with many mid-cap and penny stocks such as DIG, DXG, KBC, SCR, and HQC experiencing sharp declines. Despite VHM maintaining its green status and VIC’s surprising gains, Vingroup’s recovery was insufficient to counterbalance the broad selling pressure.

The steel sector also showed notable weakness. Leading stocks like HPG, HSG, and NKG fell by 2-4%, reflecting subdued expectations for year-end consumption. The decline in steel and real estate further dampened market sentiment.

A rare bright spot in the session was VIC, which bucked the trend with strong gains, positively contributing to the index. However, the gains from a few key stocks were insufficient to offset the widespread selling, leaving the market breadth heavily skewed toward decliners, with over 200 stocks on HoSE adjusting downward.

The VN-Index is under significant profit-taking pressure following its short-term recovery. The index’s immediate support lies around 1,660–1,670 points, while a new resistance level has been established at 1,700 points.

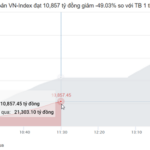

At the close, the VN-Index dropped 9.93 points (0.59%) to 1,670.97, the HNX-Index fell 1.35 points (0.48%) to 277.63, and the UPCoM-Index rose 0.46 points (0.41%) to 111.78. Liquidity decreased sharply, with HoSE trading value exceeding VND 32.1 trillion. Foreign investors net-sold over VND 116 billion, focusing on MSN, VPB, and VHM.

Market Pulse 19/09: Strong Divergence Persists as Foreign Investors Ramp Up Net Selling of VHM

At the close of trading, the VN-Index fell by 6.56 points (-0.39%), settling at 1,658.62 points, while the HNX-Index dropped by 0.68 points (-0.25%), closing at 276.24 points. Market breadth tilted toward the downside, with 434 decliners outpacing 323 advancers. Similarly, the VN30 basket saw red dominate, as 24 stocks declined, 4 advanced, and 2 remained unchanged.

Stock Market Week 15-19/09/2025: Cautious Tug-of-War

The VN-Index closed the week in the red, marking four consecutive sessions of decline. Cautious sentiment persists as trading volumes remain below the 20-day average. Amid weak liquidity and persistent net selling pressure from foreign investors, the market awaits a stronger catalyst to break free from its current stalemate.

September 19th Stock Market Update: Mid and Small-Cap Stocks Continue to Attract Investment Flow

The steady rise in mid- and small-cap stocks is fueling expectations that capital inflows into this segment will continue to grow.