Increased buying pressure in the afternoon session helped the VN-Index narrow its decline. However, VCB, GAS, BID, ACB, and VPB remained the most significant drags on the index. Meanwhile, VIC, VHM, and STB played a supportive role, preventing the index from falling further.

The banking sector generally underperformed, with most stocks like VCB (-2%), ACB (-2.3%), VPB (-2%), and STB (-1.3%) experiencing declines. Only a few stocks, such as TCB (+0.2%) and LPB (+0.2%), managed to stay in the green.

In contrast, the real estate sector saw a standout performer in VIC. Vingroup maintained its position as the market capitalization leader. By the session’s close, VIC rose 1.3% to VND 145,000 per share, pushing Vingroup’s market cap to VND 562 trillion. Vietcombank slipped to second place, with its market cap falling to VND 533 trillion amid a 1.4% stock adjustment. VCB closed at VND 63,900 per unit.

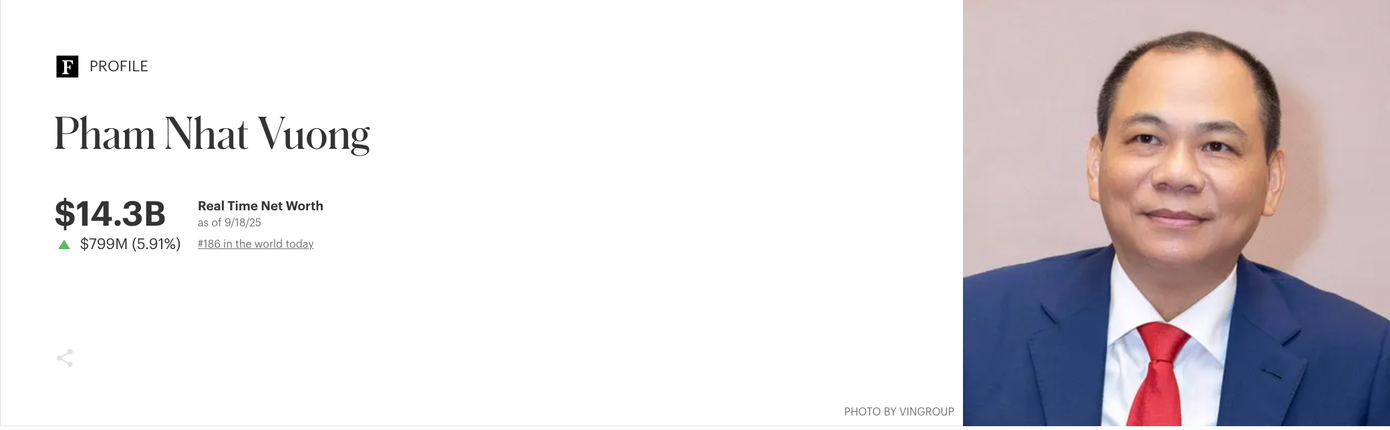

Vingroup Chairman Pham Nhat Vuong‘s assets increased by nearly $800 million. Data: Forbes.

According to Forbes data, as of the afternoon of September 18, Vingroup Chairman Pham Nhat Vuong‘s net worth rose by nearly $800 million (5.9%), reaching $14.3 billion. Mr. Vuong ranks 186th on the global billionaire list.

The securities sector showed mixed performance, with SSI holding steady, VIX up 1.4%, and VND, VCI, HCM, and SHS all down 1–2%. Energy stocks continued to weaken, with GAS (-1.6%), PVD (-1.2%), and BSR (-2.1%) all declining.

Today also marked the derivatives expiration session. Liquidity waned toward the end of the session, as cautious sentiment prevailed with the market trading near the sensitive 1,670–1,680 point resistance zone.

At the close, the VN-Index fell 5.79 points (0.35%) to 1,665.18. The HNX-Index retreated to 276.92 points (0.26%), while the UPCoM-Index dropped 0.61% to 111.10. Trading volume decreased, with HoSE transactions totaling over VND 27.6 trillion. Foreign investors intensified net selling, with a value exceeding VND 1.665 trillion, focusing on VIC, VHM, SSI, and VIX.

Surprise Power Unleashes Nearly $35 Billion to Scoop Up Vietnamese Stocks on September 18th

Proprietary trading firms significantly ramped up their net buying activities on the Ho Chi Minh Stock Exchange (HOSE), accumulating a total of VND 769 billion in the latest trading session. This surge underscores their growing confidence in the market and strategic positioning amidst evolving economic conditions.

VN-Index Projected to Surpass 1,800 Points: VCBS Highlights Sectors Poised for Year-End Momentum

With a focus on high economic growth, the investment strategy for the final months of 2025 will prioritize large-cap stocks, particularly those in sectors driven by Vietnam’s intrinsic strengths.