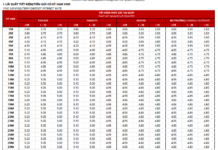

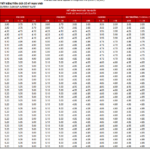

According to preliminary statistics from the General Department of Vietnam Customs, in the first eight months of the year, Vietnam exported over 7 million tons of steel, valued at USD 4.66 billion. This marks a decline in both volume and value compared to the same period in 2024, primarily due to the sharp drop in global steel prices, which has led to a more significant decrease in export value than in volume.

While the overall market has seen a downturn, some markets have experienced a notable surge in exports.

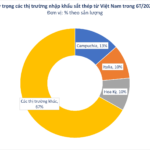

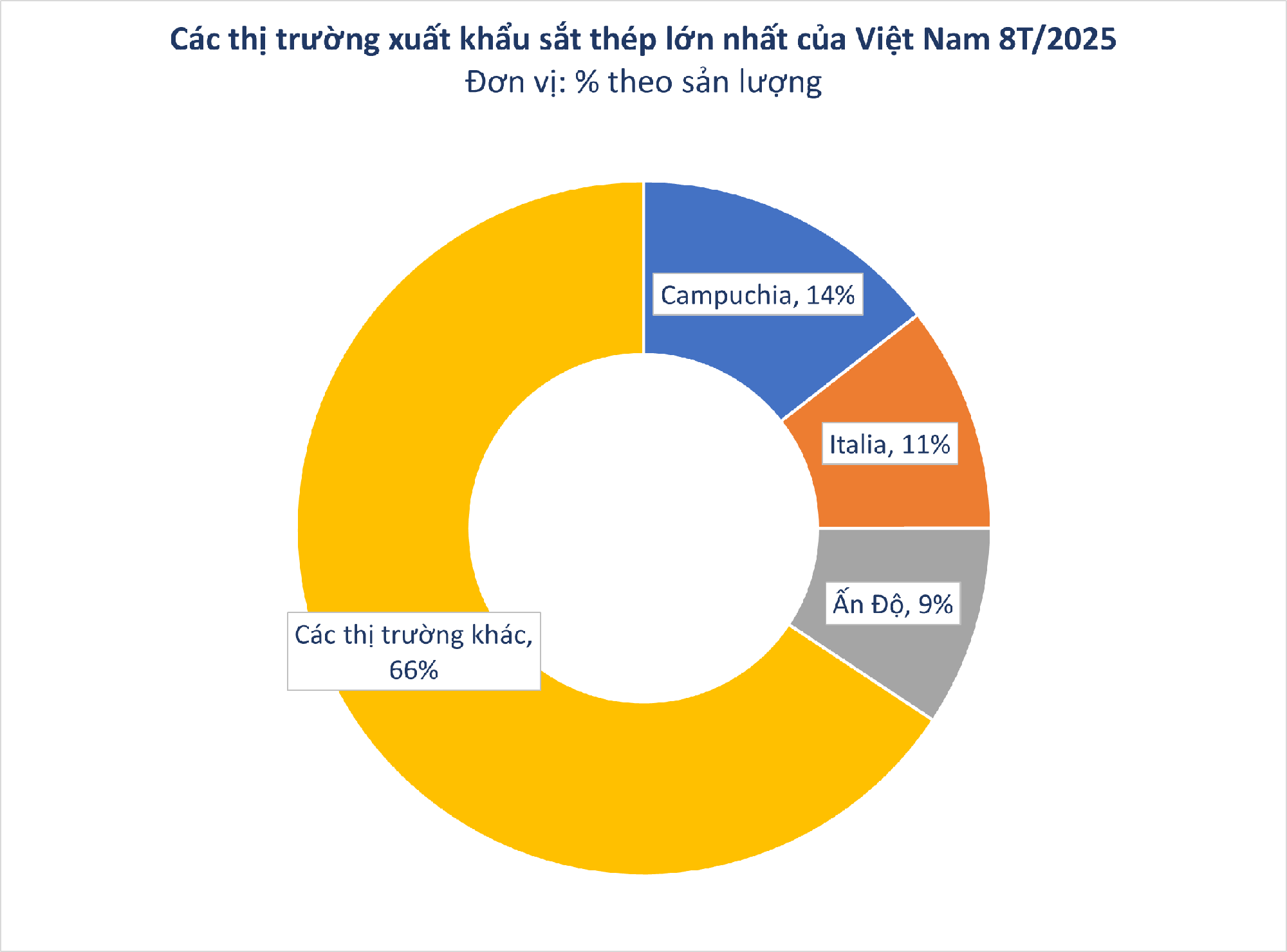

Specifically, Cambodia has emerged as the largest export market for Vietnamese steel, with over 1 million tons exported, valued at more than USD 586 million. This represents a 31% increase in volume and a 19% rise in value compared to the same period in 2024. The average export price stands at USD 571 per ton, a 9% decrease from the previous year.

Vietnamese steel products enjoy a 0% tax rate when exported to Cambodia, as per the Bilateral Trade Promotion Agreement between Vietnam and Cambodia, signed on the sidelines of the 7th ACMECS Summit, the 8th CLMV Summit, and the World Economic Forum on the Mekong Region.

Italy ranks second, importing 745,000 tons of various steel products worth over USD 467 million, a 26% decline in both volume and value. The United States has unexpectedly ceded its third-place position to India, as the latter has increased its steel imports from Vietnam by 42% in volume and 11% in value.

Steel exports to the U.S. have declined amid the country’s imposition of successive tariffs on metal products, particularly steel.

In February, U.S. President Donald Trump signed an executive order imposing a 25% tariff on imported steel and aluminum. By early June, this tariff was raised to 50% (excluding products from the UK).

In addition to the general tariffs, certain Vietnamese steel products are subject to anti-dumping duties. In April, the U.S. Department of Commerce (DOC) announced preliminary anti-dumping duties on Vietnamese coated steel sheets ranging from 39.84% to 88.12%, depending on the company.

Another challenge arose in late August when the U.S. Department of Commerce (DOC) issued its final determination on corrosion-resistant steel products from Vietnam and other countries. As a result, Vietnam faces anti-dumping duties ranging from 88.98% to 110.21%. The DOC stated that companies that did not cooperate during the investigation would be subject to duties based on available evidence.

Overall, 2025 is expected to see continued growth in domestic steel production and consumption, particularly in construction steel and products for public investment. However, steel exports may face challenges due to increasing trade barriers.

Finished steel production is projected to reach 28-30 million tons, with domestic consumption at approximately 21-25 million tons, an 8-10% increase compared to 2024. Domestic construction steel prices are likely to remain stable or rise slightly but may face downward pressure from the global market.

The Steel Giant No Longer Stands Tall: Hoa Phat Exits Vietnam’s Top 10 Largest Listed Companies as Vingroup Makes a Comeback with a Near 15,000 Billion VND Surge in Market Capitalization.

For 22 consecutive trading sessions, foreign investors have been net sellers of Hoa Phat Group’s stocks, offloading shares worth a total of nearly VND2.6 trillion.