Viglacera

On September 17, 2025, Viglacera’s Board of Directors approved a restructuring plan to streamline its Sanitary Ware division, marking the third phase of the company’s comprehensive reorganization. A new entity, Viglacera Sanitary Equipment LLC (VSE), will be established as the core unit for this division.

VGC will consolidate the operations of two production subsidiaries, Viglacera My Xuan Ceramics and Viglacera Faucets, into the newly formed VSE. All assets and personnel will be transferred, and the two subsidiaries will cease operations. VSE will consider establishing branches or factories at the current locations of these subsidiaries.

Additionally, VGC will transfer its equity stakes in three subsidiaries—Viet Tri Viglacera JSC, Thanh Tri Viglacera Ceramics JSC (UPCoM: TVA), and Viglacera Trading JSC—to VSE.

Machinery and equipment management rights will also be transferred to VSE from Viglacera Binh Duong Ceramics.

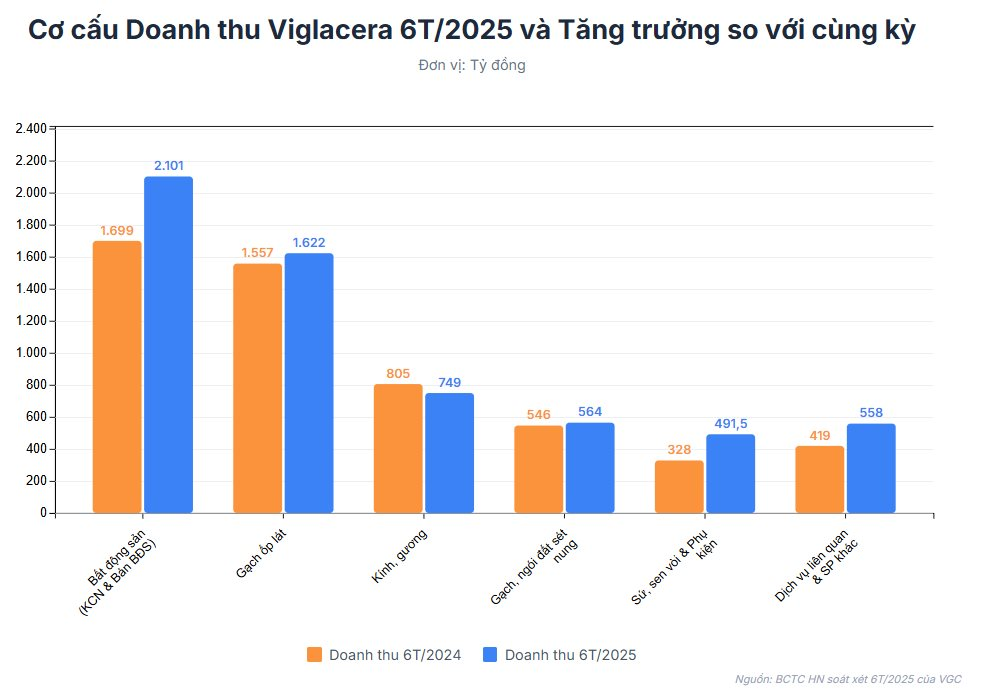

This consolidation comes amid strong growth in the Sanitary Ware division. According to the audited consolidated financial report for the first half of 2025, sanitary ware, faucets, and accessories generated approximately VND 491.5 billion in revenue, a 50% increase compared to the same period in 2024.

Prior to this restructuring, in August 2025, Viglacera announced similar plans for its Tile and Real Estate divisions.

For the Tile division, VGC plans to merge Viglacera Hanoi JSC (VIH) and Viglacera Thang Long JSC (TLT) into Viglacera Tien Son JSC (VIT). Post-merger, VIT will become the core unit, integrating the entire value chain from production to sales for the tile division, which accounts for a significant portion of VGC’s revenue.

For the Real Estate division, the restructuring includes potential divestment from service providers such as Visaho JSC—a manager of high-end office buildings and apartments—and Viglacera Consulting JSC. VGC will also reorganize its infrastructure construction units to optimize operations.

Viglacera’s Dong Van 4 Industrial Park.

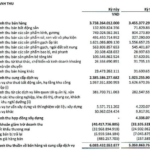

Notably, this major restructuring is taking place during a period of robust financial performance. In the first half of 2025, VGC reported consolidated net revenue of VND 6,083 billion, a 13.7% increase year-over-year. Consolidated net profit reached VND 838 billion, up 105.2% compared to the first half of 2024.

The primary growth driver was the industrial land leasing segment, which generated VND 1,967 billion in revenue, a 21% increase. The stable income from industrial real estate is seen as a solid financial foundation, enabling VGC to undertake extensive restructuring across its business segments in preparation for a “new phase of development,” as outlined by the Board of Directors.

VGC Expands Restructuring Efforts to Sanitary Ware After Tiles and Real Estate

On September 17th, the Board of Directors of Viglacera Corporation (HOSE: VGC) issued a resolution outlining a strategic plan to streamline and modernize the operational structure of its sanitary ceramics division.

“Ninja Van Vietnam Halts All Express Delivery Services from Late September 2025”

Our team is currently accepting new orders until September 8, 2025. We guarantee that all orders in our system will be processed and completed by September 26, 2025, at the latest.