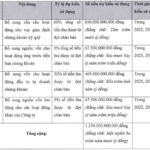

ABBank has submitted a proposal to its Annual General Meeting of Shareholders (AGM) regarding a capital increase plan. The results show that 216 shareholders participated in the vote, representing nearly 747 million shares with voting rights.

A total of 200 votes were in favor, representing over 743 million shares with voting rights, accounting for 71.815% of the total voting shares of ABBank.

The bank plans to raise capital through two methods: a rights issue for existing shareholders and an Employee Stock Ownership Plan (ESOP) for employees.

In the first plan, ABBank intends to issue 310.5 million shares at a price of 10,000 VND per share to existing shareholders at a ratio of 30% (100 shares held at the record date will receive 30 purchase rights). These shares will not be subject to transfer restrictions. This plan is expected to raise over 3,105 billion VND.

In the second plan, ABBank plans to issue nearly 52 million shares to employees under the ESOP at a price of 10,000 VND per share, representing a 5% ratio. The maximum capital increase from the ESOP is expected to be nearly 518 billion VND.

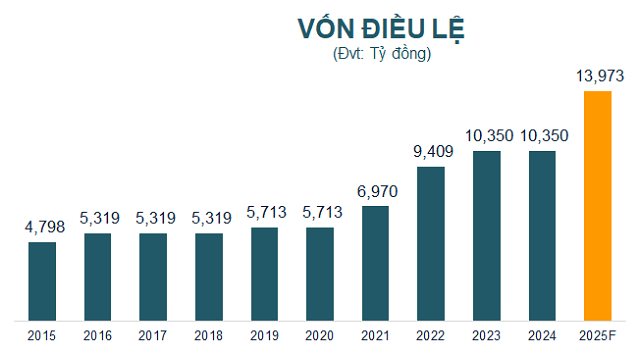

Following these two plans, ABBank’s chartered capital will increase from 10,350 billion VND to 13,973 billion VND.

Source: VietstockFinance

|

All proceeds from the capital increase will be used to supplement the bank’s capital for lending to customers.

ABBank notes that the stock market outlook for 2025 and beyond is positive, with strong growth prospects and significant interest from domestic and international investors. Favorable market liquidity and investor sentiment provide an ideal environment for the successful implementation of the capital increase through additional share issuance.

On the UPCoM market, ABB shares closed at 12,400 VND per share on September 19, up nearly 70% since the beginning of the year. Daily liquidity exceeds 4 million units.

| Price movement of ABB shares since the beginning of the year |

– 15:58 19/09/2025

LPBS Offers 878 Million Shares to Shareholders

LPBS is set to launch an offering of 878 million shares to existing shareholders, commencing on September 15 and concluding on October 15, 2025. Upon successful completion, the company’s chartered capital is projected to rise to 12,668 billion VND.

State Shareholders Remain Silent, Becamex IDC’s (BCM) Share Offering Fizzles Out

Becamex IDC plans to offer 150 million shares to the public via an open auction, with a starting price of no less than VND 50,000 per share, as outlined in the proposal to shareholders.