Vietnam’s stock market witnessed significant volatility during the final trading session of the week. The VN-Index experienced a sharp decline of over 26 points before narrowing its losses by the end of the session on September 19th. At closing, the VN-Index dropped by 6.56 points to 1,658.62 points. Trading value on the Ho Chi Minh City Stock Exchange (HOSE) reached VND 27,262 billion.

This session also marked the final day for three ETFs—VanEck Vectors Vietnam ETF, Xtrackers Vietnam Swap UCITS ETF, and ETF Fubon—to complete their portfolio rebalancing.

Against this backdrop, foreign investors continued their net selling spree, offloading a staggering VND 3,029 billion across the market. Specifically:

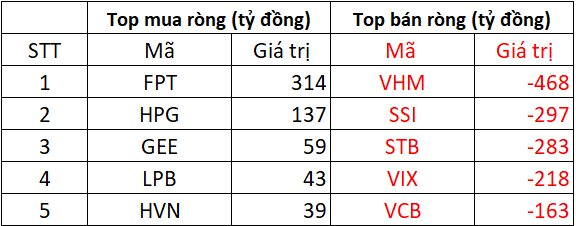

On HOSE, foreign investors net sold approximately VND 2,823 billion

On the buying side, FPT led the market with a net purchase value of VND 314 billion. This followed the inclusion of FPT in both the MarketVector Vietnam Local Index and STOXX Vietnam Total Market Liquid Index. HPG followed with a net buy of VND 137 billion, while GEE, LPB, and HVN saw net inflows of tens of billions each.

Conversely, foreign investors heavily offloaded VHM, with net sales reaching VND 468 billion. SSI and STB also faced significant net selling, at VND 283 billion and VND 297 billion, respectively. VIX and VCB were similarly impacted, with net sales of VND 218 billion and VND 163 billion, respectively.

On HNX, foreign investors net bought approximately VND 213 billion

NTP led the buying activity with a net inflow of VND 3 billion, followed by PLC, IDJ, IVS, and IPA, which saw net purchases ranging from a few hundred million to VND 1 billion.

On the selling side, SHS faced the brunt with a net sell-off of VND 94 billion. HUT, IDC, and CEO also experienced net selling, ranging from VND 15 billion to VND 60 billion each. MBS saw a net sell of approximately VND 7 billion.

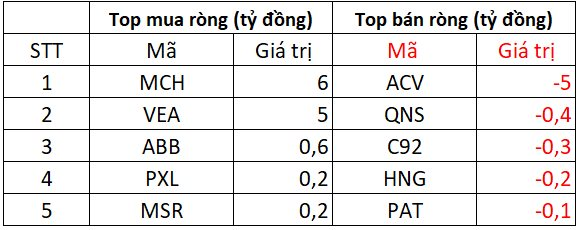

On UPCOM, foreign investors net bought a modest VND 7 billion

MCH and VEA led the buying activity with net purchases of VND 5-6 billion each. ABB, PXL, and MSR also saw net inflows of a few hundred million each.

Conversely, ACV faced a net sell-off of VND 5 billion, while QNS, C92, HNG, and PAT saw net selling of just a few hundred million each.

FPT CEO: Businesses Lagging Behind Government in Digital Transformation Era

At the session titled “Science, Technology & Innovation – The Momentum to Soar,” part of the Vietnam Private Economic Forum 2025 on September 15th, Mr. Nguyen Van Khoa, CEO of FPT Corporation, shared insightful perspectives and notable proposals for businesses.

Unveiling Vietnam’s New Stock Market Capitalization King

Vingroup’s market capitalization soared to the highest level on the entire exchange, surpassing Vietcombank. VIC shares emerged as the strongest driver, significantly curbing the decline of the VN-Index during today’s session (September 18). However, the benchmark index failed to reverse its downward trend.

Surprise Power Unleashes Nearly $35 Billion to Scoop Up Vietnamese Stocks on September 18th

Proprietary trading firms significantly ramped up their net buying activities on the Ho Chi Minh Stock Exchange (HOSE), accumulating a total of VND 769 billion in the latest trading session. This surge underscores their growing confidence in the market and strategic positioning amidst evolving economic conditions.

Billions Deployed to Scoop Up Vietnamese Stocks Amid Market Dip: Which Securities Are Brokerage Firms Most Aggressively Targeting?

Proprietary trading desks at securities firms have resumed net buying activities on the Ho Chi Minh City Stock Exchange (HOSE), signaling a potential shift in market sentiment.