Ha Do Group Joint Stock Company (Stock Code: HDG, HoSE) has recently submitted a report regarding changes in ownership by major shareholders and investors holding 5% or more of the company’s shares.

On September 11, 2025, Pyn Elite Fund, a Finnish investment fund, successfully purchased 2 million HDG shares on the stock exchange.

Following this transaction, the fund increased its HDG holdings from approximately 28.6 million shares to nearly 30.6 million shares, raising its ownership stake from 7.73% to 8.27% of Ha Do Group’s capital.

Illustrative image

Based on the closing price of HDG shares on September 11, 2025, at VND 31,500 per share, Pyn Elite Fund is estimated to have spent around VND 63 billion on this acquisition.

In a related development, Mr. Dao Huu Khanh (father of Mr. Dao Huu Tung, Chief Accountant of Ha Do Group) previously registered to sell 200,000 HDG shares to meet personal financial needs.

The transaction is expected to take place via order matching from August 21, 2025, to September 19, 2025.

Prior to the transaction, Mr. Khanh held 656,895 HDG shares, equivalent to a 0.178% ownership stake. If successful, his holdings will decrease to 456,895 shares, representing a 0.123% stake.

Regarding business performance, according to the audited consolidated financial report for the first half of 2025, Ha Do Group generated net revenue of over VND 1,188.3 billion, a 15% decrease compared to the same period in 2024. After-tax profit reached nearly VND 234.2 billion, down 35.5%.

For 2025, Ha Do Group aims to achieve consolidated revenue of VND 2,936 billion and after-tax profit of VND 1,057 billion.

By the end of the first two quarters, the company has completed 40.5% of its revenue target and 22.2% of its after-tax profit goal.

As of June 30, 2025, Ha Do Group’s total assets increased by 3.5% from the beginning of the year to nearly VND 14,327.8 billion. Fixed assets account for 58% of total assets, amounting to approximately VND 8,306.3 billion.

On the liabilities side, total payables stand at nearly VND 6,596.5 billion, an increase of VND 123 billion from the start of the year. Short-term and long-term loans total VND 5,013.3 billion, representing 76% of total liabilities.

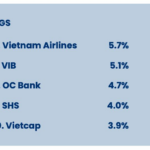

The Winning Stocks for the $1.3 Billion Foreign Fund

PYN Elite Fund had an impressive run in August, with a focus on banking stocks (+20%) and securities firms (+19%)—the two sectors that dominated the fund’s portfolio—leading to substantial gains.

The Billion-Dollar Fund’s Big Win with Banks and Brokerages: Unveiling the Reason Behind the $2 Billion VIX Stock Holding

As of the beginning of this year, this billion-dollar foreign fund has doubled down on its equity stock holdings, bringing the total allocation to a substantial 14%. This strategic move was executed by adding VIX and SHS to its portfolio, showcasing a confident and bold approach to investing.