The resounding success of blockbuster series like Brother’s Odyssey, Sisters Riding the Waves, and the latest Ha Ha Family has propelled Yeah1 Corporation (stock code: YEG) back into the spotlight of Vietnam’s entertainment and media landscape. This resurgence has also reignited interest from the stock market in a company that once stumbled after its fallout with YouTube.

As a pioneer in digital media, Yeah1 was once valued at hundreds of millions of USD and stood as a beacon of Vietnam’s entertainment industry on the stock exchange. However, the 2019 dispute with YouTube plunged the company into a prolonged downturn, marked by consecutive losses, plummeting stock prices, and regulatory warnings.

After nearly five years of restructuring, Yeah1 is demonstrating a remarkable transformation. Shifting away from reliance on third-party content platforms, the company now focuses on producing large-scale, proprietary TV programs, collaborating with OTT platforms, cable networks, and international partners.

Shows like Sisters Riding the Waves—a Vietnamese adaptation of a Chinese hit—and Brother’s Odyssey—a reality game show rich in human values—have not only generated social media buzz but also attracted sponsorships and media attention, opening new revenue streams for the company.

Ample Growth Potential in the Second Half of the Year

This turnaround coincides with an accelerating advertising market cycle.

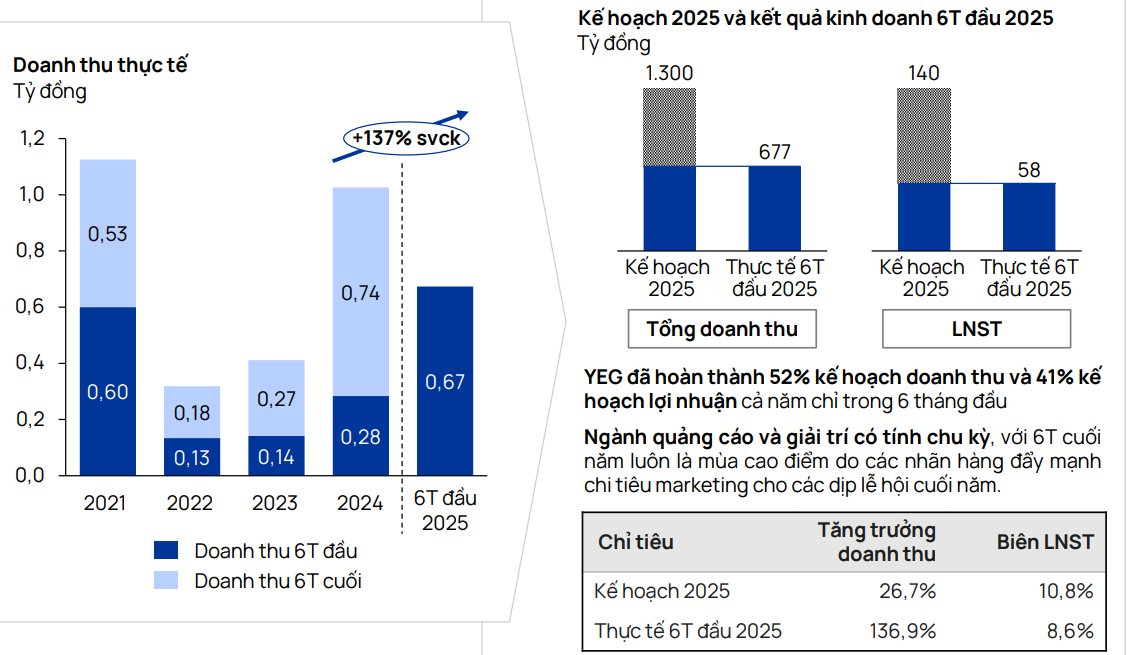

In a recent update, Vietcap Securities (stock code: VCI) highlights the cyclical nature of the advertising and entertainment industry, with the second half of the year traditionally peaking as brands ramp up marketing spend for year-end festivities.

In the first half of 2025, Yeah1 reported revenue of VND 677 billion, a 137% year-on-year increase, achieving 52% of its annual revenue target. After-tax profit reached VND 58 billion, fulfilling 41% of the year’s goal.

Vietcap also notes that YEG is deploying capital raised from investors to acquire content rights and fund new projects, sustaining its growth momentum. Inventory and receivables have yet to reflect in 2025 profits. Specifically, YEG invested VND 26 billion in content rights (+61% YoY) and VND 57 billion in software development (new projects Onstudio, YEG DX) in the first six months of 2025, signaling plans for new programs and ecosystem expansion.

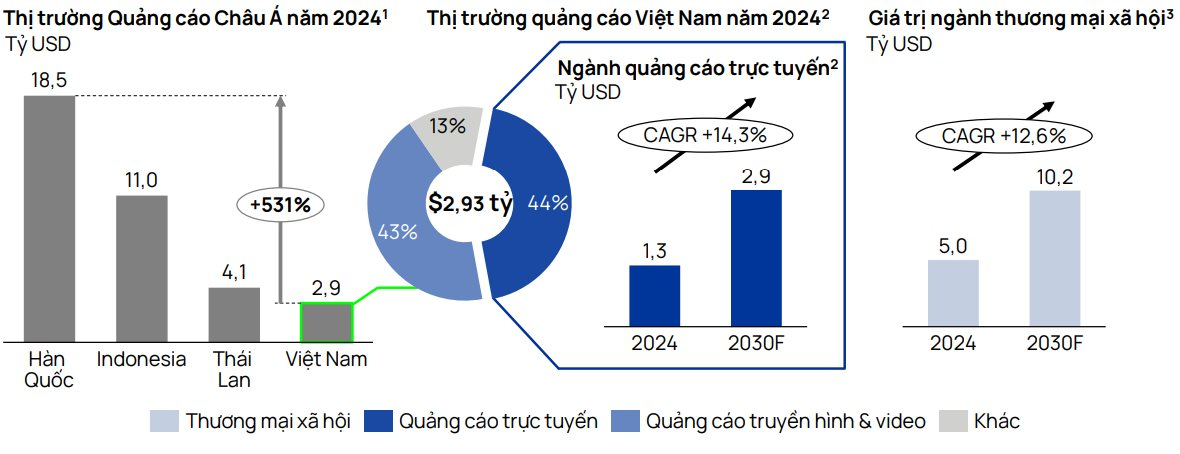

Furthermore, Vietcap analysts see significant growth potential in Vietnam’s advertising market compared to regional peers like South Korea (USD 18.5 billion) and Thailand (USD 4.1 billion). As a market leader, Yeah1’s ecosystem stands to benefit directly from this growth.

Specifically, Vietnam’s advertising market is projected to grow at a CAGR of +9% from 2024 to 2030F, with YEG’s core online advertising segment expected to expand at a CAGR of +14.3% over the same period.

Additionally, the social commerce sector’s CAGR of +12.6% from 2024 to 2030F provides Yeah1 with opportunities to build a modern distribution system, leveraging exclusive content and KOL/artist networks to optimize online shopping through entertainment (Shoppertainment).

Profitable Venture: Producer’s Triumph as Hit Show “Brother Overcomes Adversity” Triples Profits

As of the first half of 2025, Yeah1 has achieved remarkable financial growth with a staggering net revenue of over VND 673.5 billion, reflecting a 2.4x surge compared to the same period in 2024. Impressively, their net profit after corporate income tax reached nearly VND 56.6 billion, marking a 2.6x increase year-over-year.

The Retail Renaissance: Unveiling Opportunities for Businesses to Soar

The retail market is due for a shake-up, according to experts. It’s a time of flux, with many businesses exiting the industry and leaving a void that only the most resilient and forward-thinking enterprises can fill. This creates a unique opportunity for those with a strong foundation to step up and seize the initiative.

“Brother Overcomes Adversity 2024”: Tickets Sold Out in 30 Minutes! How Does This Entertainment Company Stay Afloat in a Competitive Market?

Within just 30 minutes of going on sale, all 20,000 tickets for the highly anticipated “Brother Overcoming Adversity 2024” concert were snapped up by eager fans. The event organizers were thrilled to announce a sold-out show, with every seat filled for what promises to be an unforgettable musical experience.