Garment production at TNG – Illustrative image

|

TNG Investment and Trading JSC (HNX: TNG) announced its first cash dividend payment for 2025 at a rate of 5%, totaling over VND 61 billion. The ex-dividend date is September 24, with payment scheduled for October 6. This is part of the company’s 2025 dividend plan, targeting 16-20% in cash and/or stock as per the Annual General Meeting’s resolution.

Previously, TNG distributed a 20% cash dividend for 2024 across four installments, amounting to VND 245 billion. The founding family of Chairman Nguyễn Văn Thời holds the largest stake and significantly benefits from the dividend policy. Mr. Thời owns 18.58%, while his two sons, Vice Chairman Nguyễn Đức Mạnh and Board Member Nguyễn Mạnh Linh, hold 8.83% and 0.59%, respectively.

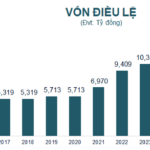

Concurrently, TNG’s Board of Directors announced the issuance of 6.1 million ESOP shares, equivalent to 5% of outstanding shares, at VND 10,000 per share. The payment period is from September 19 to October 8. These shares are restricted from transfer for three years. Post-issuance, the chartered capital is expected to rise to VND 1,287 billion. The proceeds, over VND 61 billion, will fund raw material purchases.

As of June 30, 2025, TNG employed 19,693 workers, an increase of 641 since the year’s start. The ESOP program includes 494 employees and leaders eligible to purchase shares. Notably, Chairman Nguyễn Văn Thời’s family is allocated nearly 2.4 million shares, or 39% of the ESOP, valued at approximately VND 24 billion if fully exercised.

In H1 2025, TNG reported record-high revenue of VND 4,038 billion and net profit of over VND 161 billion, achieving 53% of annual revenue and 51% of profit targets.

| TNG’s Semi-Annual Business Results Over the Years |

On the stock market, TNG shares trade at VND 20,900, up 50% from April’s low but down 14% year-over-year. Average liquidity is nearly 1.6 million shares daily. The ESOP issuance price is less than half the market price.

| TNG Stock Price Movement Over the Past Year |

– 14:58 19/09/2025

ABBank Plans to Boost Chartered Capital to Nearly VND 14 Trillion

On September 16th, An Binh Commercial Joint Stock Bank (ABBank, UPCoM: ABB) announced a resolution passed by its Annual General Meeting of Shareholders to increase its chartered capital from VND 10,350 billion to nearly VND 13,973 billion, representing a 35% increase.

Surprise Power Unleashes Nearly $35 Billion to Scoop Up Vietnamese Stocks on September 18th

Proprietary trading firms significantly ramped up their net buying activities on the Ho Chi Minh Stock Exchange (HOSE), accumulating a total of VND 769 billion in the latest trading session. This surge underscores their growing confidence in the market and strategic positioning amidst evolving economic conditions.

PNJ Announces 14% Dividend Payout for Second Tranche of 2024

PNJ is set to distribute nearly VND 473.1 billion in dividends for the second tranche of 2024, offering a 14% cash payout to shareholders. The final registration date for eligibility is September 29, 2025.