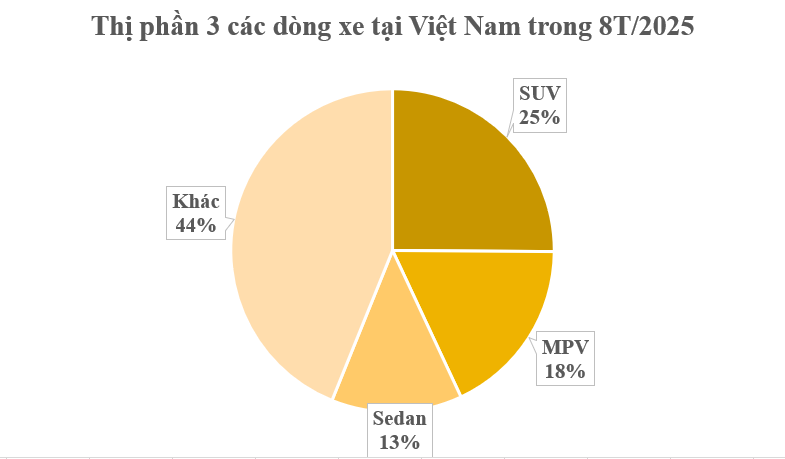

The Vietnamese automotive market is witnessing a significant shift in consumer preferences. Just three years ago, sedans were the go-to choice, favored for their compact design and affordability, consistently maintaining a market share above 20%. However, SUVs and MPVs have now taken the lead in sales.

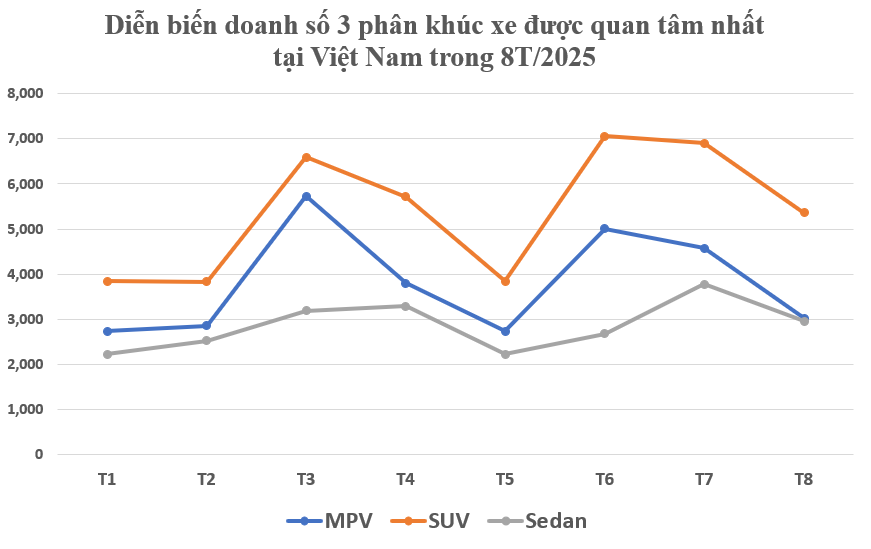

According to data from the Vietnam Automobile Manufacturers Association (VAMA) for the first eight months of 2025 (excluding Hyundai and VinFast sales), SUVs consistently topped monthly sales, ranging from 3,800 to over 7,000 units. Notably, in March and June, SUV sales reached 6,700 and 7,100 units, respectively, nearly doubling sedan sales.

This robust growth reflects consumers’ growing preference for high-clearance vehicles, which are practical for Vietnam’s infrastructure challenges like potholes and flooding, while offering a sense of safety and sporty style.

MPVs have also emerged as a rising star in the market. From under 3,000 units at the beginning of the year, MPV sales surged to nearly 5,800 units in March, rivaling SUVs. Although sales stabilized between 4,000 and 5,000 units monthly afterward, models like the Mitsubishi Xpander, Toyota Veloz, Suzuki Ertiga Hybrid, and the new VinFast Limo Green are meeting the needs of young families and transport service providers, who prioritize spaciousness and cost-effectiveness.

In contrast, sedans are losing momentum. In the first eight months of the year, sedan sales rarely exceeded 3,800 units monthly, even dropping to just over 2,200 units at one point. This decline indicates that sedans no longer hold the same appeal as they did five to seven years ago, as Vietnamese consumers increasingly prioritize versatility, capacity, and multi-purpose functionality over traditional styling.

It’s worth noting that the above figures exclude Hyundai and VinFast, two of the market’s top-selling brands. Including the Hyundai Accent—a sedan that has consistently led sales for years—would make sedans appear less disadvantaged in the current chart.

However, according to sales reports from TC Group, Hyundai Accent sales in August 2025 were only 332 units, a 34% drop from July, marking its first time in third place among Hyundai models, behind the Tucson and Creta.

Accent sales peaked in March with 1,049 units but have since declined sharply. The steep drop in August, with just over 300 units delivered, saw the model fall behind competitors. Cumulative sales for the first eight months of 2025 reached only 4,629 units, a 33% year-on-year decrease.

Conversely, adding Hyundai’s Creta, Tucson, and Santa Fe, along with VinFast’s electric SUVs, further solidifies SUVs’ dominance. In August 2025 alone, VinFast’s best-selling model, the VF 5, sold 2,745 units, nearly matching monthly sedan sales. The VinFast Hero Green and VF 6 sold 2,395 and 2,038 units, respectively, highlighting SUVs’ popularity and the growing electric vehicle trend.

This shift isn’t unique to Vietnam. SUVs surpassed sedans in the U.S. years ago, while China has seen a strong resurgence in electric MPVs. Globally, consumer preferences are aligning toward versatility, comfort, and safety.

With current growth trends, SUVs and MPVs are likely to remain the driving force in Vietnam’s automotive market through 2025–2026. Electric and hybrid models in these segments are expected to compete fiercely, offering more choices for consumers. As Vietnamese buying habits evolve, automakers must adapt their product portfolios to stay competitive.

Why are A-class cars like Kia Morning, Hyundai i10 selling less in Vietnam, despite being the “golden egg-laying chicken”?

In recent times, there has been a decline in the appeal of small-sized cars priced below 500 million Vietnamese dong among Vietnamese consumers.